- United States

- /

- Food and Staples Retail

- /

- NYSE:DG

Dollar General's (NYSE:DG) Dividend Will Be $0.59

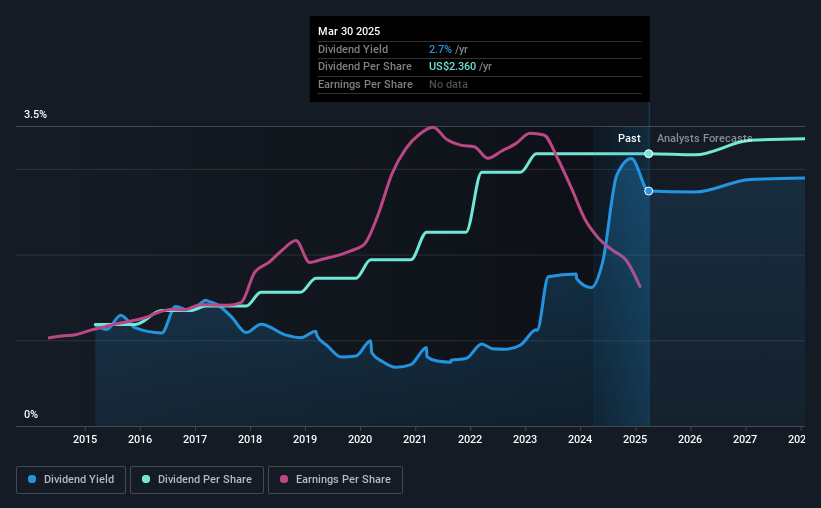

Dollar General Corporation (NYSE:DG) will pay a dividend of $0.59 on the 22nd of April. Based on this payment, the dividend yield on the company's stock will be 2.7%, which is an attractive boost to shareholder returns.

Dollar General's Projected Earnings Seem Likely To Cover Future Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, Dollar General was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 36.2%. If the dividend continues on this path, the payout ratio could be 38% by next year, which we think can be pretty sustainable going forward.

See our latest analysis for Dollar General

Dollar General Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2015, the dividend has gone from $0.88 total annually to $2.36. This works out to be a compound annual growth rate (CAGR) of approximately 10% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth Is Doubtful

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. In the last five years, Dollar General's earnings per share has shrunk at approximately 5.2% per annum. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

In Summary

Overall, we think Dollar General is a solid choice as a dividend stock, even though the dividend wasn't raised this year. While the payments look sustainable for now, earnings have been shrinking so the dividend could come under pressure in the future. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 2 warning signs for Dollar General that investors should take into consideration. Is Dollar General not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DG

Dollar General

A discount retailer, provides various merchandise products in the southern, southwestern, midwestern, and eastern United States.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

GE Vernova (GEV): Data Center Electrification and "Angstrom-Scale" Grid Demand Fuel a Powerhouse Outlook

Taiwan Semiconductor Manufacturing Co. (TSM): AI Giga-Cycle Drives Record Revenue and the Arrival of the "Angstrom Era"

Vicor Corporation (VICR): Powering the AI Infrastructure Wave as Volatility Tests the "Bull" Thesis

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks