- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Costco (COST): Exploring Valuation and Growth Prospects After Recent Share Price Performance

Reviewed by Kshitija Bhandaru

Costco Wholesale (COST) has had an interesting run this year, with the stock posting a 5% gain over the past year despite some recent volatility. Investors have kept a close watch as the company navigates changing market conditions and consumer trends.

See our latest analysis for Costco Wholesale.

Despite a handful of market swings in recent months, Costco’s long-term momentum remains steady. Its latest $915.38 share price translates to a 5.3% total shareholder return over the past year, and even stronger gains over longer periods. While recent share price returns have been more muted, the overall trend suggests investors still see solid value in the company’s scale and business model.

If you’re looking for your next idea beyond retail giants, expand your search and discover fast growing stocks with high insider ownership

With shares trading just below analyst targets and ongoing revenue and income growth, investors are left to wonder if Costco’s current price underestimates its potential or if all future growth is already reflected in the valuation.

Most Popular Narrative: 13.7% Undervalued

Costco’s narrative fair value estimate stands noticeably above the latest close, suggesting the stock could have more room to climb if the story plays out as projected. The consensus builds this outlook on both the strength of current momentum and assumptions for future growth.

Costco's extension of gas station hours is designed to enhance member convenience, which could lead to higher gasoline sales and increased store traffic, positively impacting revenue. The updated employee agreement with higher wages may initially increase SG&A expenses, but Costco's focus on labor productivity and cost discipline could help maintain net margins over time.

Want to know which fundamental drivers make this fair value so ambitious? The blueprint involves faster membership growth plus profit margins that are typically associated with blue-chip disruptors. The one thing that could change everything? It is hiding in plain sight. See what powers Costco’s future forecasts before the next move happens.

Result: Fair Value of $1,061 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising labor expenses and unpredictable foreign exchange rates could pressure Costco’s profit margins. These factors may challenge the optimistic outlook if such trends persist.

Find out about the key risks to this Costco Wholesale narrative.

Another View: Are Shares Priced for Perfection?

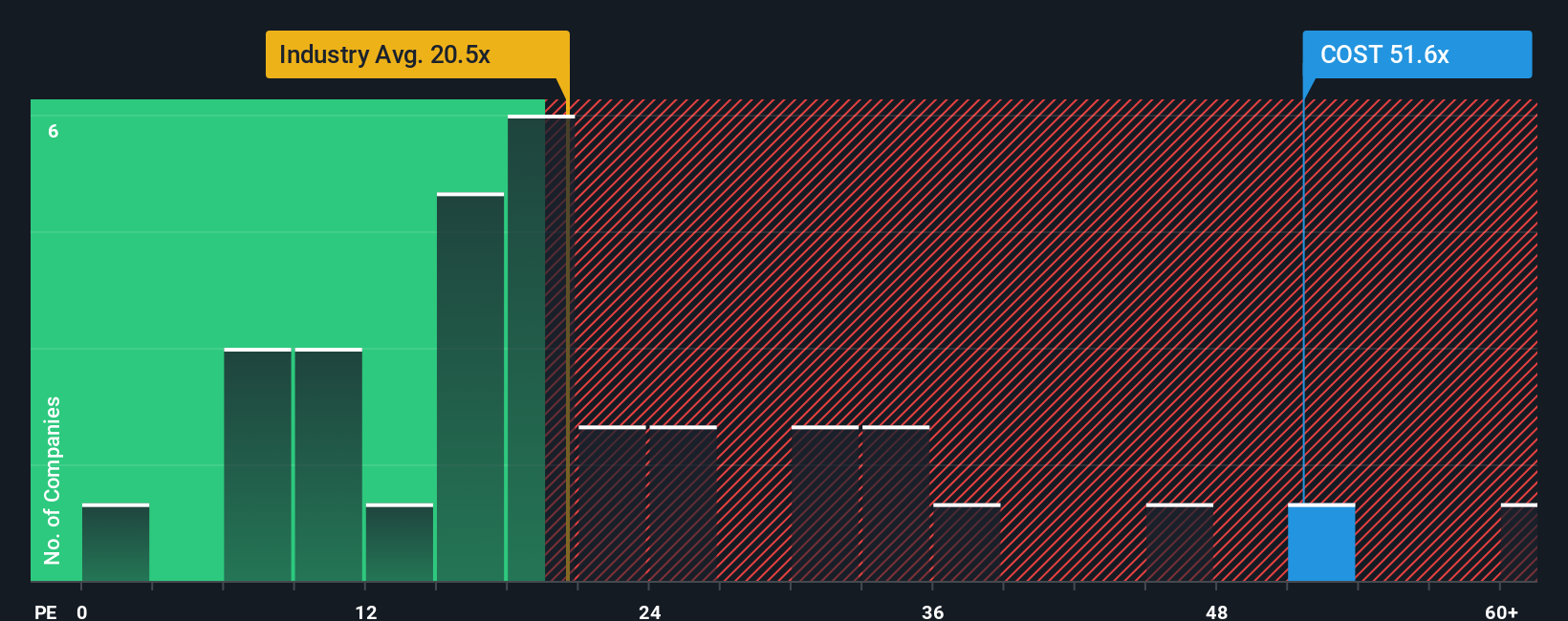

Looking from a market multiples perspective, Costco’s current price-to-earnings ratio is about 50 times. This is substantially higher than the industry average of 21 times and the fair ratio of 29.5. Such a premium signals that investors have high expectations built in, which can make the stock more vulnerable if any setbacks arise. Could such a rich valuation limit future upside for new buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costco Wholesale Narrative

If you see a different story in the numbers or want to dig deeper on your own, building your own view takes just a few minutes. Do it your way

A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open. See what opportunities are stirring beneath the surface and unlock fresh potential for your portfolio right now.

- Tap into the latest market buzz by scanning these 3569 penny stocks with strong financials for small caps making big moves this season.

- Catch the next wave in healthcare innovation by checking out these 32 healthcare AI stocks companies transforming patient care with artificial intelligence.

- Boost your income stream by reviewing these 19 dividend stocks with yields > 3%, which is packed with reliable payers offering attractive yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives