- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:GO

Grocery Outlet Holding (GO): Exploring Valuation on Rising Earnings, Sales Growth, and Analyst Buy Ratings

Reviewed by Kshitija Bhandaru

Recent commentary emphasizes Grocery Outlet Holding (GO) as a name to watch, thanks to its expected growth in earnings and sales. The company’s favorable ranking has also landed it on a prominent 'Buy' list.

See our latest analysis for Grocery Outlet Holding.

After a difficult few years for shareholders, Grocery Outlet Holding’s momentum has started to shift. Despite a challenging 13% share price drop over the last month, the stock has gained nearly 15% in the past 90 days. This suggests fresh optimism in the market. However, the one-year total shareholder return remains negative, reflecting the tough long-term environment and a company still working to rebuild confidence and value.

If you’re interested in seeing what else is attracting attention lately, broaden your search and check out fast growing stocks with high insider ownership.

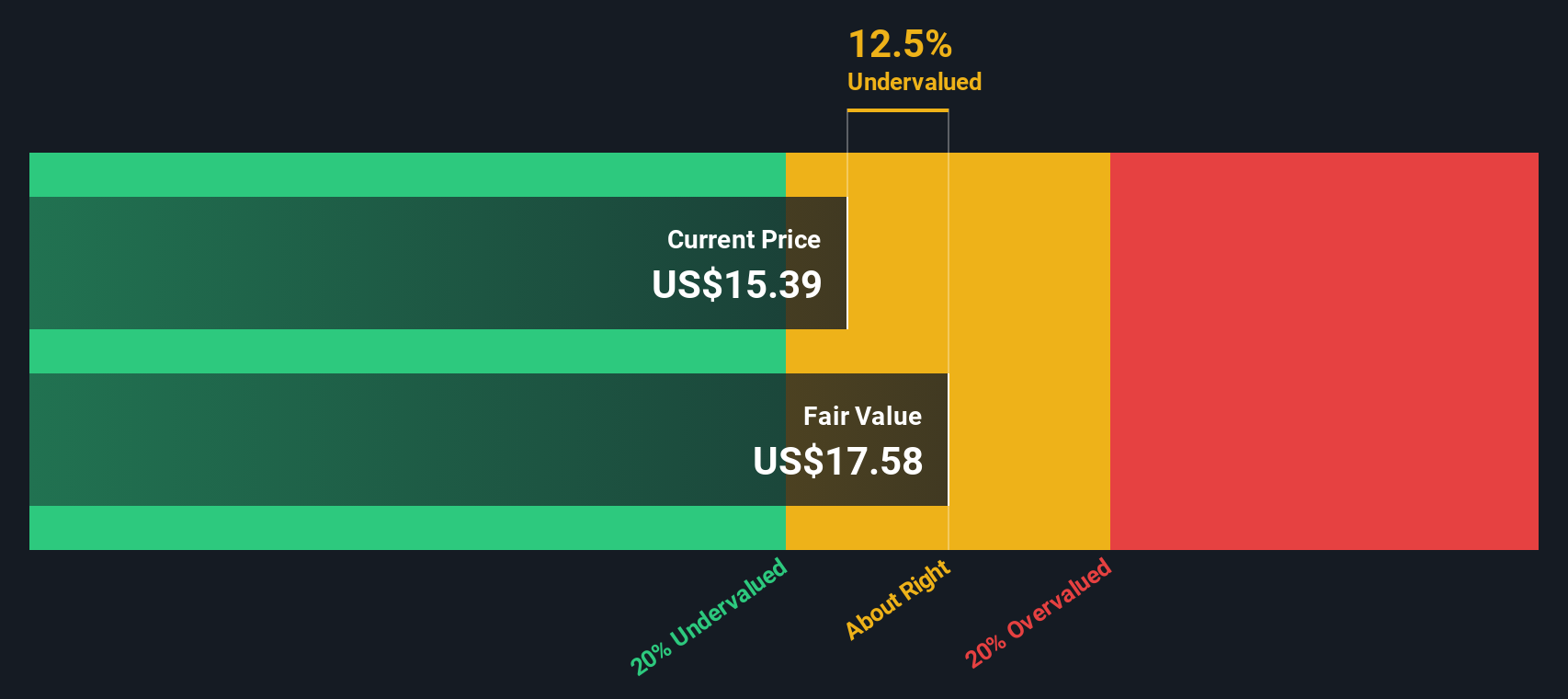

Given recent gains and rising expectations, the key question becomes whether Grocery Outlet Holding is undervalued at current levels or if the market is already factoring in all of its future growth potential.

Most Popular Narrative: 7% Undervalued

Compared to its recent close at $15.46, the most popular narrative sees Grocery Outlet Holding’s fair value nearly $1 higher, suggesting room for upside if projections hold true. The narrative builds on expectations for notable improvement in revenue and margins, supported by operational changes and new initiatives.

Management is prioritizing disciplined and data-driven store expansion, emphasizing infill markets with strong brand awareness and clustering strategies. The aim is for higher store-level returns, targeting cash-on-cash returns above 20% in year 4 and aspiring for 30%. This approach could meaningfully boost long-term profitability and returns on invested capital.

Wondering what underpins this upbeat outlook? The narrative’s math relies on rapid profit growth, ambitious store expansion, and a future earnings multiple that outpaces most peers. The exact financial projections might surprise you.

Result: Fair Value of $16.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in consumer demand or tougher competition from digital-first grocers could challenge the company's ability to deliver on these optimistic forecasts.

Find out about the key risks to this Grocery Outlet Holding narrative.

Another View: Our DCF Model Results

While many focus on fair value based on future earnings and multiples, the SWS DCF model takes a different approach. Right now, it suggests Grocery Outlet Holding is trading almost exactly at its calculated fair value. This close alignment could signal that most upside is already reflected. However, is the DCF missing something in the company’s growth story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Grocery Outlet Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Grocery Outlet Holding Narrative

If the conclusions above don't align with your perspective, you can dive into the numbers and craft your own narrative in just a few minutes. Do it your way

A great starting point for your Grocery Outlet Holding research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always look beyond a single opportunity. Don't miss out on top-performing stocks and emerging trends that could give your portfolio an extra edge.

- Boost your income potential by targeting steady payers with these 18 dividend stocks with yields > 3% to find reliable yields above 3%.

- Unleash your curiosity for artificial intelligence with these 25 AI penny stocks, and catch companies redefining tomorrow’s digital landscape.

- Capitalize on bargains by seeking businesses currently undervalued using these 881 undervalued stocks based on cash flows, based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GO

Grocery Outlet Holding

Operates as a retailer of consumables and fresh products sold through independently operated stores in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives