- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

Kroger (NYSE:KR) Unveils Summer Meals Under US$50 Emphasizing Quality And Savings

Reviewed by Simply Wall St

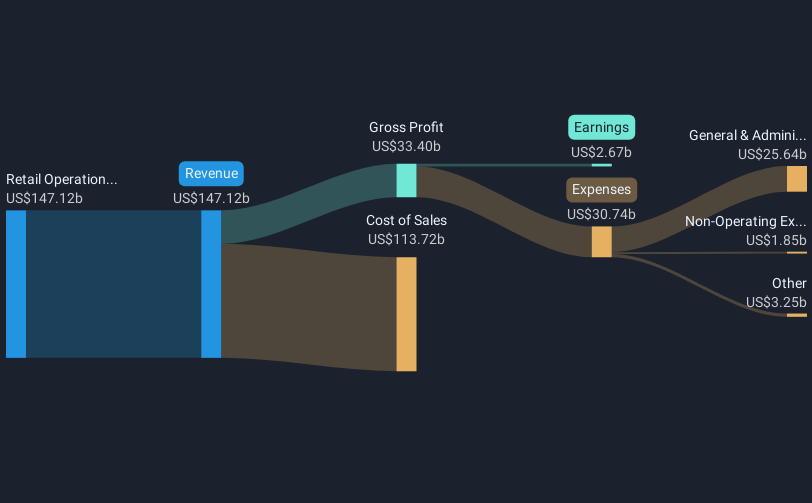

Kroger (NYSE:KR) recently launched a summer meals initiative, offering family-friendly, affordable meal options. Over the last quarter, the company's stock price rose 6%. This increase occurred amid several key events, including a share buyback program completion and a modest dividend increase, reflecting the company's commitment to shareholder value. Meanwhile, the broader market saw minimal movement due to ongoing trade policy uncertainties. Kroger's strategic focus on affordability and value through pricing initiatives likely strengthened its investor appeal, adding weight to its stock price gains, as the market digested wider macroeconomic concerns and trade developments.

We've discovered 3 possible red flags for Kroger that you should be aware of before investing here.

The recent launch of Kroger's summer meals initiative may bolster the company's appeal among cost-conscious consumers, potentially enhancing its value proposition and attracting more customers amid economic uncertainties. This development aligns with Kroger's existing focus on affordability and convenience, which could positively impact its revenue and earnings forecasts. Looking at the long-term performance, Kroger's total shareholder return including dividends was 126.69% over the past five years. This shows significant long-term growth, which stands in contrast to the shorter-term market dynamics. Over the past year, Kroger has outperformed the US Consumer Retailing industry, which saw a return of 23.4% in comparison.

The share buyback program and dividend increase highlighted in the introduction indicate Kroger's commitment to enhancing shareholder returns. These initiatives might further improve the market perception of Kroger's fiscal health and stability. With the current share price near US$71.35, just a 4.6% discount to the consensus price target of US$74.82, the potential for continued appreciation is suggested to be moderate by analysts. Future revenue and margin expansions, particularly through digital and health-focused offerings, could serve as critical growth drivers, influencing the present valuation narratives.

Click here to discover the nuances of Kroger with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives