- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CASY

A Closer Look at Casey's General Stores (CASY) Valuation Following Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Casey's General Stores (CASY) stock has been showing steady momentum lately, catching the eye of investors interested in retailers that combine convenience with growth. Over the past month, shares have climbed 13%, outpacing many sector peers.

See our latest analysis for Casey's General Stores.

Casey’s latest surge builds on a longer stretch of quiet but consistent momentum, with a 1-month share price return of 13% and a healthy 1-year total shareholder return of 54%. While not always grabbing headlines, the stock’s performance suggests confidence is building in its growth outlook and ability to execute even in a competitive retail landscape.

If this steady climb has you rethinking your next move, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

The question facing investors now is whether this rally reflects Casey’s true value, or if shares still have room to run. Is there an attractive entry point, or has the market already priced in all the expected growth?

Most Popular Narrative: 1.7% Undervalued

At $561.40 per share, Casey's General Stores trades just below the most popular narrative's stated fair value of $571.38. Investors are weighing whether this slight discount means the market is missing something about Casey’s future drivers.

Strategic investments in digital platforms (nearly 9.5 million Rewards members, personalized promotions), analytics, and targeted guest engagement lay the groundwork for higher frequency, bigger basket sizes, and incremental revenue as digital adoption rises in convenience retail.

Want to know why Casey’s digital push and expanding store network fuel this bullish price? The narrative builds on aggressive sales projections, margin expansion, and a profit multiple that bucks the sector trend. Curious about the bold moves and optimistic assumptions behind that lofty fair value? Dig into the full story and challenge the consensus!

Result: Fair Value of $571.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentration in rural markets and the ongoing transition in fuel demand could challenge Casey’s growth trajectory and put pressure on its optimistic forecasts.

Find out about the key risks to this Casey's General Stores narrative.

Another View: Multiples Signal Caution

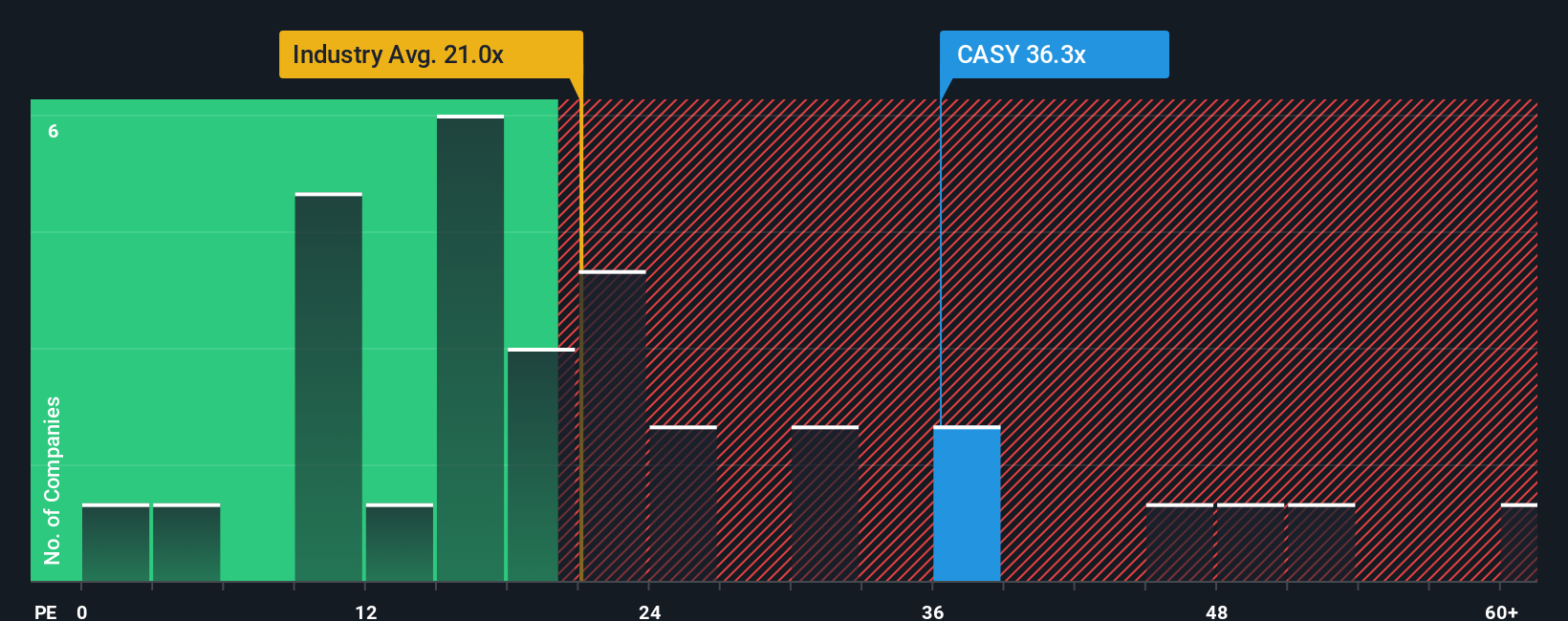

Looking from a different angle, the current price-to-earnings ratio for Casey’s stands at 35.9x, which is much higher than its industry’s 20.6x average, the peer average of 17.3x, and even the fair ratio estimate of 21.4x. This wide gap suggests that market optimism for Casey’s growth is already reflected in today’s stock price, potentially limiting upside if forecasts are not exceeded. So, is this a premium worth paying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casey's General Stores Narrative

If the consensus doesn’t align with your outlook, why not dive into the numbers and build your own custom narrative in just minutes? Do it your way

A great starting point for your Casey's General Stores research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one winning opportunity. Use the Simply Wall Street Screener to uncover unique stocks that could boost your portfolio with fresh momentum and hidden value.

- Unlock new potential by screening for value with these 904 undervalued stocks based on cash flows stocks that stand out for strong cash flows and price disconnects.

- Supercharge your watchlist by targeting breakout technology with these 24 AI penny stocks as artificial intelligence and automation continue to evolve.

- Maximize your returns by seeking out steady income through these 19 dividend stocks with yields > 3% with yields above 3% for reliable passive growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CASY

Casey's General Stores

Operates convenience stores under the Casey's and Casey’s General Store names in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives