- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

Kroger (NYSE:KR) Expands Plant-Based Offerings With Beyond Chicken Launch At 1,900 Stores

Reviewed by Simply Wall St

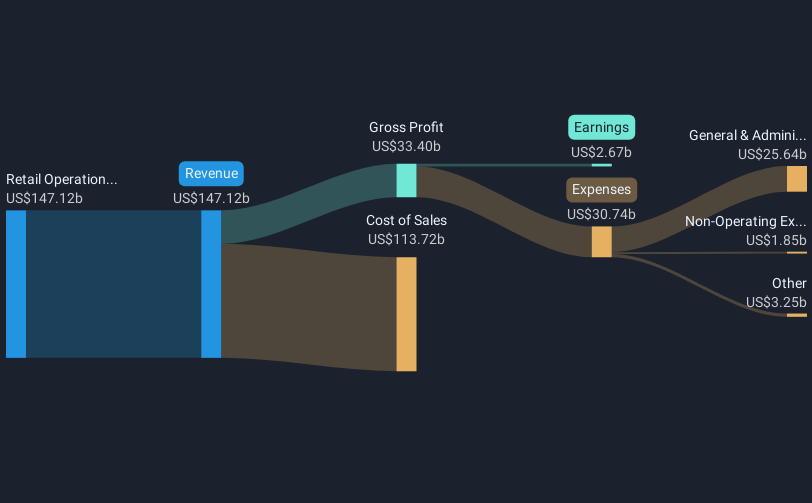

Kroger (NYSE:KR) experienced a significant price move of 18% over the last quarter. This period saw dynamic events, including the national rollout of Beyond Meat's Beyond Chicken at over 1,900 Kroger stores, which aligns with the increasing consumer demand for plant-based alternatives. Meanwhile, the company announced robust buyback activities and strategic executive changes following the resignation of CEO Rodney McMullen. These factors likely contributed to the positive market sentiment surrounding the company, complementing its stock performance amid a broader market upswing, where the S&P 500 also saw gains supported by strong tech earnings.

Kroger has 3 warning signs we think you should know about.

The recent rollout of Beyond Meat products across 1,900 Kroger stores aligns well with the company's focus on fresh, affordable food, potentially boosting both customer traffic and loyalty. This initiative may enhance revenue streams, especially as Kroger strengthens its digital sales, which saw more than US$13 billion in sales in 2024. Coupled with strategic executive changes, these moves may improve operational efficiency and contribute positively to the anticipated revenue and earnings forecasts.

Over the last five years, Kroger's total shareholder return, which includes both share price appreciation and dividends, was 145.14%. Within the previous year, however, Kroger's performance was below the US Consumer Retailing industry, which returned 36.4%. While the company has experienced a substantial short-term price increase recently, the current share price of US$71.38 is approximately 5.4% above the consensus analyst price target of US$67.73, suggesting a need to reassess future prospects given potential risks and forecasts. However, the company's strong share repurchase activities could lead to a reduction in shares outstanding, potentially elevating earnings per share and contributing to better market positioning in the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kroger, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives