- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:GO

Grocery Outlet Holding Corp.'s (NASDAQ:GO) 26% Share Price Surge Not Quite Adding Up

Grocery Outlet Holding Corp. (NASDAQ:GO) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

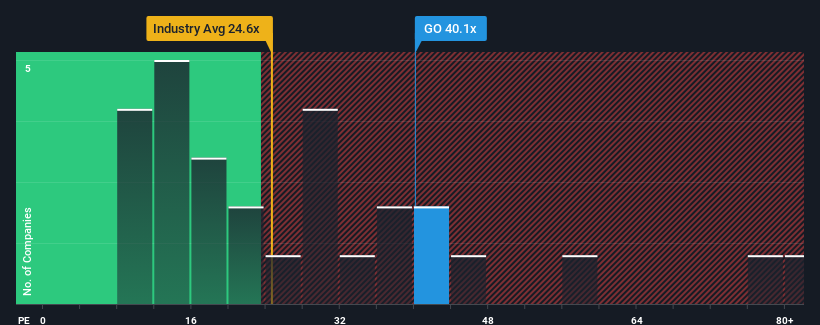

After such a large jump in price, Grocery Outlet Holding's price-to-earnings (or "P/E") ratio of 40.1x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 19x and even P/E's below 11x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Grocery Outlet Holding could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Grocery Outlet Holding

Is There Enough Growth For Grocery Outlet Holding?

Grocery Outlet Holding's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 37% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 12% per annum during the coming three years according to the analysts following the company. With the market predicted to deliver 11% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's curious that Grocery Outlet Holding's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

The strong share price surge has got Grocery Outlet Holding's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Grocery Outlet Holding's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Grocery Outlet Holding that you should be aware of.

Of course, you might also be able to find a better stock than Grocery Outlet Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GO

Grocery Outlet Holding

Operates as a retailer of consumables and fresh products sold through independently operated stores in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026