- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Costco (COST): A Fresh Look at Valuation After Q4 Earnings Beat and Rising Membership Strength

Reviewed by Simply Wall St

Costco Wholesale (COST) caught fresh attention after exceeding Wall Street’s expectations for its fiscal fourth quarter. This performance was driven by strong net sales growth and higher membership fee income. Investors have been watching how the business adapts after last year’s membership fee hike.

See our latest analysis for Costco Wholesale.

Costco’s steady gains this year reflect its strong execution and ability to innovate, even as retail competition rises. The share price has edged up 2.9% year-to-date to $936.11. The one-year total shareholder return of 5.3% shows Costco’s consistency, while its remarkable 95.5% total return over three years highlights a track record of rewarding longer-term holders. Recent buybacks, launches of new member benefits, and exclusive in-store products have kept momentum building for both the business and its investors, even as markets weigh shifting consumer sentiment.

If you’re curious about what else is keeping markets moving, it’s a great time to discover fast growing stocks with high insider ownership

But with Costco's stock rallying over recent years, is the impressive growth already priced in? Could this be a rare moment for investors to secure long-term value before further gains take hold?

Most Popular Narrative: 11.8% Undervalued

The latest analyst-driven narrative points to Costco’s fair value well above the recent close, highlighting a belief in upside potential despite high valuation multiples. This reflects a bold outlook grounded in continued business momentum and scale advantages.

The company’s scale, supply chain capabilities, and ongoing gains in market share are expected to reinforce its competitive position and support long-term growth. Renewal rates remain high and customer loyalty among higher-income demographics continues to drive stability in revenues and earnings.

Want to know what’s fueling Costco’s premium price target? The narrative is built on aggressive revenue expansion, margin optimism, and a profit multiple that rivals fast-growing tech names. Curious about the financial forecasts and model assumptions that justify this stance? Unpack the numbers and see what drives Wall Street’s bullish estimate.

Result: Fair Value of $1,061 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unpredictable labor costs and shifting foreign exchange rates could quickly pressure margins. This could potentially lead analysts to reassess Costco’s growth story.

Find out about the key risks to this Costco Wholesale narrative.

Another View: What Do Market Multiples Suggest?

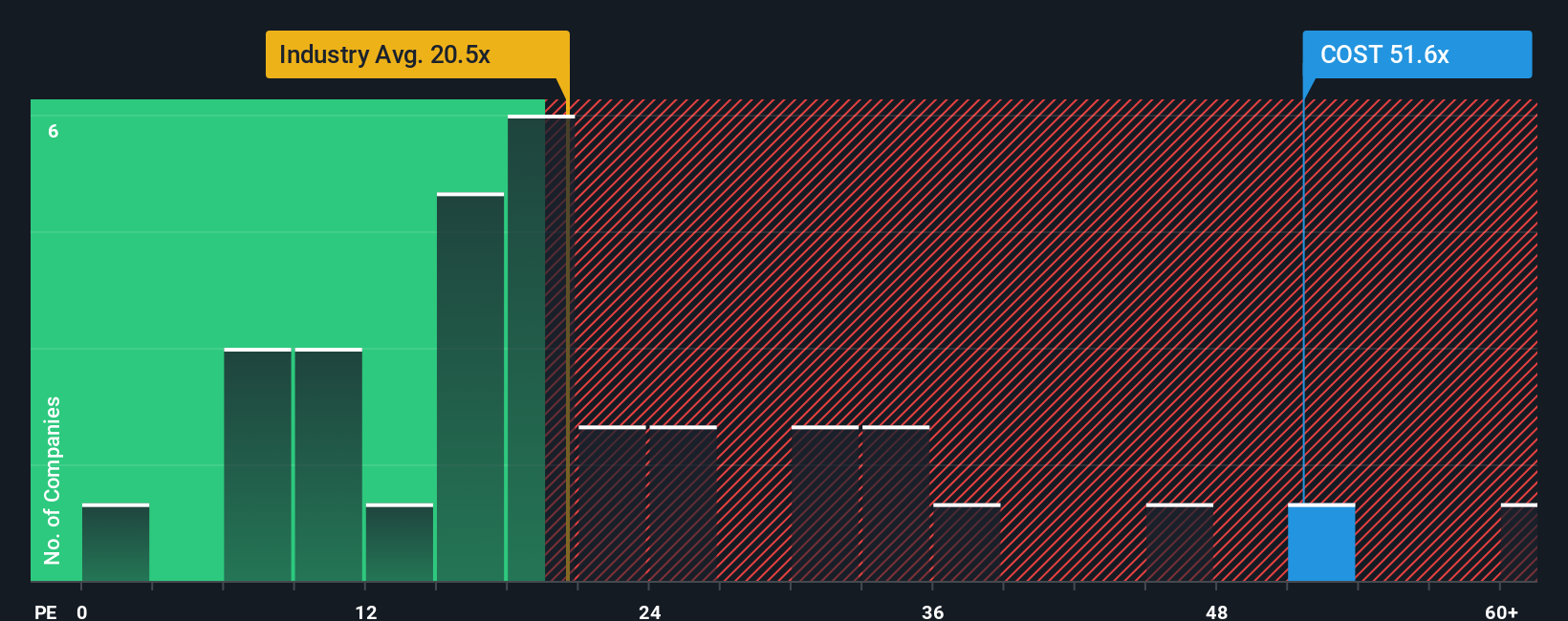

Taking a look from a market multiples perspective, Costco's price-to-earnings ratio sits at 51.2 times, which is much higher than both the industry average of 20.7 times and its fair ratio of 29.5 times. This premium leaves little margin for error, which could signal a valuation risk, or it could indicate that the market expects Costco to continue outperforming.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costco Wholesale Narrative

If you see the story differently or want to dig into the data on your own, you can quickly assemble a fresh perspective yourself. Do it your way

A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your strategy to just one opportunity. Take the lead by checking out top stocks handpicked for growth potential, yield, or revolutionary innovation right now.

- Boost your potential returns by targeting these 874 undervalued stocks based on cash flows, where strong fundamentals meet attractive entry prices. These smart moves are ones others might overlook.

- Secure consistent income and financial stability as you tap into these 17 dividend stocks with yields > 3%, offering yields above 3% for portfolio peace of mind.

- Amplify your exposure to the next wave of digital disruption with these 24 AI penny stocks, featuring companies that are powering the artificial intelligence revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives