- United States

- /

- Food and Staples Retail

- /

- NYSE:NGVC

Natural Grocers by Vitamin Cottage (NYSE:NGVC) Is Paying Out A Dividend Of $0.10

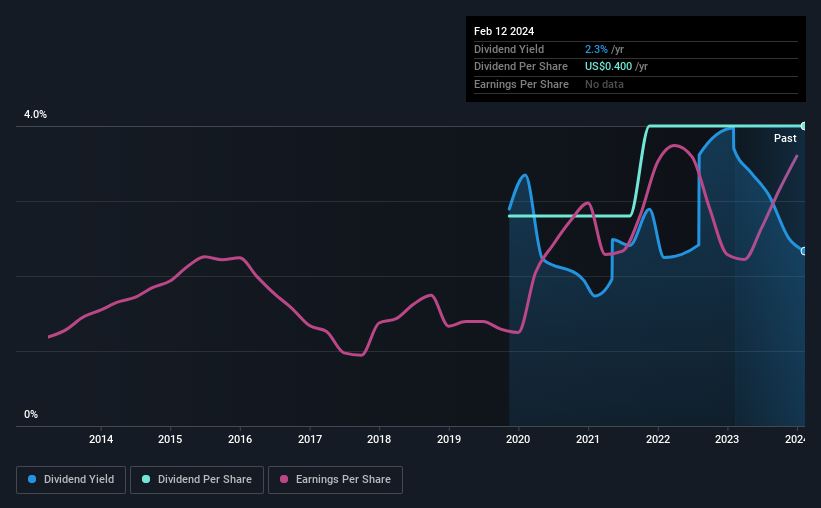

The board of Natural Grocers by Vitamin Cottage, Inc. (NYSE:NGVC) has announced that it will pay a dividend on the 20th of March, with investors receiving $0.10 per share. This makes the dividend yield 2.3%, which will augment investor returns quite nicely.

View our latest analysis for Natural Grocers by Vitamin Cottage

Natural Grocers by Vitamin Cottage Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. However, Natural Grocers by Vitamin Cottage's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

EPS is set to grow by 22.0% over the next year if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could reach 121%, which probably can't continue without starting to put some pressure on the balance sheet.

Natural Grocers by Vitamin Cottage Is Still Building Its Track Record

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. Since 2020, the dividend has gone from $0.28 total annually to $0.40. This works out to be a compound annual growth rate (CAGR) of approximately 9.3% a year over that time. Natural Grocers by Vitamin Cottage has been growing its dividend at a decent rate, and the payments have been stable. However, the payment history is very short, so there is no evidence yet that the dividend can be sustained over a full economic cycle.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see that Natural Grocers by Vitamin Cottage has been growing its earnings per share at 22% a year over the past five years. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

We Really Like Natural Grocers by Vitamin Cottage's Dividend

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 2 warning signs for Natural Grocers by Vitamin Cottage that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Natural Grocers by Vitamin Cottage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NGVC

Natural Grocers by Vitamin Cottage

Natural Grocers by Vitamin Cottage, Inc., together with its subsidiaries, retails natural and organic groceries, and dietary supplements in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.