- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CART

How Investors May Respond To Maplebear (CART) As Amazon Speeds Up Groceries And Instacart Adds New Partners

Reviewed by Sasha Jovanovic

- In late November 2025, Amazon announced plans for an ultrafast grocery delivery option under 30 minutes in major cities, coinciding with Maplebear’s Instacart platform rolling out new partnerships, including same-day Home Depot Canada delivery and a WellTheory collaboration focused on food-as-medicine for autoimmune care.

- Taken together, these developments highlight how Instacart is expanding its retail and health ecosystems even as investor attention shifts to intensifying competition from Amazon’s speed-focused offering.

- We’ll now explore how Amazon’s ultrafast delivery push, alongside Instacart’s new Home Depot Canada partnership, may reshape Maplebear’s investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Maplebear Investment Narrative Recap

To own Maplebear, you need to believe Instacart can stay relevant as grocery and essentials keep shifting online, even as delivery becomes faster and more commoditized. Amazon’s under 30‑minute push sharpens the competitive risk around pricing and speed, while the key near term catalyst remains Instacart’s ability to grow higher margin services like advertising and enterprise solutions. For now, the Amazon news mainly reinforces an existing competitive risk rather than creating a new one.

The new Home Depot Canada partnership is the clearest counterpoint to Amazon’s ultrafast headlines, because it shows Instacart extending beyond groceries into home improvement and bulky-item delivery. Same day fulfillment from more than 175 stores, with in store pricing and support for heavier goods, reinforces the thesis that Instacart’s platform can deepen retailer integrations and widen its role in everyday essentials, even if competition on speed and fees intensifies.

But while partnerships are expanding, investors should also be aware that rising competition and potential price pressure could...

Read the full narrative on Maplebear (it's free!)

Maplebear's narrative projects $4.6 billion revenue and $779.9 million earnings by 2028.

Uncover how Maplebear's forecasts yield a $50.70 fair value, a 22% upside to its current price.

Exploring Other Perspectives

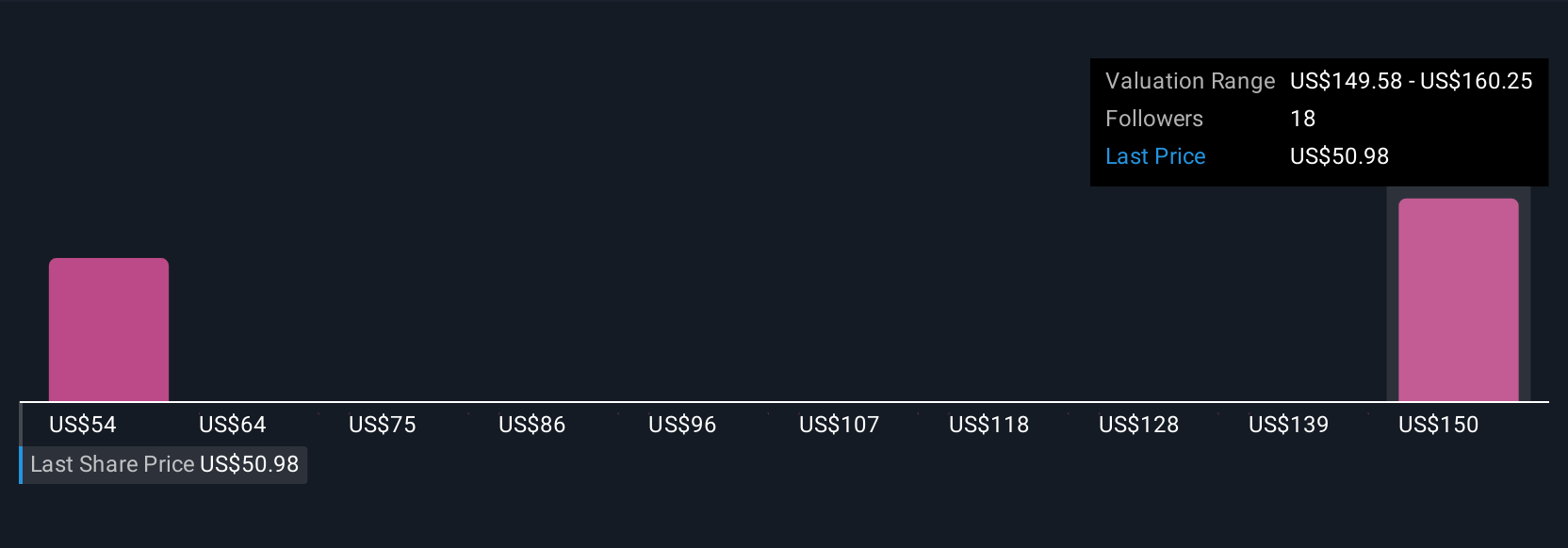

Two fair value estimates from the Simply Wall St Community span roughly US$50.70 to US$94.63, underscoring how far apart individual views can be. Against that wide range, Amazon’s push into ultrafast grocery delivery keeps competitive pressure front and center for Instacart’s future performance, so it is worth weighing several viewpoints before forming your own.

Explore 2 other fair value estimates on Maplebear - why the stock might be worth over 2x more than the current price!

Build Your Own Maplebear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maplebear research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Maplebear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Maplebear's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CART

Maplebear

Maplebear Inc., doing business as Instacart, engages in the provision of online grocery shopping services to households in North America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026