- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:SFM

Is Sprouts Still a Smart Pick After Its Sharp 2025 Pullback?

Reviewed by Bailey Pemberton

If you follow grocery retailers, you’ve probably noticed the intriguing story playing out with Sprouts Farmers Market lately. Maybe you’re considering jumping in after recent dips, or you’re already holding and trying to decide if this is just a bump in a longer road to growth. Sprouts’ stock has been on a wild rollercoaster. After an incredible run over the past five years, returning nearly 370%, the last few months have had investors second-guessing. Shares are down 5.5% over the past week, off 25.9% in the last 30 days, and down 22.7% year-to-date. Even with that, long-term holders are still sitting on massive gains, with a three-year return of 263.4%.

This sharp pullback has some folks worried about whether something fundamental has changed, while others see an opportunity. The shifts can be connected to market-wide jitters about the grocery sector, and for Sprouts in particular, some evolving sentiment around the company’s ability to keep up the momentum that fueled its earlier run. But has the market gotten ahead of itself with this pessimism? Could Sprouts actually be undervalued at these levels?

Here’s where things get interesting: using a rigorous valuation framework that checks six key areas for company undervaluation, Sprouts scores a 4. That means it looks undervalued in four out of six important checks. Let’s break down what these different valuation measures are actually saying. Stick around, because there’s an even sharper way to get to the heart of Sprouts’ true value that we’ll get to at the end of this article.

Why Sprouts Farmers Market is lagging behind its peers

Approach 1: Sprouts Farmers Market Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by forecasting a company’s future cash flows and discounting them back to today’s dollars. This approach aims to estimate what the business is really worth at present. It is considered one of the most rigorous ways to estimate intrinsic value, especially when a company’s future cash stream is fairly predictable.

For Sprouts Farmers Market, the latest twelve months’ Free Cash Flow sits at $499.6 million. Analysts project healthy growth in the years to come, with cash flows expected to reach $922 million by the end of 2029, based on estimates from multiple analysts for the near term and further long-term projections extrapolated from Simply Wall St. This consistent rise in Free Cash Flow is a strong indicator of business expansion and operational efficiency.

