- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Costco's (NASDAQ:COST) Business is Tailor-Made for 2022

With the broad market down year-to-date, rising inflation, and commodity prices - it is natural for investors to look for a safe haven for their money. While the Staples sector has been one of those places, some of the stocks in that sector have already done extraordinarily well – with Costco Wholesale Corporation (NASDAQ: COST) rising almost 17%.

Yet, even with its P/E ratio closing in on 50, there are arguments that the stock is not overvalued.

Comparable Sales are Growing

The latest comparable sales estimates are in, and the results are overwhelmingly positive.

- US Comparable sales: +12.7% vs. +9.2% consensus

- Total comparable sales: +17.2% vs. 11.2% consensus

While Evercore ISI lifted the target price to "just "US$610, Goldman Sachs sees it at US$627, while Loop Capital and Oppenheimer bumped it to US$645. Meanwhile, Credit Suisse and Deutsche Bank are not as optimistic, with the first holding the target of US$570 and the latter at US$527.

Why Does Costco Benefit From the Ongoing Trends?

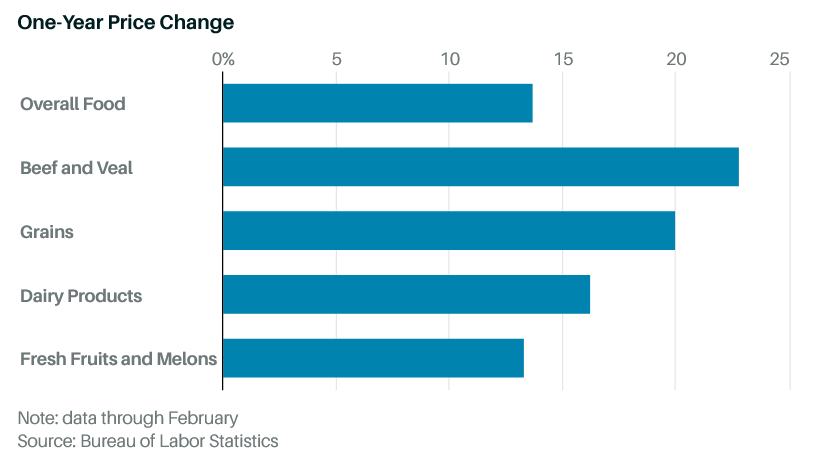

In recent months we have seen a variety of inflationary factors: labor, freight, port delays, and higher commodity prices.

With food prices rising, Costco is well-positioned to benefit from its exceptional supply chain and the ability to leverage its size to absorb the inflationary costs. Additionally, with surging fuel prices, the company provides another reason for its customers to shop there as gas attributes for 10-12% of sales.

According to the National Bureau of Economic Research, bulk shopping in the pre-recession period (2004-2007) would have reduced costs by 20-47%. Thus, if the economic activity contracts, we can expect bulk retailers to do even better.

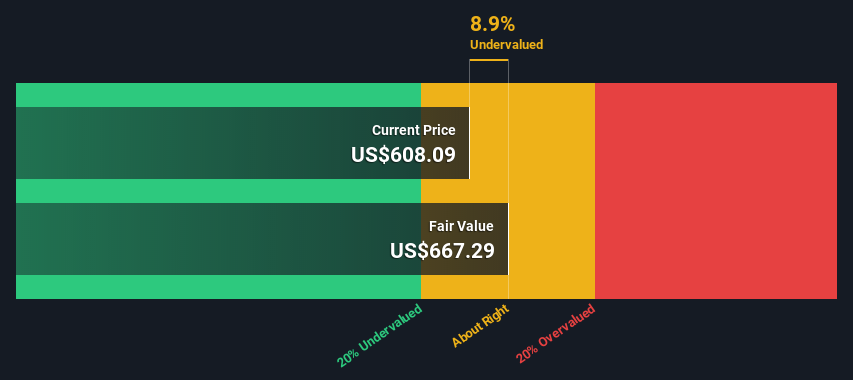

Costco's Valuation According to Our Model

Relative to the current share price of US$608, the company appears at about fair value at an 8.9% discount to where the stock price trades currently. The assumptions in any calculation have a significant impact on the valuation, so it is better to view this as a rough estimate, not precise down to the last cent. In our model's case, these assumptions are the discount rate and cash flow projections.

Remember that there are many ways to estimate a company's value, and a discounted cash flow is just one method. If you want to learn more about discounted cash flow, the rationale behind this calculation can be read in detail in the Simply Wall St analysis model.

Conclusion

As inflation and rising commodity prices wear heavy on the markets, well-positioned retailers like Costco can go even higher. If anything, an ongoing geopolitical crisis of major food exporters (Russia and Ukraine), withering foreign trade, and a poor harvest in China might only amplify these effects.

Although our valuation tool projects our price target higher than the institutions do at the moment, a DCF calculation cannot be the only metric to check when researching a company.

It would be best if you considered the following when researching Costco:

- Risks: You should be aware of the 1 warning sign for Costco Wholesale we've uncovered before considering an investment in the company.

- Future Earnings: How does COST's growth rate compare to its peers and the broader market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other Solid Businesses: Low debt, high returns on equity, and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

PS. Simply Wall St updates its DCF calculation for every American stock every day, so if you want to find the intrinsic value of any other stock, search here.

If you're looking to trade Costco Wholesale, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives