- United States

- /

- Food and Staples Retail

- /

- NasdaqCM:CHSN

Chanson International Holding's (NASDAQ:CHSN) 44% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Chanson International Holding (NASDAQ:CHSN) shares have been powering on, with a gain of 44% in the last thirty days. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

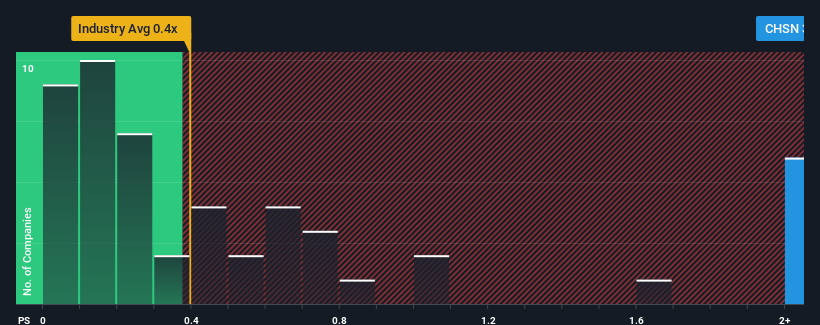

Following the firm bounce in price, when almost half of the companies in the United States' Consumer Retailing industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider Chanson International Holding as a stock not worth researching with its 3.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Chanson International Holding

How Has Chanson International Holding Performed Recently?

For example, consider that Chanson International Holding's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Chanson International Holding's earnings, revenue and cash flow.How Is Chanson International Holding's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Chanson International Holding's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 9.7% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 5.5% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 3.7% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's curious that Chanson International Holding's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What Does Chanson International Holding's P/S Mean For Investors?

The strong share price surge has lead to Chanson International Holding's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't expect to see Chanson International Holding trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 3 warning signs for Chanson International Holding (2 don't sit too well with us!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CHSN

Chanson International Holding

Manufactures and sells a range of bakery products, seasonal products, and beverage products for individual and corporate customers in the People’s Republic of China, Cayman Islands, and the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives