- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:GO

Did Grocery Outlet's (GO) Transparency Claims in Tech Lawsuit Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, Grocery Outlet Holding Corp. filed a motion to dismiss a class action lawsuit that alleged the company misled investors about complications during its technology platform transition, asserting it maintained transparency and the claims lack sufficient evidence of deceptive statements by executives.

- This legal development puts a spotlight on Grocery Outlet's transparency in communications and its approach to operational risk management at a time of increased investor attention.

- We’ll explore how ongoing scrutiny of the retailer’s technology transition and legal transparency could influence the company’s investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Grocery Outlet Holding Investment Narrative Recap

For shareholders, long-term belief in Grocery Outlet Holding centers on its ability to drive store productivity and operational efficiency while expanding its footprint through disciplined new store openings. The recent motion to dismiss a class action lawsuit related to technology platform transitions does not appear to materially affect the key short-term catalyst, successful rollout and execution of new inventory management systems, nor does it fundamentally shift the largest risk, which remains around store-level execution and cost management during this technology upgrade phase.

Grocery Outlet's latest announcement confirms its third-quarter 2025 financial results will be released after the market closes on November 4, 2025, followed by a conference call. This scheduled update is timely, occurring while the market remains attentive to the impacts of the technology transition as well as the company's adherence to guidance, and may provide further insight on operational progress and leadership’s handling of recent challenges.

Yet, despite company reassurances, investors should be aware that challenges related to execution at the store level and the effectiveness of new technology investments remain top of mind for the market…

Read the full narrative on Grocery Outlet Holding (it's free!)

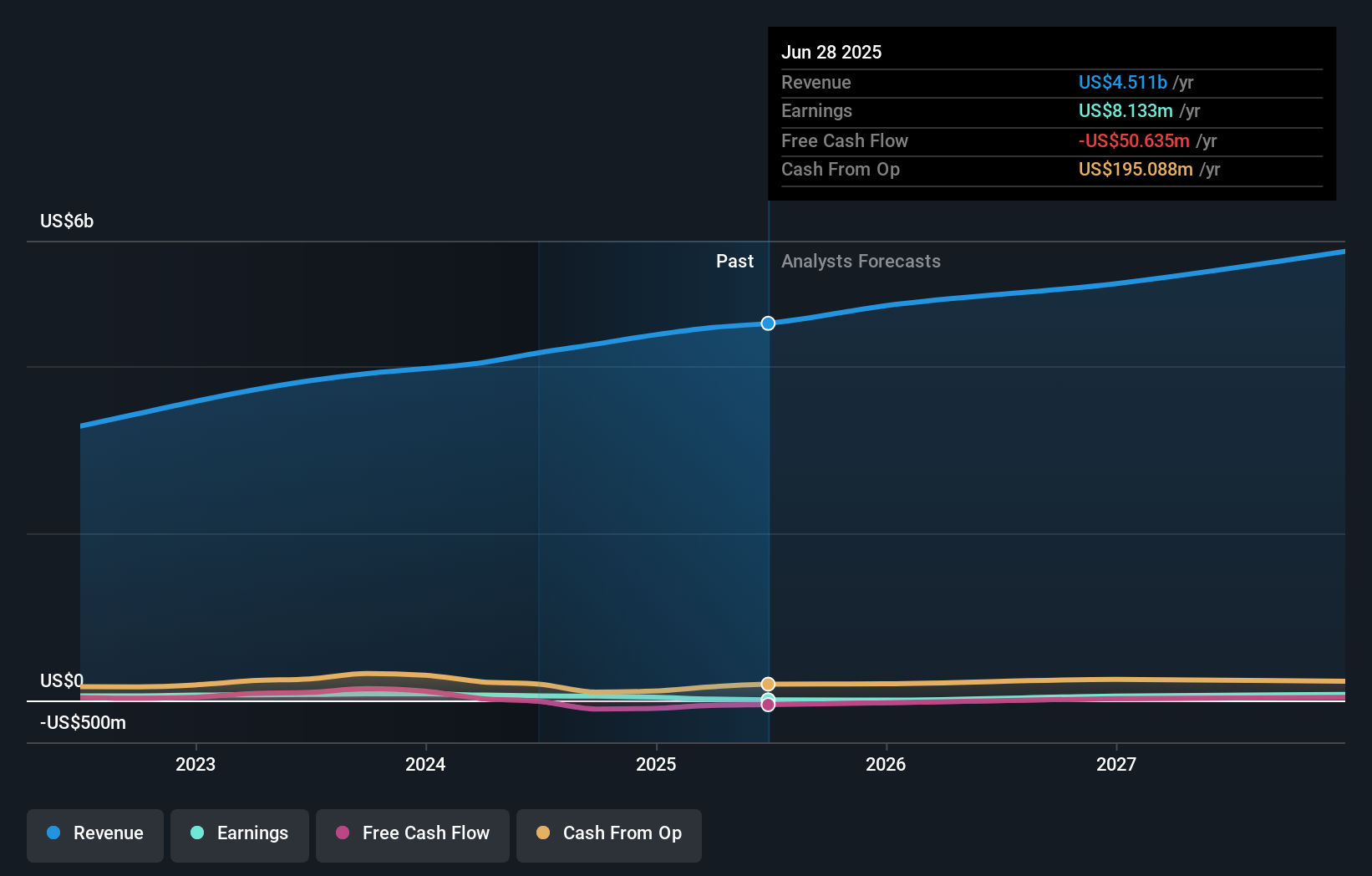

Grocery Outlet Holding's narrative projects $5.7 billion in revenue and $88.0 million in earnings by 2028. This requires 8.3% yearly revenue growth and a $79.9 million increase in earnings from $8.1 million currently.

Uncover how Grocery Outlet Holding's forecasts yield a $17.15 fair value, a 13% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community contributed 1 fair value estimate for Grocery Outlet, all converging at US$17.15 per share. As you weigh this consensus, consider that store-level execution risks tied to ongoing technology upgrades could have a meaningful impact on future returns, explore more perspectives to broaden your view.

Explore another fair value estimate on Grocery Outlet Holding - why the stock might be worth as much as 13% more than the current price!

Build Your Own Grocery Outlet Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Grocery Outlet Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Grocery Outlet Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Grocery Outlet Holding's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GO

Grocery Outlet Holding

Operates as a retailer of consumables and fresh products sold through independently operated stores in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives