- United States

- /

- Food and Staples Retail

- /

- NYSE:DG

There's Reason For Concern Over Dollar General Corporation's (NYSE:DG) Price

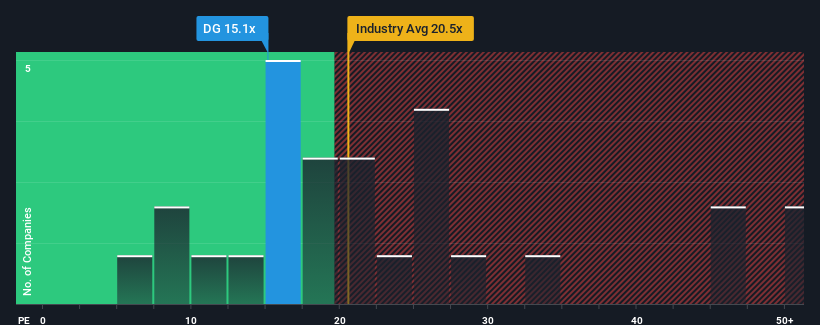

There wouldn't be many who think Dollar General Corporation's (NYSE:DG) price-to-earnings (or "P/E") ratio of 15.1x is worth a mention when the median P/E in the United States is similar at about 17x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Dollar General hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Dollar General

Is There Some Growth For Dollar General?

There's an inherent assumption that a company should be matching the market for P/E ratios like Dollar General's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. This means it has also seen a slide in earnings over the longer-term as EPS is down 14% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 1.5% per year over the next three years. That's shaping up to be materially lower than the 13% per year growth forecast for the broader market.

In light of this, it's curious that Dollar General's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Dollar General currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Dollar General that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DG

Dollar General

A discount retailer, provides various merchandise products in the southern, southwestern, midwestern, and eastern United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives