- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Can Costco’s (COST) Focus on Exclusive Tech Products Bolster Its Competitive Edge in Retail?

Reviewed by Sasha Jovanovic

- Costco Wholesale recently reported fourth-quarter and full-year 2025 results, highlighting revenue of US$86.16 billion for the quarter and the introduction of new, exclusive product bundles such as the HOVERAir X1 PROMAX and AXIL’s X30i earplugs in stores and online. These moves underscore the company’s focus on member-driven value through both warehouse expansion and differentiated product offerings, providing access to new technologies and brands for its membership base.

- The exclusive launches and expanding product selection at Costco reflect the retailer’s ongoing effort to attract diverse customer segments, including technology enthusiasts and families, strengthening its competitive advantage in the warehouse club sector.

- We’ll explore how Costco’s recent product launches, including the HOVERAir hands-free camera bundle, reinforce its investment narrative around expansion and innovation.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Costco Wholesale Investment Narrative Recap

To be a Costco shareholder, you need to believe in the long-term growth of its membership-based model, supported by ongoing warehouse expansion and a robust pipeline of exclusive product launches. The recent rollout of the HOVERAir X1 PROMAX camera bundle and other tech-forward products reflects this strategy, but the most important near-term catalyst, continued expansion and membership growth, is largely unaffected. The biggest risk remains margin pressure from labor costs and tariffs, which recent news has not materially changed.

The introduction of the exclusive HOVERAir bundle stands out as the most relevant announcement, highlighting Costco’s ability to attract tech-savvy consumers and broaden its value proposition for members. This development supports Costco’s ongoing focus on unique offerings to drive member loyalty, providing incremental support for membership and warehousing catalysts. But at the same time, investors should remain aware of how closely watched margin risks, such as rising labor and import costs, could impact results if...

Read the full narrative on Costco Wholesale (it's free!)

Costco Wholesale's outlook suggests revenues reaching $329.0 billion and earnings of $10.4 billion by 2028. This scenario assumes annual revenue growth of 7.0% and an earnings increase of $2.6 billion from the current $7.8 billion.

Uncover how Costco Wholesale's forecasts yield a $1061 fair value, a 16% upside to its current price.

Exploring Other Perspectives

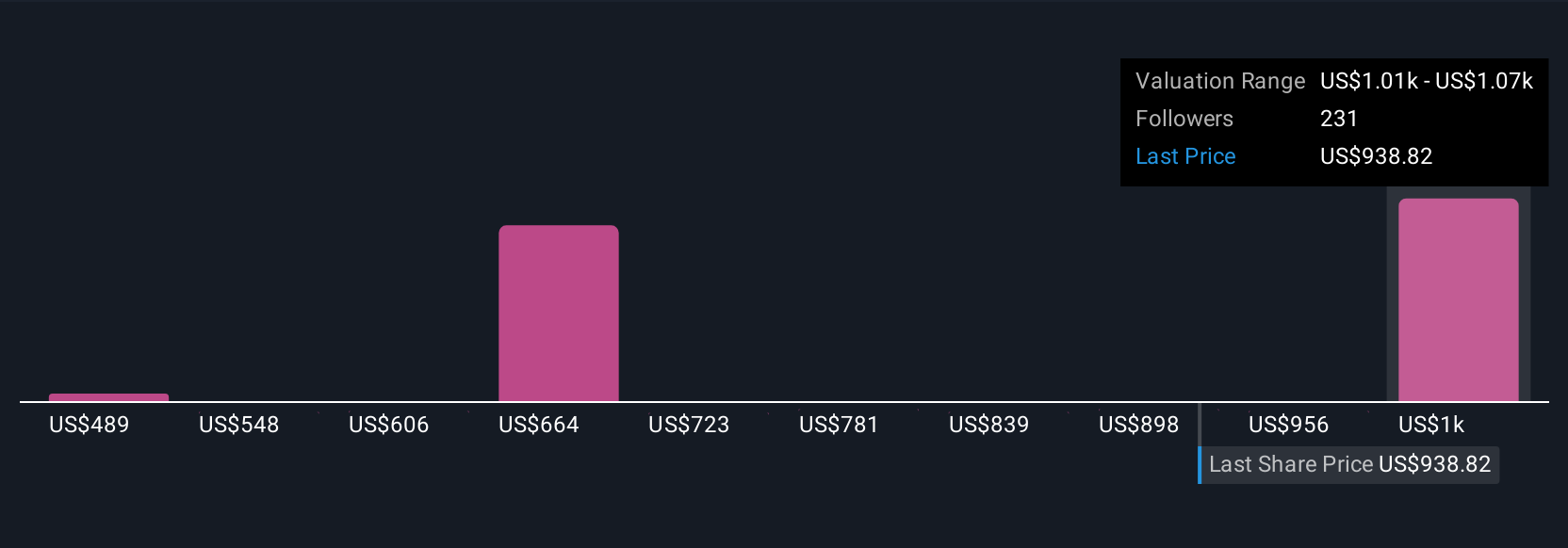

Simply Wall St Community members provided 34 fair value estimates for Costco ranging from US$489 to US$1,061 per share. With such a wide range, margin risks and high operating costs remain front of mind for many market participants seeking a fuller picture of potential outcomes.

Explore 34 other fair value estimates on Costco Wholesale - why the stock might be worth as much as 16% more than the current price!

Build Your Own Costco Wholesale Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Costco Wholesale research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Costco Wholesale's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives