- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CASY

Casey's General Stores (CASY): Assessing Valuation After Strong Q1 Results and Reaffirmed 2026 Guidance

Reviewed by Simply Wall St

Casey's General Stores (CASY) has been making headlines after reporting a jump in both sales and net income for the first quarter, news that grabbed the market’s attention even before management doubled down by reaffirming their fiscal 2026 outlook. That combination of stronger financials and steady guidance provides investors with something solid to chew on, especially with the company's plan to open at least 80 new stores this year still on track. For anyone tracking consumer retail stocks, these developments could be the kind of signal that prompts a closer look at where the opportunity might lie.

Amid these updates, Casey’s stock price has risen 46% in the past year, with a 40% gain year to date. This momentum follows a multi-year string of store expansions, share buybacks, and steady dividend affirmation, all while posting consistent annual revenue and net income growth. While positive Q1 results and ambitious growth plans have played a big part in boosting sentiment, recent shareholder meetings and corporate moves indicate that management isn’t letting up on its long-term strategy.

With the stock’s sustained rally and upbeat guidance, could there still be value left on the table for new buyers, or is the market already pricing in everything Casey’s has accomplished and plans to do next?

Most Popular Narrative: 1.9% Undervalued

According to the most widely followed narrative, Casey's General Stores is seen as slightly undervalued in relation to analyst expectations. The consensus view highlights durable growth prospects, continued earnings momentum, and ambitious expansion plans as key reasons the company's fair value sits modestly above its current share price.

Ongoing momentum in prepared foods, bakery, and private label offerings, with high gross margins and innovation through LTOs, capitalizes on shifting consumer preferences for convenient meal solutions. This supports both revenue and net margin expansion.

Ever wondered what is driving Casey’s robust price target, despite its already remarkable run? This narrative hinges on big-picture fundamentals such as future revenue, profit margins, and a premium market multiple that is rarely seen in this sector. Want to see the numbers and assumptions analysts are betting on for sustained outperformance? The full story behind this valuation might surprise you.

Result: Fair Value of $564.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Casey’s growth story still faces risks, including slower synergy gains from acquisitions and potential shifts in rural and regional demand patterns.

Find out about the key risks to this Casey's General Stores narrative.Another View: What Do Traditional Valuation Ratios Say?

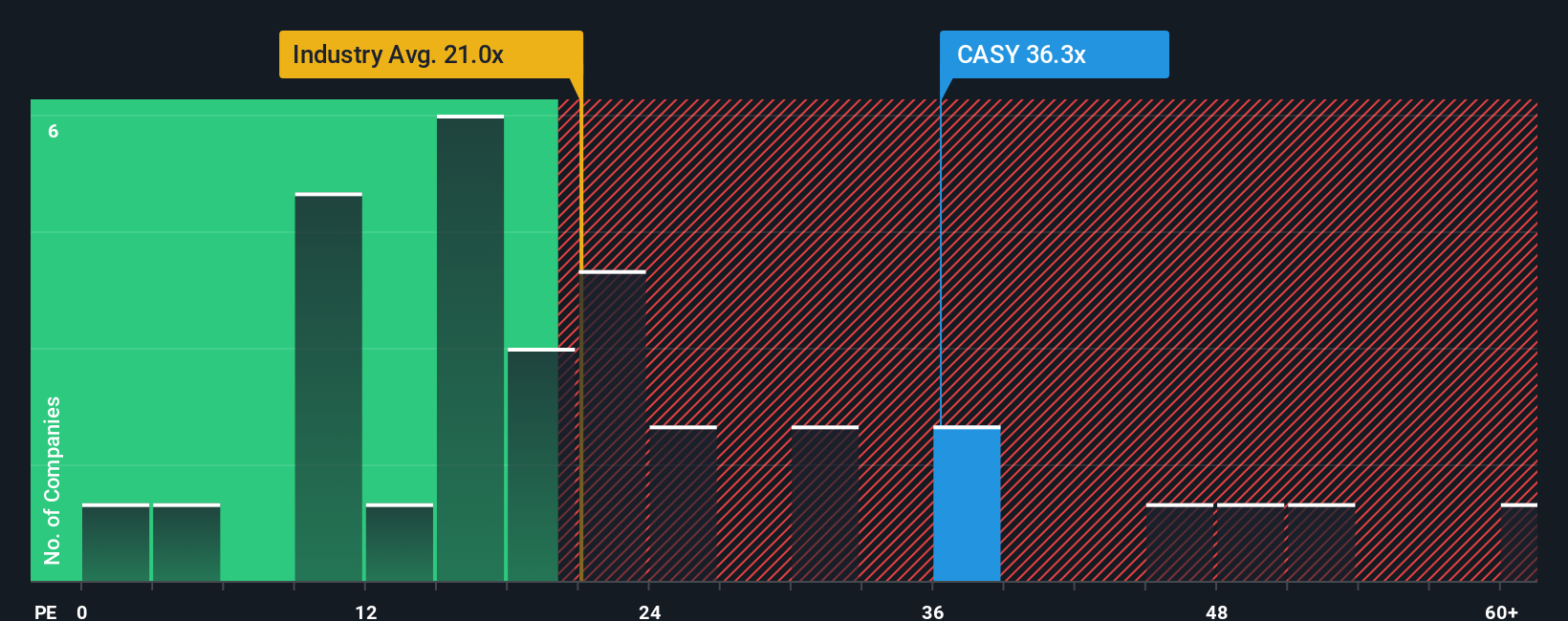

On the other hand, if you glance at traditional ratios, Casey’s trades at a much higher price compared to most consumer retail stocks. This method suggests the market may already be pricing in the growth story. Is this optimism justified, or are expectations running too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Casey's General Stores to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Casey's General Stores Narrative

If you see these numbers differently or want to build your own perspective, you can quickly shape your own narrative using the latest data. It takes just a few minutes. Do it your way

A great starting point for your Casey's General Stores research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself when more smart investing opportunities are just a step away? Take action now and see what's possible with these standout strategies below.

- Uncover high-yield income streams with reliable performance by checking out dividend stocks with yields > 3%. Explore top companies outpacing the market in consistent payouts.

- Ride the accelerating wave of intelligent automation and tap into next-generation leaders through AI penny stocks. Discover stocks shaping tomorrow’s innovation landscape.

- Boost your portfolio’s potential with overlooked opportunities by seeking out undervalued stocks based on cash flows. Find stocks trading at compelling valuations based on core fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CASY

Casey's General Stores

Operates convenience stores under the Casey's and Casey’s General Store names in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026