- United States

- /

- Food and Staples Retail

- /

- NYSE:BJ

Digital Sales Surge and Aggressive Expansion Could Be a Game Changer for BJ's (BJ)

Reviewed by Sasha Jovanovic

- BJ’s Wholesale Club Holdings recently reported a 34% increase in digitally enabled comparable sales, record membership fee income, and outlined plans to open 25 to 30 new clubs focused on high-growth suburban and Sunbelt markets.

- An interesting detail is that digital adoption, including record mobile app engagement and same-day delivery, is now a foundation of BJ's strategy to boost convenience and member retention during a challenging economy.

- We'll explore how the club expansion plans highlighted in BJ’s latest update could influence its long-term investment narrative and growth outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

BJ's Wholesale Club Holdings Investment Narrative Recap

To believe in BJ's Wholesale Club Holdings as a shareholder, you need conviction in its ability to drive recurring revenue through membership growth and digital adoption, while balancing pressures from rising costs and shifting consumer habits. The recent 34% surge in digitally enabled comparable sales displays momentum behind BJ's omnichannel strategy, but the short-term catalysts and macro-driven risks, including margin pressures and consumer uncertainty, remain fundamentally unchanged by this development.

Among recent announcements, management’s plan to open 25 to 30 new clubs across fast-growing suburban and Sunbelt markets directly aligns with the business’s core growth catalyst: expanding its store footprint to capture new members and build scale. This type of expansion could help offset cyclical slowdowns in discretionary merchandise and reinforce BJ’s resilience, should near-term volatility persist.

Yet, as digital engagement expands, investors should not overlook the risk that...

Read the full narrative on BJ's Wholesale Club Holdings (it's free!)

BJ's Wholesale Club Holdings' outlook projects $25.2 billion in revenue and $683.1 million in earnings by 2028. This requires 6.5% annual revenue growth and a $104.2 million increase in earnings from the current $578.9 million.

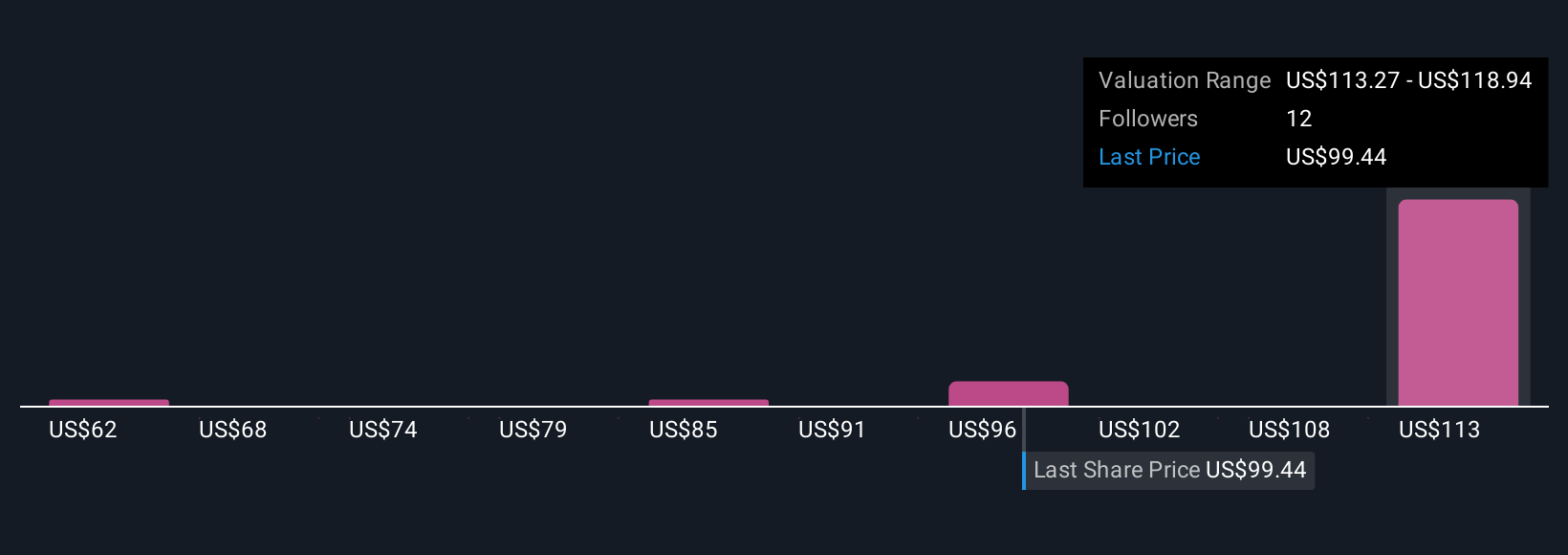

Uncover how BJ's Wholesale Club Holdings' forecasts yield a $115.63 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Fair value estimates from nine members of the Simply Wall St Community range widely from US$54.74 to US$144.70, signaling varied outlooks on future returns. With ongoing store expansion in growth markets, many are considering how slower forecast revenue growth could influence the company’s performance, highlighting the benefit of comparing multiple viewpoints before making a decision.

Explore 9 other fair value estimates on BJ's Wholesale Club Holdings - why the stock might be worth as much as 61% more than the current price!

Build Your Own BJ's Wholesale Club Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BJ's Wholesale Club Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BJ's Wholesale Club Holdings' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BJ's Wholesale Club Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BJ

BJ's Wholesale Club Holdings

Operates membership warehouse clubs on the eastern half of the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives