- United States

- /

- Food and Staples Retail

- /

- NasdaqCM:CHSN

Why We're Not Concerned Yet About Chanson International Holding's (NASDAQ:CHSN) 26% Share Price Plunge

The Chanson International Holding (NASDAQ:CHSN) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The good news is that in the last year, the stock has shone bright like a diamond, gaining 248%.

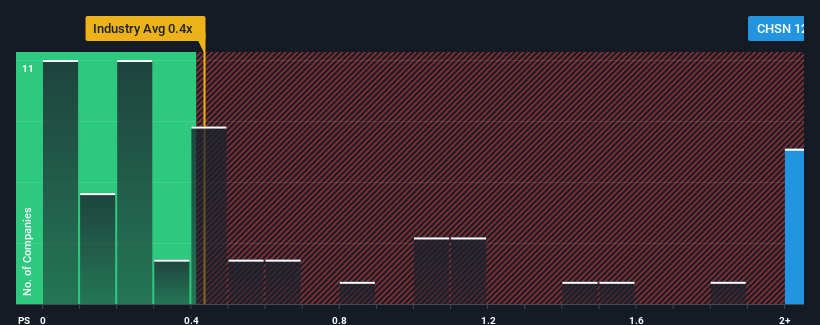

Even after such a large drop in price, you could still be forgiven for thinking Chanson International Holding is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 12.1x, considering almost half the companies in the United States' Consumer Retailing industry have P/S ratios below 0.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Chanson International Holding

How Has Chanson International Holding Performed Recently?

The revenue growth achieved at Chanson International Holding over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Chanson International Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Chanson International Holding's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. Pleasingly, revenue has also lifted 33% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 4.8% shows it's noticeably more attractive.

In light of this, it's understandable that Chanson International Holding's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Chanson International Holding's P/S?

Chanson International Holding's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Chanson International Holding maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Chanson International Holding that you need to be mindful of.

If you're unsure about the strength of Chanson International Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CHSN

Chanson International Holding

Manufactures and sells a range of bakery products, seasonal products, and beverage products for individual and corporate customers in the People’s Republic of China, Cayman Islands, and the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives