- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CHEF

Chefs' Warehouse (CHEF): Assessing Valuation After Recent Share Price Softness

Reviewed by Simply Wall St

Chefs' Warehouse (CHEF) has quietly become a strong long term performer, with the stock up about 26% over the past year and more than doubling over the past 5 years.

See our latest analysis for Chefs' Warehouse.

At around $60.39, Chefs' Warehouse has seen some near term share price softness after a strong year to date rebound, yet its multi year total shareholder returns still point to solid, sustained momentum rather than a fading story.

If this kind of steady compounding appeals to you, it might be worth seeing what else fits that profile by exploring fast growing stocks with high insider ownership.

With double digit earnings growth, a sizeable discount to analyst targets and a history of outperformance, is Chefs' Warehouse still trading below its true value, or is the market already baking in the next leg of growth?

Most Popular Narrative: 20.9% Undervalued

Compared to the last close at $60.39, the most followed narrative sees Chefs' Warehouse worth significantly more, anchoring that view in accelerating premium focused growth.

Analysts expect earnings to reach $121.9 million (and earnings per share of $2.24) by about September 2028, up from $69.6 million today. The analysts are largely in agreement about this estimate.

Want to see what justifies paying up for a niche distributor? This narrative leans on rising margins, steady top line gains, and a richer earnings multiple. Curious how those assumptions connect to that higher fair value target? Dive into the full story to unpack the precise growth and profitability path behind this valuation call.

Result: Fair Value of $76.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising labor costs and integration challenges from acquisitions could squeeze margins and limit the upside implied by the premium positioning narrative.

Find out about the key risks to this Chefs' Warehouse narrative.

Another View: Rich Valuation on Earnings

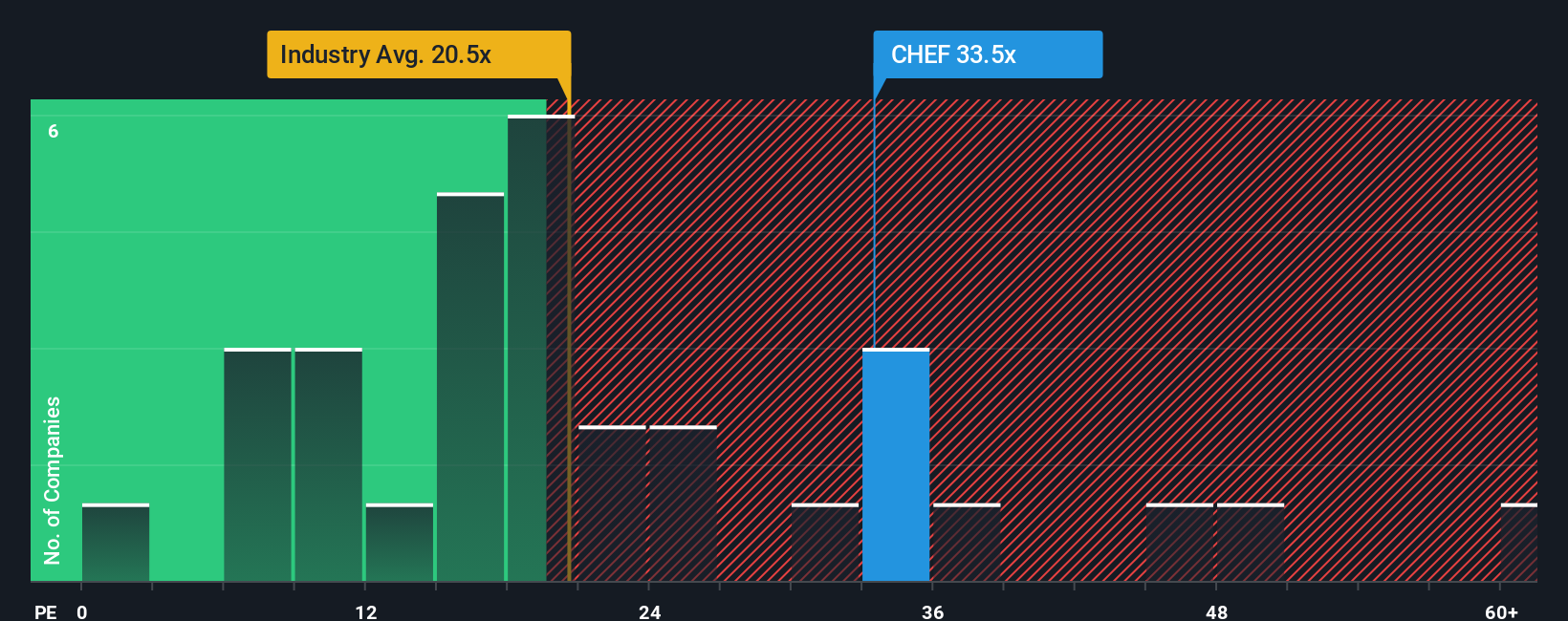

While narratives and fair value estimates point to upside, the current share price already bakes in a lot of optimism. Chefs' Warehouse trades on a P/E of about 32.9 times, versus 27.6 times for peers and a fair ratio of 16.4 times, which suggests meaningful valuation risk if growth or margins disappoint. Could today’s premium simply be pulling forward tomorrow’s returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chefs' Warehouse Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes with Do it your way.

A great starting point for your Chefs' Warehouse research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider using the Simply Wall Street Screener to uncover fresh, data driven opportunities that most investors overlook.

- Explore mispriced potential by targeting these 912 undervalued stocks based on cash flows that could offer stronger long term returns than widely followed names.

- Focus on powerful technological shifts by looking at these 26 AI penny stocks positioned at the heart of machine learning and automation growth.

- Strengthen your income stream by zeroing in on these 15 dividend stocks with yields > 3% that may deliver dependable cash flow alongside capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHEF

Chefs' Warehouse

Distributes specialty food and center-of-the-plate products in the United States, the Middle East, and Canada.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026