- United States

- /

- Consumer Durables

- /

- NYSEAM:MSN

Introducing Emerson Radio (NYSEMKT:MSN), The Stock That Dropped 41% In The Last Year

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Emerson Radio Corp. (NYSEMKT:MSN) share price slid 41% over twelve months. That contrasts poorly with the market return of 19%. The silver lining (for longer term investors) is that the stock is still 2.5% higher than it was three years ago. The falls have accelerated recently, with the share price down 19% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for Emerson Radio

Because Emerson Radio is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year Emerson Radio saw its revenue fall by 45%. That looks pretty grim, at a glance. The stock price has languished lately, falling 41% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

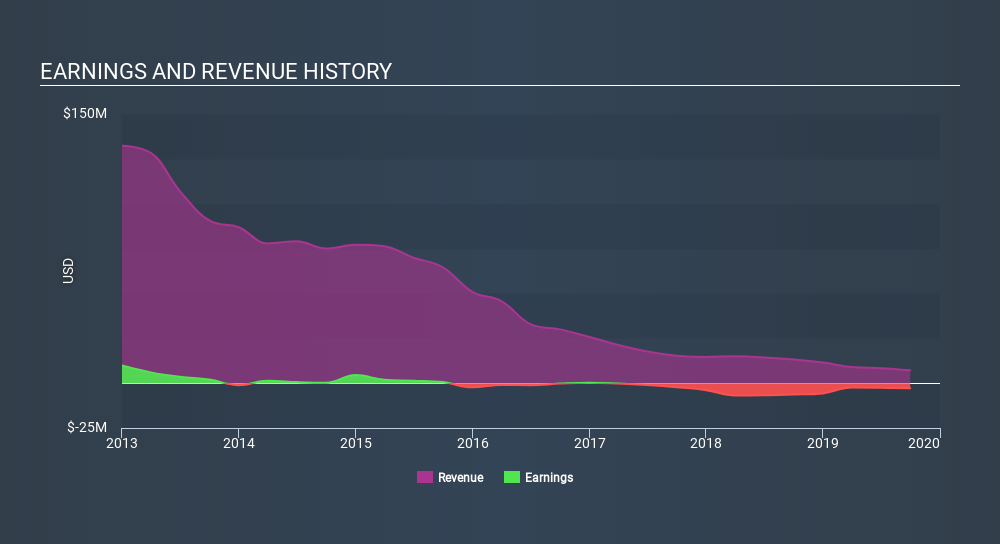

The company's revenue and earnings (over time) are depicted in the image below.

Take a more thorough look at Emerson Radio's financial health with this free report on its balance sheet.

A Different Perspective

Emerson Radio shareholders are down 41% for the year, but the market itself is up 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5.2% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You could get a better understanding of Emerson Radio's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSEAM:MSN

Emerson Radio

Designs, sources, imports, markets, and sells various houseware and consumer electronic products under the Emerson brand in the United States and internationally.

Flawless balance sheet and overvalued.