- United States

- /

- Food and Staples Retail

- /

- NYSE:ACI

Do Exclusive Brand Partnerships Signal a New Growth Strategy for Albertsons (ACI)?

Reviewed by Sasha Jovanovic

- In recent news, several brands announced expanded partnerships and exclusive product launches at Albertsons stores, including Wienerschnitzel's signature corn dogs and Go Raw's new pumpkin seed multipack, now available across hundreds of grocery locations in California and Nevada. These collaborations also included a retail media agreement between Albertsons Media Collective and Perion Network Ltd., offering advertisers new ways to reach millions of verified Albertsons shoppers through omnichannel campaigns.

- These developments reflect Albertsons' growing focus on enhancing its product mix and strengthening its digital marketing platform, aiming to increase both foot traffic and online engagement through unique offerings and technology-driven solutions.

- We’ll examine how the addition of exclusive and branded products at Albertsons may shape its broader investment narrative and growth outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Albertsons Companies Investment Narrative Recap

To see value in Albertsons Companies as a shareholder, investors generally need to believe that expanding exclusive brands and digital initiatives will boost revenue growth and improve margins despite competitive and cost headwinds. While the recent news on product launches and media partnerships is aligned with this thesis, it appears unlikely to materially impact the most immediate catalyst, which remains the scaling of e-commerce profitability. The primary risk continues to be labor costs and union pressures, which could affect margins and near-term earnings growth.

Among the latest developments, Albertsons’ collaboration with Perion Network Ltd. is especially relevant, as it aims to strengthen the company's digital advertising platform and broaden reach to millions of verified shoppers. If successful, this partnership could support omnichannel engagement and loyalty, directly tied to its digital transformation catalysts, even if the financial impact may take some time to become clear.

On the other hand, investors should be aware that ongoing labor negotiations and wage inflation may significantly influence Albertsons’ bottom line if...

Read the full narrative on Albertsons Companies (it's free!)

Albertsons Companies' outlook anticipates $86.1 billion in revenue and $1.1 billion in earnings by 2028. This reflects a 2.1% annual revenue growth rate and a $145.7 million increase in earnings from the current $954.3 million.

Uncover how Albertsons Companies' forecasts yield a $24.06 fair value, a 43% upside to its current price.

Exploring Other Perspectives

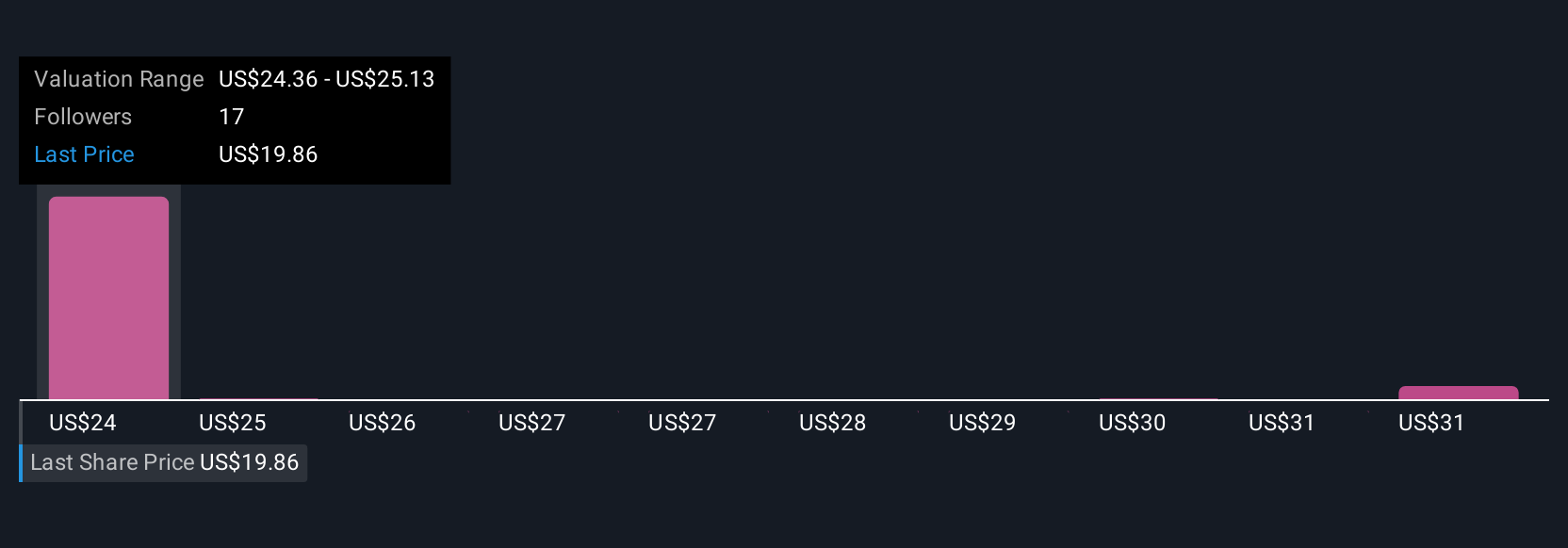

Six members of the Simply Wall St Community estimate Albertsons’ fair value between US$19.77 and US$39.42 per share, showing a wide spectrum of views. As you consider these opinions, remember that controlling labor costs remains essential, with sustained margin pressure posing challenges for future performance.

Explore 6 other fair value estimates on Albertsons Companies - why the stock might be worth over 2x more than the current price!

Build Your Own Albertsons Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Albertsons Companies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Albertsons Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Albertsons Companies' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACI

Albertsons Companies

Through its subsidiaries, operates in the food and drug retail industry in the United States.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives