- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:DADA

Dada Nexus (NASDAQ:DADA shareholders incur further losses as stock declines 12% this week, taking one-year losses to 37%

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Dada Nexus Limited (NASDAQ:DADA) share price slid 37% over twelve months. That's well below the market decline of 1.6%. Dada Nexus hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. In the last ninety days we've seen the share price slide 55%. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Dada Nexus

SWOT Analysis for Dada Nexus

- Debt is well covered by earnings.

- No major weaknesses identified for DADA.

- Forecast to reduce losses next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio and estimated fair value.

- Debt is not well covered by operating cash flow.

Dada Nexus isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Dada Nexus increased its revenue by 37%. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 37%. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

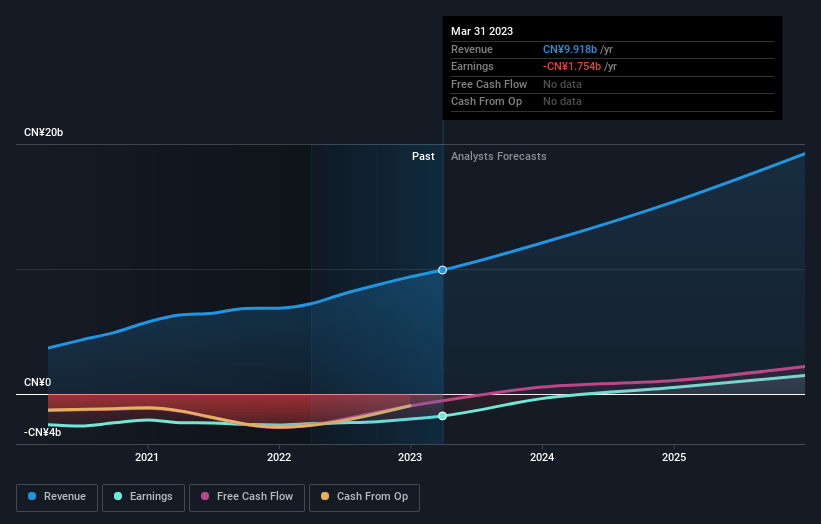

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Dada Nexus is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Dada Nexus in this interactive graph of future profit estimates.

A Different Perspective

Given that the market gained 1.6% in the last year, Dada Nexus shareholders might be miffed that they lost 37%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Notably, the loss over the last year isn't as bad as the 55% drop in the last three months. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. It's always interesting to track share price performance over the longer term. But to understand Dada Nexus better, we need to consider many other factors. For example, we've discovered 1 warning sign for Dada Nexus that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DADA

Dada Nexus

Operates a platform of local on-demand retail and delivery in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives