- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:IMKT.A

Ingles Markets (IMKT.A): Valuation Check After Weaker Full-Year Earnings and Impairment Charge

Reviewed by Simply Wall St

Ingles Markets (IMKT.A) just posted full year results showing lower sales, softer profits, and a property and equipment impairment charge, a combination that puts the recent stock performance into sharper context for investors.

See our latest analysis for Ingles Markets.

The soft full year earnings, impairment charge, and recent board change help explain why the latest 1 day share price return of minus 2.53 percent contrasts with a still solid year to date share price gain of 15.51 percent. This suggests momentum is cooling after a stronger run.

If this mix of resilience and pressure has you rethinking your grocery exposure, it might be worth exploring fast growing stocks with high insider ownership as potential higher growth alternatives backed by committed insiders.

With earnings sliding, an impairment charge hitting profitability, and shares still up solidly this year, the key question now is whether Ingles Markets is quietly undervalued or if the market is already pricing in its future growth.

Price-to-Earnings of 16.9x: Is it justified?

Ingles Markets last closed at 74.25 dollars, and on a price to earnings basis it looks modestly priced versus the broader US market but more demanding than its closest peers.

The price to earnings ratio compares the current share price to the company’s earnings per share. It is a straightforward way to see how much investors are paying for each dollar of profit. For a mature supermarket operator like Ingles Markets, this multiple is a key lens because earnings are a primary driver of long term value.

On one hand, Ingles Markets trades on 16.9 times earnings, which is cheaper than the US market average of 18.7 times and below the US consumer retailing industry average of 21.9 times. This implies investors are not paying a premium for its profits relative to many retailers. On the other hand, the same 16.9 times earnings looks expensive against the narrower peer group average of 12.4 times, especially given earnings have declined by 18.8 percent per year over the past five years and fell 21.2 percent over the past year. This suggests the market is still assigning a relatively full multiple despite a weak profit trend.

This combination of below market and industry averages, but above peer levels, underlines how finely balanced sentiment is around Ingles Markets near term earnings power and its ability to stabilise margins from here.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.9x (ABOUT RIGHT)

However, softer earnings trends, including the recent impairment, and structurally thin supermarket margins could quickly erode today’s seemingly reasonable valuation if these pressures persist.

Find out about the key risks to this Ingles Markets narrative.

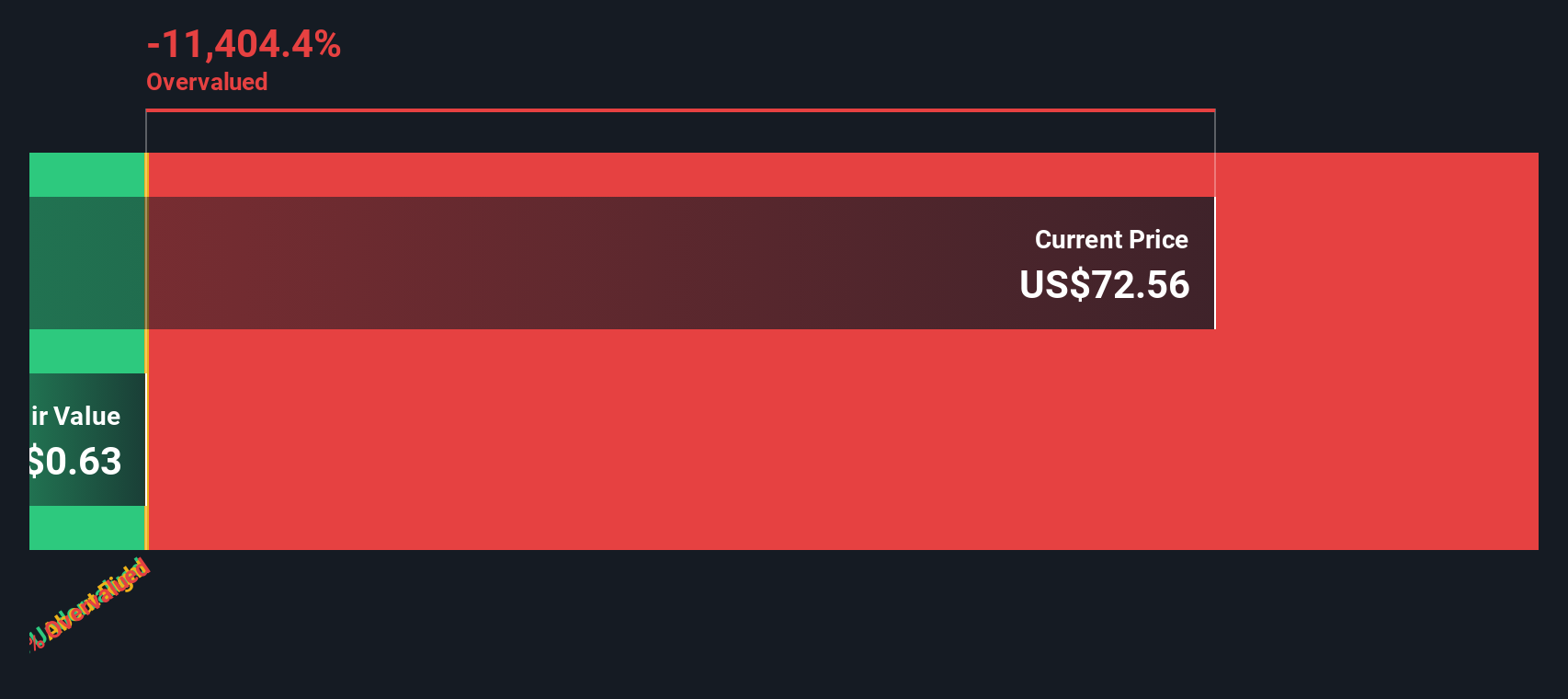

Another View, Our DCF Signals Caution

While a 16.9 times earnings multiple makes Ingles Markets look roughly fairly priced, our DCF model paints a harsher picture. It suggests fair value is closer to 17.86 dollars, implying the current 74.25 dollars share price could be significantly overvalued. Which signal should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ingles Markets for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ingles Markets Narrative

If you see the story differently or want to stress test these assumptions with your own numbers, you can build a custom view in just minutes: Do it your way.

A great starting point for your Ingles Markets research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next edge in the market?

Before you move on, give yourself more options: use the Simply Wall Street Screener to uncover fresh ideas that complement or outperform your current grocery exposure.

- Capture potential value by scanning these 902 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Supercharge your growth hunt with these 26 AI penny stocks harnessing artificial intelligence to reshape industries and earnings potential.

- Strengthen income resilience by reviewing these 15 dividend stocks with yields > 3% that offer attractive yields alongside sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IMKT.A

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026