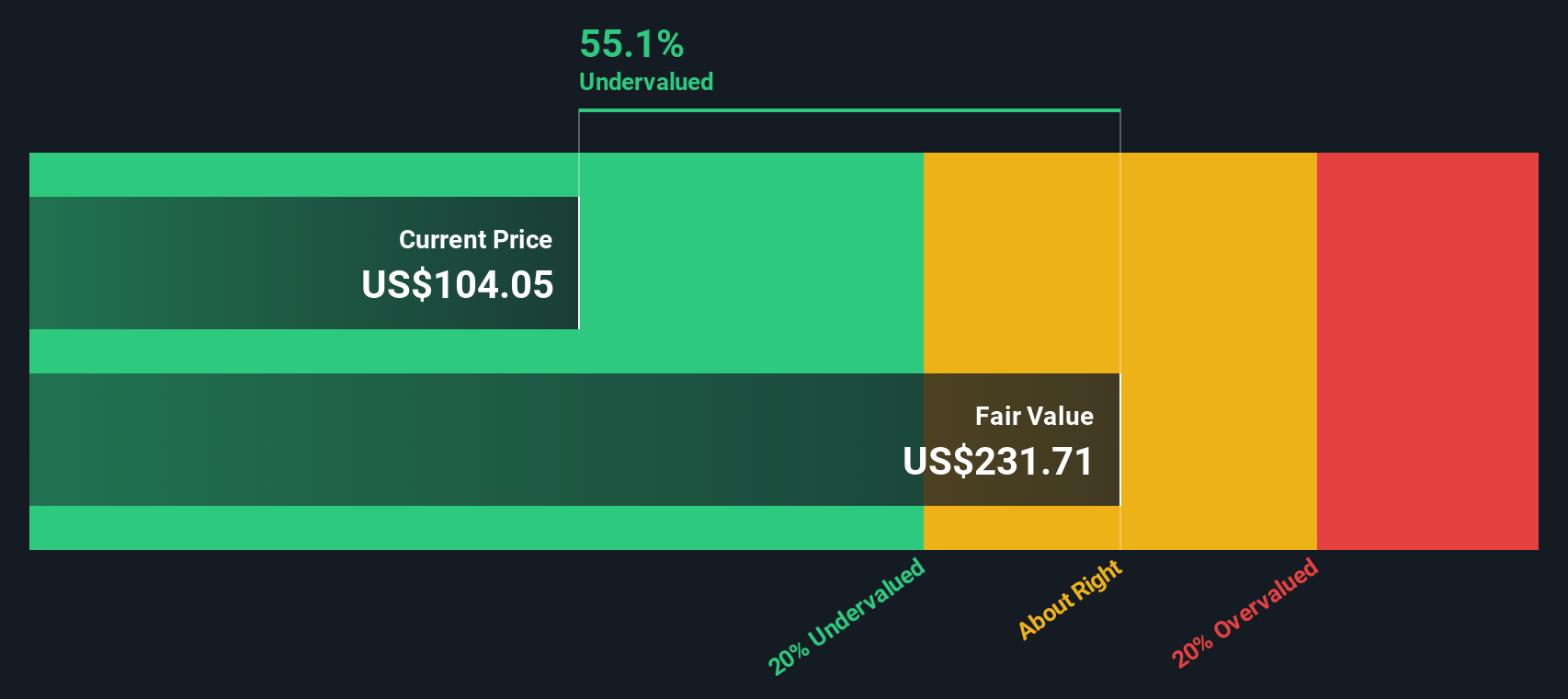

Based on these forecasts and the 2 Stage Free Cash Flow to Equity model, the DCF calculation estimates Sprouts Farmers Market’s intrinsic value at $231.11 per share. This represents a 55.5% discount compared to where shares are currently trading, suggesting the market has taken an overly pessimistic view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sprouts Farmers Market is undervalued by 55.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sprouts Farmers Market Price vs Earnings

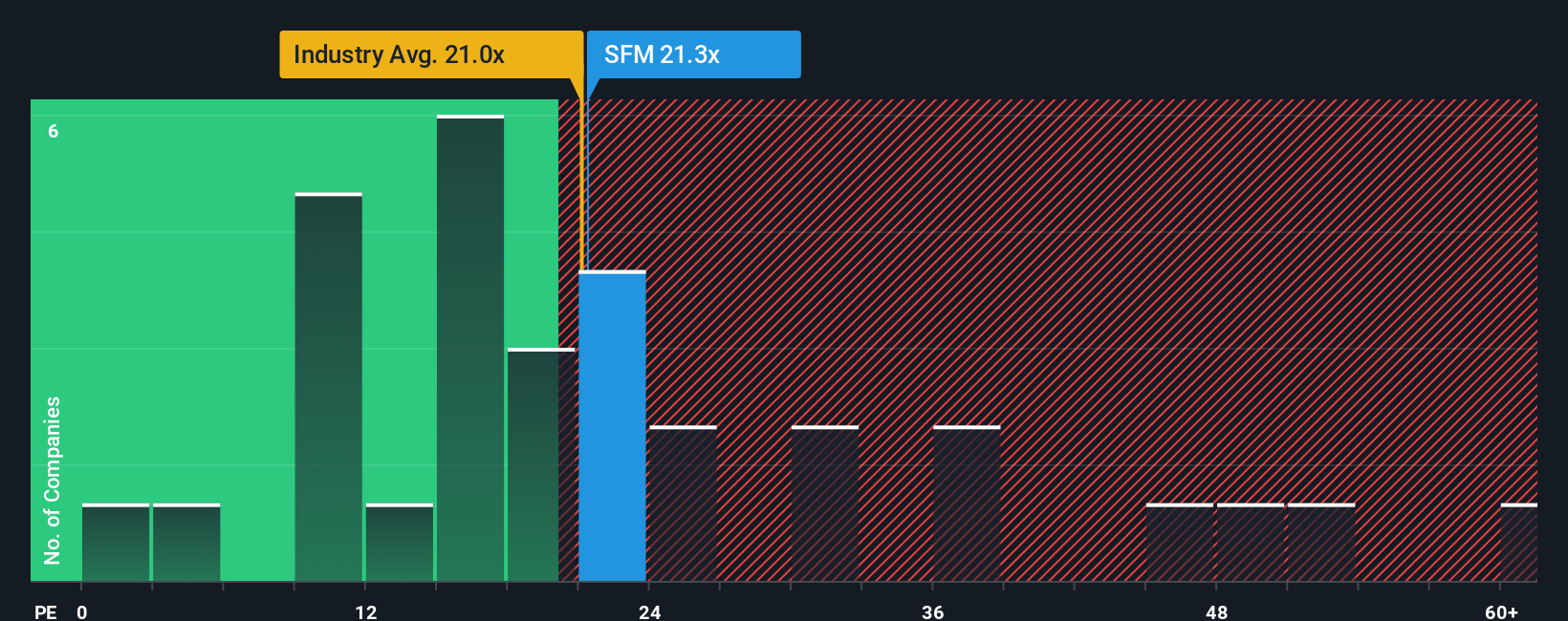

For profitable companies like Sprouts Farmers Market, the Price-to-Earnings (PE) ratio is a widely accepted starting point for valuation. It helps investors gauge how much they are paying for each dollar of the company’s current earnings. While a higher PE can signal optimism about future growth, it also builds in greater expectations and potential risk. A “fair” PE ratio takes into account not only a company’s current profits but also factors such as expected future earnings growth, market sentiment, and industry risk.

Sprouts currently trades at a PE ratio of 20.7x. To put this into perspective, this is just below the industry average for Consumer Retailing at 20.6x and is nearly identical to the peer group average of 20.8x. On the surface, this suggests Sprouts is priced broadly in line with competitors and the sector, reflecting similar growth and risk profiles.

However, Simply Wall St’s proprietary “Fair Ratio” for Sprouts comes in at 20.7x. This metric goes beyond simple peer or industry comparisons by adjusting for Sprouts' own growth rates, profit margins, company size, and sector-specific risks. By factoring in these company-specific details, the Fair Ratio provides a more accurate picture of what a justified valuation should look like for Sprouts in today’s market.

Since the actual PE ratio and the Fair Ratio are essentially the same, it suggests the market is valuing Sprouts Farmers Market just about right given its current prospects and risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sprouts Farmers Market Narrative

Now, there is a smarter, more dynamic way to understand valuation: Narratives. Rather than relying solely on numbers, a Narrative lets you map out your own story about Sprouts Farmers Market by combining your outlook on its future growth, margins, and opportunities into a financial forecast that then connects to a Fair Value. This approach is not just for professionals. On Simply Wall St’s Community page, millions of everyday investors can quickly create, view, and compare Narratives.

Narratives help you decide what Sprouts Farmers Market is truly worth and, most importantly, when it may be time to buy or sell by directly comparing your Fair Value to today’s share price. The real power of Narratives is that they are updated when new facts emerge, whether it is earnings results, news, or strategic shifts.

For example, the most optimistic view on Sprouts predicts robust healthy food demand, aggressive expansion, and strong private label growth that could justify a Fair Value of $209 per share. The most cautious view sees competitive threats, cost pressures, and slower growth pulling fair value closer to $155. Narratives simplify how you act on your research, so you can invest with confidence using not just numbers, but your belief in the company’s story and the data driving it.

Do you think there's more to the story for Sprouts Farmers Market? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFM

Sprouts Farmers Market

Engages in the retailing of fresh, natural, and organic food products in the United States.

Outstanding track record and good value.

Similar Companies

Market Insights

Community Narratives