- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

Kroger (KR): Rethinking Valuation After a Recent 7% Pullback in the Share Price

Reviewed by Simply Wall St

Kroger (KR) has quietly slipped about 7 % over the past month, even as its long term returns still look solid. That pullback has investors asking whether the grocery giant is drifting or resetting.

See our latest analysis for Kroger.

At around $62.10 a share, Kroger’s recent 1 month share price return of roughly negative 7 percent looks more like a breather than a breakdown. This is especially the case given its 5 year total shareholder return above 120 percent, which suggests the longer term story is still firmly intact.

If Kroger’s pullback has you rethinking your exposure to defensives, this is also a handy moment to explore fast growing stocks with high insider ownership that might be setting up their next leg higher.

With shares now trading at a double digit discount to analyst targets despite steady earnings growth, investors face a key question: Is Kroger quietly undervalued, or is the market already banking on every bit of future growth?

Most Popular Narrative Narrative: 17% Undervalued

With Kroger last closing at $62.10 against a most popular narrative fair value near the mid $70s, the story leans toward underappreciated execution rather than fading momentum.

The rapid growth in Kroger's e commerce business, highlighted by a 15% YoY increase and strong improvements in delivery, suggests significant upside potential as more consumers shift to online grocery shopping. Ongoing investment in unified digital platforms and fulfillment operations is expected to drive future revenue growth and accelerate profit improvement as the business scales.

Curious how modest top line growth, richer margins, and a leaner share count add up to that higher fair value, and why the assumed future earnings multiple looks more conservative than what many consumer names enjoy today, even as profitability is expected to climb? Want to see the exact building blocks behind that call?

Result: Fair Value of $74.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising labor and benefits costs, along with heavy digital and store investment, could compress margins and delay the earnings growth this narrative assumes.

Find out about the key risks to this Kroger narrative.

Another Angle on Valuation

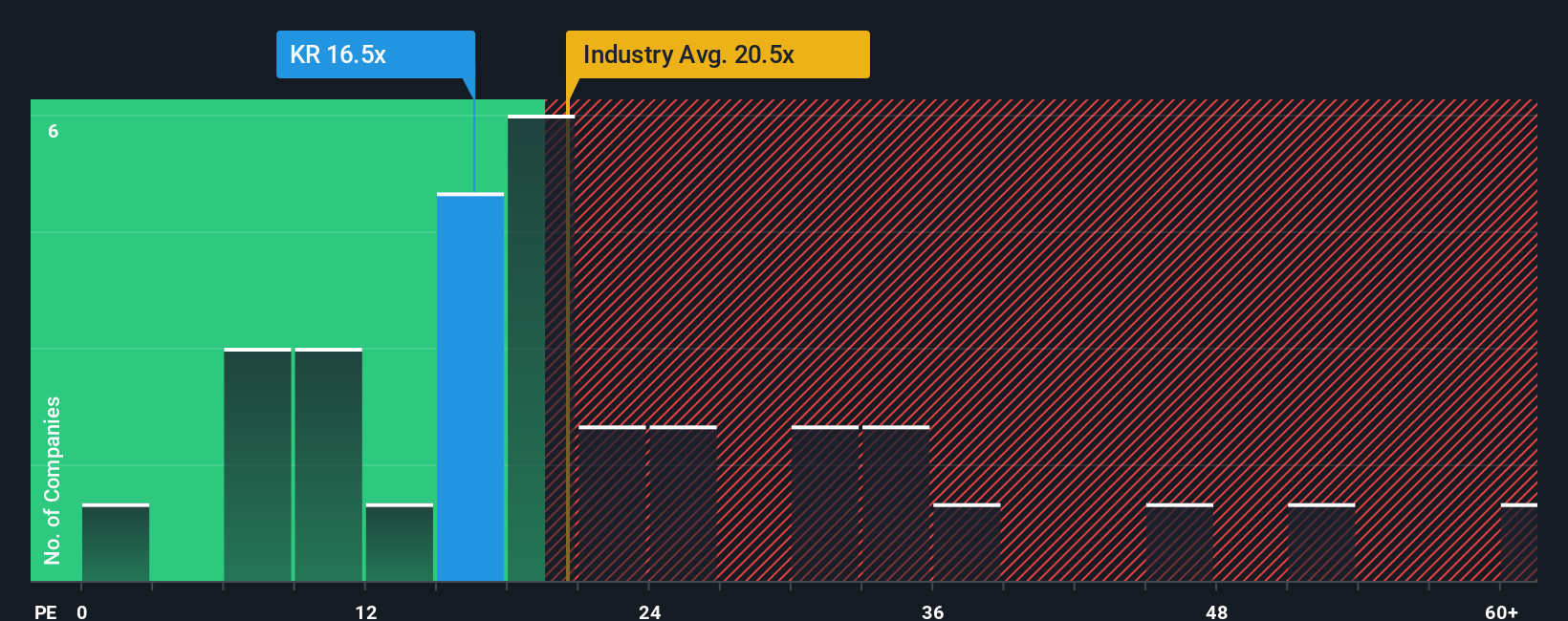

Our fair value work suggests Kroger is about 17% undervalued today, but its current price to earnings ratio near 50 times versus a fair ratio of 38 times, and roughly 22 times for the consumer retailing industry and 21 times for peers, paints a far richer picture. That kind of premium can support solid compounders, or it can vanish quickly if growth disappoints, so which side of that trade do you believe in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kroger Narrative

If the current narrative does not quite fit your view, or you would rather dive into the numbers yourself, you can build a custom take in just a few minutes, Do it your way

A great starting point for your Kroger research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready to act on your next investing move?

Before you stop at Kroger, give yourself an edge by scanning focused stock ideas on Simply Wall Street that could sharpen your portfolio’s next upgrade.

- Lock in potential cash flow and capital strength by screening for income opportunities through these 13 dividend stocks with yields > 3% built for yield focused investors.

- Target growth stories the market may be mispricing with these 909 undervalued stocks based on cash flows that highlight stocks trading below their cash flow potential.

- Tap into powerful secular themes by reviewing these 30 healthcare AI stocks that sit at the crossroads of medicine, data, and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion