- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CHEF

Can Chefs' Warehouse's (CHEF) Pricing Power Sustain Its Edge Among Luxury Dining Clients?

Reviewed by Sasha Jovanovic

- Chefs' Warehouse recently reported strong financial results, recording 8.4% revenue growth along with margin expansion that reflects solid pricing power in its luxury market segment.

- The company's focus on supplying high-end restaurants and hotels has offered insulation from consumer trade-downs during a challenging economic period.

- We'll take a closer look at how this solid client base and pricing power shape Chefs' Warehouse's investment narrative going forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Chefs' Warehouse Investment Narrative Recap

To be a shareholder in Chefs' Warehouse, you need confidence in its unique ability to serve luxury restaurants and hotels while maintaining pricing power and resilience in less favorable economic cycles. The recent strong results reinforce the value of its client base, but don't materially change the main short-term catalyst, continued operational execution in its premium segment, nor do they diminish the persistent risk from rising structural costs impacting long-term margins.

One recent highlight especially relevant to the current outlook is the company's raised full-year 2025 sales and gross profit guidance, now anticipating US$4.00 billion to US$4.06 billion in revenue. This upward adjustment signals management's conviction in its premium market positioning and provides a near-term benchmark for progress toward improved profitability and margin expansion, both of which are core to the investment case.

However, investors should also be mindful that despite these strengths, pressure from structural cost inflation could still affect...

Read the full narrative on Chefs' Warehouse (it's free!)

Chefs' Warehouse's narrative projects $4.9 billion in revenue and $121.9 million in earnings by 2028. This requires 7.6% yearly revenue growth and a $52.3 million increase in earnings from the current $69.6 million.

Uncover how Chefs' Warehouse's forecasts yield a $76.62 fair value, a 38% upside to its current price.

Exploring Other Perspectives

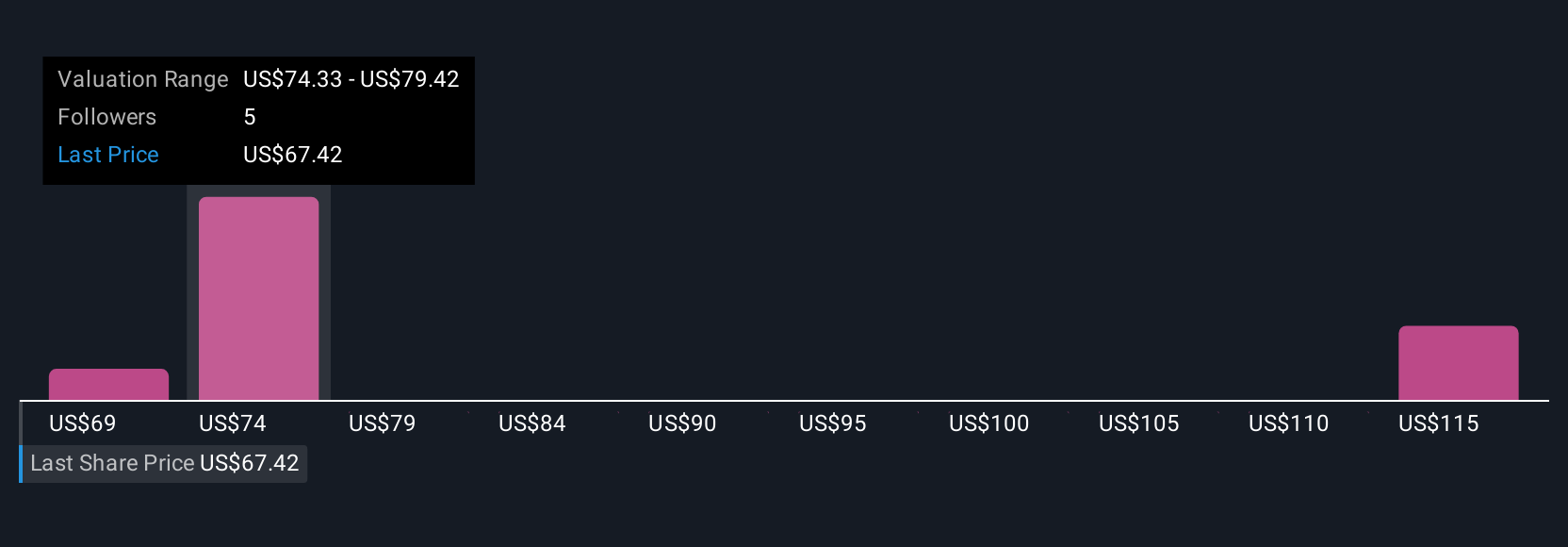

Five private investors in the Simply Wall St Community valued Chefs' Warehouse between US$38.55 and US$108.10 per share. Given ongoing cost inflation risks, readers should explore these varied views to see how expectations contrast with recent margin improvements.

Explore 5 other fair value estimates on Chefs' Warehouse - why the stock might be worth 30% less than the current price!

Build Your Own Chefs' Warehouse Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chefs' Warehouse research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chefs' Warehouse research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chefs' Warehouse's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHEF

Chefs' Warehouse

Distributes specialty food and center-of-the-plate products in the United States, the Middle East, and Canada.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives