- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Costco (COST): Taking Stock of Its Valuation After Recent Share Price Consolidation

Reviewed by Simply Wall St

Costco Wholesale (COST) has been treading water lately, with the stock slipping about 3% over the past month and roughly 9% over the past 3 months despite solid underlying growth.

See our latest analysis for Costco Wholesale.

Zooming out, Costco’s share price has cooled off after a strong multi year run. The latest $894.68 level and softer 1 year total shareholder return suggest momentum is consolidating rather than collapsing as investors reassess valuation against still healthy growth.

If Costco’s steady compounding has you thinking about what else might be quietly compounding in the background, it could be worth scanning fast growing stocks with high insider ownership for your next idea.

With earnings still climbing and the stock taking a breather near 895, investors now face a key question: Is Costco quietly becoming undervalued, or is the market already pricing in every ounce of its future growth?

Most Popular Narrative: 15.3% Undervalued

With Costco Wholesale last closing at $894.68 against a most popular narrative fair value near $1,055.97, the valuation story leans firmly optimistic on future compounding.

The analysts have a consensus price target of $1072.667 for Costco Wholesale based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1225.0, and the most bearish reporting a price target of $620.0.

Want to see why steady warehouse expansion, rising margins and a premium future earnings multiple all align behind this valuation call? The full narrative unpacks the growth runway, the margin uplift and the profit trajectory that support this fair value view, while keeping one crucial assumption hidden in plain sight.

Result: Fair Value of $1055.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that optimistic path could be challenged if higher labor and supply chain costs persist, or if a stronger dollar further dents international profitability.

Find out about the key risks to this Costco Wholesale narrative.

Another Lens on Value

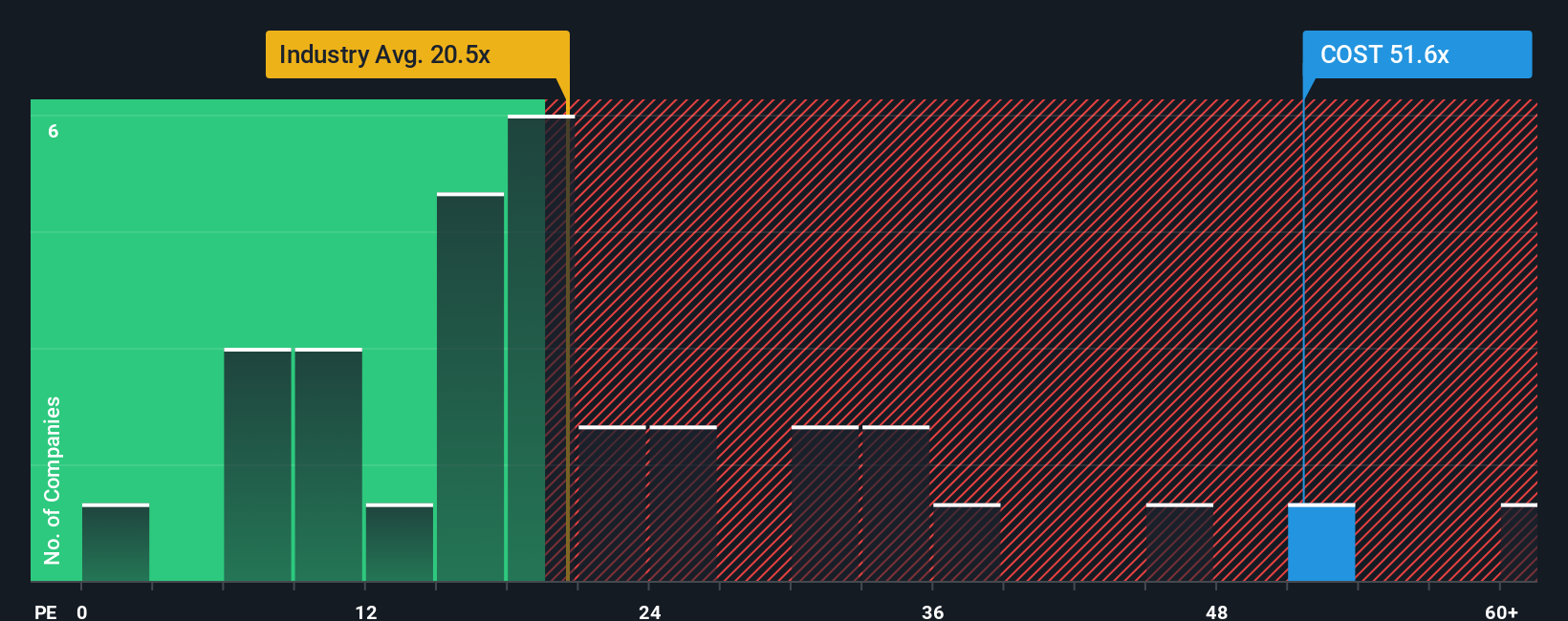

While the narrative fair value pegs Costco as 15.3% undervalued, its 49x price to earnings ratio tells a tougher story. That is more than double the US Consumer Retailing industry at 21.9x and well above the 34.7x fair ratio our models suggest the market could drift toward. If sentiment cools further, this premium may shift from a badge of quality to a source of downside risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costco Wholesale Narrative

If you see Costco’s story differently, or prefer to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover stocks that match your strategy, not the crowd’s.

- Capture potential multi baggers early by scanning these 3578 penny stocks with strong financials that pair tiny market caps with surprisingly robust balance sheets and improving fundamentals.

- Capitalize on transformative technology trends by targeting these 26 AI penny stocks that may benefit from surging demand for automation, data intelligence and scalable digital infrastructure.

- Secure a growing income stream by focusing on these 15 dividend stocks with yields > 3% that combine reliable cash flows with yields strong enough to matter in your long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026