- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:SFM

Sprouts Farmers Market (NasdaqGS:SFM) Earnings Shine With US$381 Million Net Income Despite 2% Share Dip

Reviewed by Simply Wall St

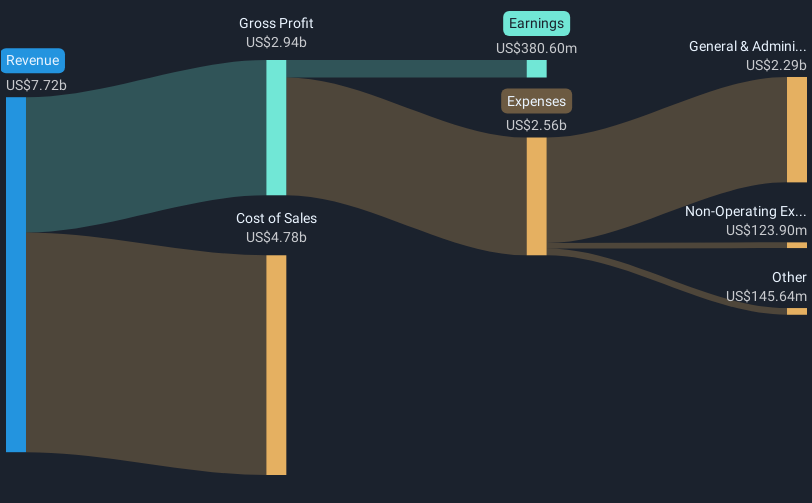

Sprouts Farmers Market (NasdaqGS:SFM) recently reported strong earnings for 2024, with sales rising to $7,719 million and net income surging to $381 million. Despite this robust performance, its share price dipped by 2.12% over the past month, aligning with broader market trends. The Dow Jones and Nasdaq both experienced declines of 2.5% as investors grappled with disappointing economic data and a broad sell-off in major tech and healthcare stocks, including UnitedHealth and Nvidia. Despite Sprouts providing favorable guidance for 2025, with expected sales growth between 10.5% and 12.5%, the broader market sentiment and volatility seem to have weighed on its stock, mirroring the downturn seen across indices. This context underscores how macroeconomic factors and sector-wide shifts can impact individual stock performance, even when company-specific news is positive.

Take a closer look at Sprouts Farmers Market's potential here.

Over the past five years, Sprouts Farmers Market's total shareholder returns reached an impressive value, aided by significant earnings growth. Key events contributing to this performance include the company's high-quality earnings, with a 47.1% earnings growth over the past year, notably surpassing its five-year average of 9% per year. Additionally, the company has outpaced the Consumer Retailing industry, which only saw a 9.8% growth. Despite trading at a premium with a Price-To-Earnings Ratio of 37.4x compared to peers, the stock was considered undervalued in terms of discounted cash flow, indicating higher fair value estimates. Significant insider sales over the past quarter, however, introduce an element of caution.

The company's strategic financial maneuvers, including a substantial share repurchase program from May to September 2024, also played a role in boosting total returns. In parallel, Sprouts has enhanced its corporate presence through partnerships, such as with Uber Eats in December 2023, increasing its market reach.

- Learn how Sprouts Farmers Market's intrinsic value compares to its market price with our detailed valuation report.

- Analyze the downside risks for Sprouts Farmers Market and understand their potential impact—click to learn more.

- Already own Sprouts Farmers Market? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFM

Sprouts Farmers Market

Engages in the retailing of fresh, natural, and organic food products under the Sprouts brand in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives