- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

What Do Kroger’s Recent Layoffs Signal for Its Stock Valuation in 2025?

Reviewed by Bailey Pemberton

Trying to decide what to do with Kroger stock right now? You are not alone. Whenever a stock posts a five-year gain of 114.2%, even longtime holders start to wonder if there is still room to grow or if it is time to take some profits off the table. Over the past year, Kroger has climbed 21.0% and it is up 7.0% year-to-date. However, in recent weeks, the ride has gotten bumpier, with a 2.8% slip over the past 30 days, partly offset by a modest 1.3% rebound in the last week.

This turbulence has come alongside major company headlines. Kroger’s failed merger with Albertsons made waves, and the aftermath has not been easy. News just broke that nearly 1,000 corporate employees are being laid off, which is a clear effort to control costs and adapt strategy. Despite this, interest from partners like Krispy Kreme signals Kroger’s continued relevance in retail innovation and hints at fresh opportunities ahead.

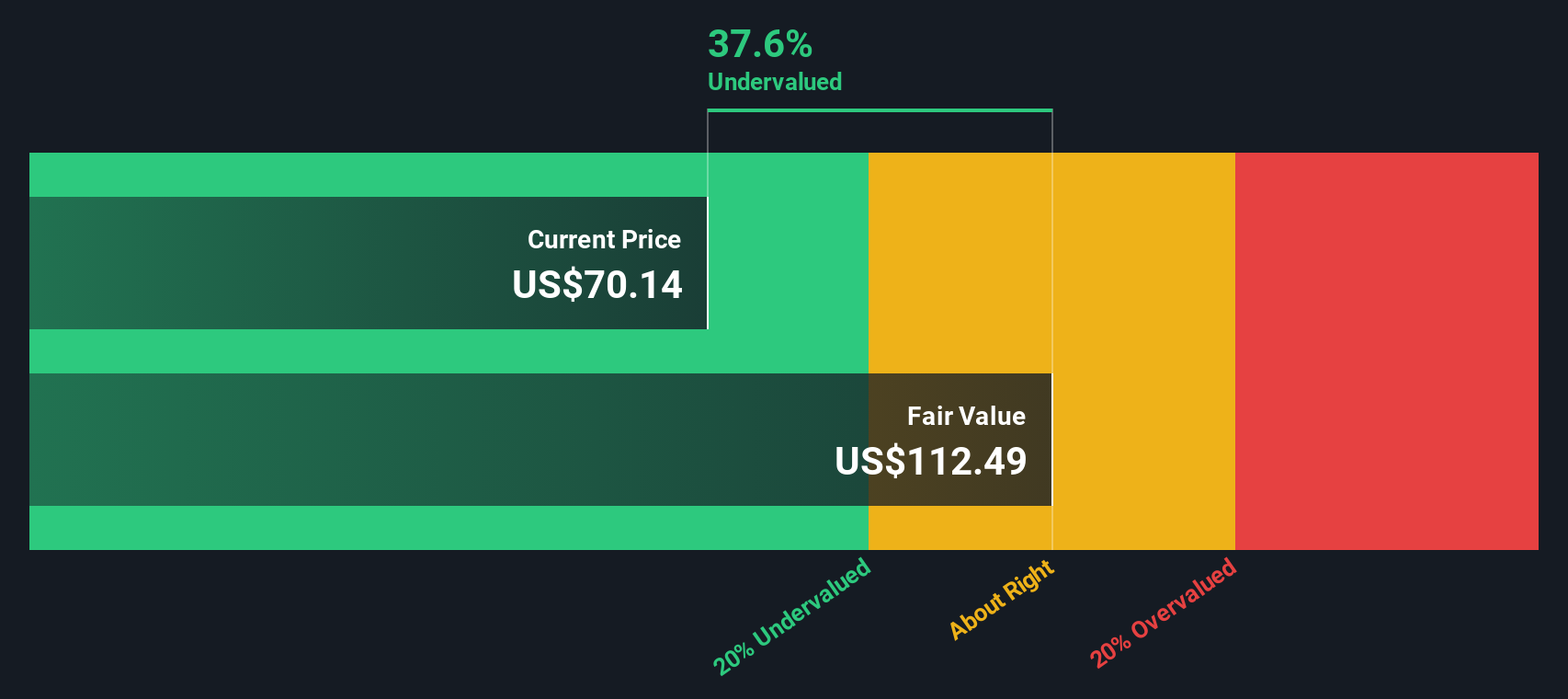

With uncertainty creeping in, many investors are focusing on valuation. By the numbers, Kroger scores a 5 out of 6 based on key undervaluation checks, suggesting the stock may still be trading at a discount by several measures. Of course, not every valuation method tells the full story. In the next section, we will break down how each score is calculated and what it means for Kroger’s outlook. Stay tuned, because there is an even better way to weigh valuation that many overlook.

Approach 1: Kroger Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This approach offers investors an in-depth look at what Kroger’s expected future earnings could be worth right now, using a structured, multi-stage analysis of its Free Cash Flow (FCF).

For Kroger, the latest reported Free Cash Flow stands at approximately $2.21 Billion. Analyst forecasts expect steady growth, projecting FCF to reach about $3.16 Billion by 2030. The first five years of these projections are based on analyst estimates, while years beyond that rely on extrapolations to provide a longer-term perspective. Each future year’s cash flow is discounted to reflect its value in today’s terms.

Based on this detailed model, Kroger’s intrinsic value is calculated at $87.23 per share. Comparing this figure with the company’s current market price, the analysis finds that Kroger stock is trading at a 24.0% discount to its fair value. This suggests that shares remain undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kroger is undervalued by 24.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kroger Price vs Earnings (PE Ratio)

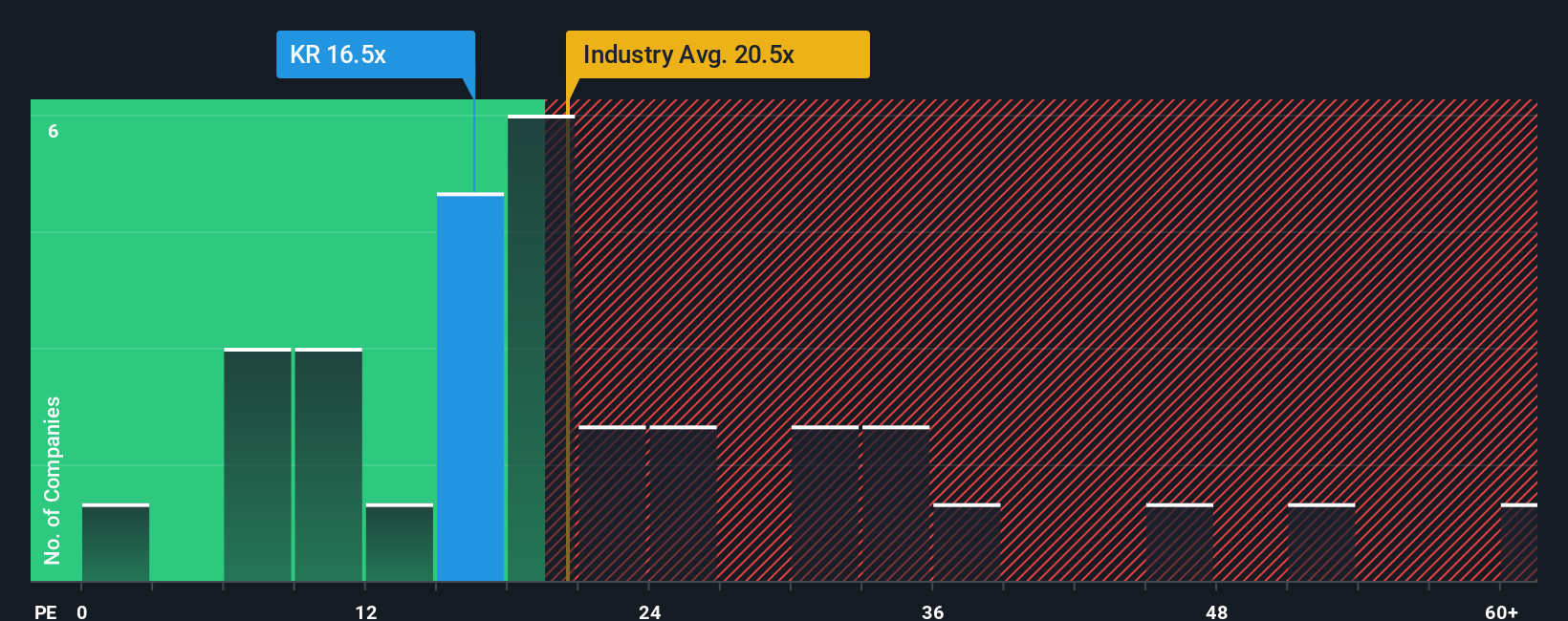

The Price-to-Earnings (PE) ratio is a widely used valuation tool for established, profitable companies like Kroger because it connects the company’s share price directly to its bottom-line earnings. This makes it a straightforward way for investors to judge whether a stock is priced appropriately relative to how much profit it generates.

It is important to remember that what counts as a "normal" or "fair" PE ratio depends on a mix of growth prospects and perceived risks. Higher growth typically commands a higher PE, while extra risk might push it lower. For context, Kroger’s current PE ratio stands at 16.24x, which is noticeably below both the Consumer Retailing industry average of 21.03x and the peer group average of 22.20x. On the surface, this might signal a bargain compared to competitors.

A deeper look comes from the proprietary "Fair Ratio" developed by Simply Wall St, which takes into account much more than just industry averages. The Fair Ratio for Kroger is calculated at 21.77x, incorporating specifics like Kroger’s profit margins, earnings growth, industry, and overall market cap. This approach gives a more tailored assessment, reflecting the company’s unique strengths and risks rather than lump-sum comparisons. Because Kroger’s PE is well below its Fair Ratio, this analysis shows the stock is undervalued based on earnings multiples as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kroger Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your story about a company in financial form; it lets you connect the dots between what you believe about Kroger’s future and the numbers, such as fair value, revenue growth, and profit margins, that reflect those beliefs.

Narratives are more than numbers. They combine your view of the company’s strategy, risks, and opportunities, and translate them into a financial forecast and an estimated fair value. This helps you make buy or sell decisions by showing exactly how your expectations compare to the current share price. The best part is, Narratives are easy to create and adjust on Simply Wall St's Community page, used by millions of investors worldwide, making powerful analysis accessible to everyone.

Because Narratives update dynamically whenever important news or earnings are released, you always have a real-time sense of whether your view is still supported by the facts. For example, one investor might feel Kroger's e-commerce push and health focus justify an $85 per share fair value, while another, more cautious about sector competition and costs, might see just $63 as fair. Narratives show your perspective in the clearest financial terms possible.

Do you think there's more to the story for Kroger? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives