- United States

- /

- Leisure

- /

- NYSE:YETI

Does the Recent Product Expansion Signal Opportunity for YETI Holdings in 2025?

Reviewed by Bailey Pemberton

If you are trying to make sense of where YETI Holdings stock sits right now, you are far from alone. Investors eyeing this outdoor lifestyle brand have seen a bit of a rollercoaster in recent years, with the stock closing recently at $34.92. In just the last week, YETI is up a healthy 2.8%, while the past month has been a modest 1.0% climb. But step back for the full year or more, and some bumps appear. The stock is down 6.9% year-to-date and 4.5% over the past twelve months. Zoom out even further, and the five-year return stands at -34.2%, though the three-year return shows some resilience, up 10.1%.

So what is behind the twists and turns? Over the past few months, YETI has made headlines for its increased investment in new product lines and a sharp focus on expanding direct-to-consumer sales. This pivot is clearly catching investor attention, as it suggests the company is positioning itself for long-term brand growth, even if it means some short-term costs. In addition, the recent introduction of limited-edition gear collaborations and successful digital campaigns has helped revive some optimism around the brand’s momentum.

Where does that leave the valuation? On our value score, a simple system where we add one point for each of six key checks of undervaluation, YETI earns a solid 4, putting it near the top of the outdoor retail pack on this metric. Of course, scores and ratios only capture part of the story. To really understand whether YETI offers upside or hidden risk, let’s take a closer look at the different valuation approaches and why there may be an even smarter way to gauge what this company is truly worth, which we will discuss at the end.

Approach 1: YETI Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a business’s value by projecting its future cash flows and then discounting them back to today’s dollars. This approach aims to capture the intrinsic worth of a company based on its expected ability to generate free cash flow over time.

For YETI Holdings, the most recent twelve months’ Free Cash Flow stands at $210.9 million. Analysts project these figures out over several years, with estimates rising to $262.5 million by 2029. Beyond analyst estimates, further cash flow growth is extrapolated, reaching about $343.1 million ten years from now. These projections use a two-stage Free Cash Flow to Equity model, which adjusts for the fact that near-term and more distant cash flows may grow at different rates.

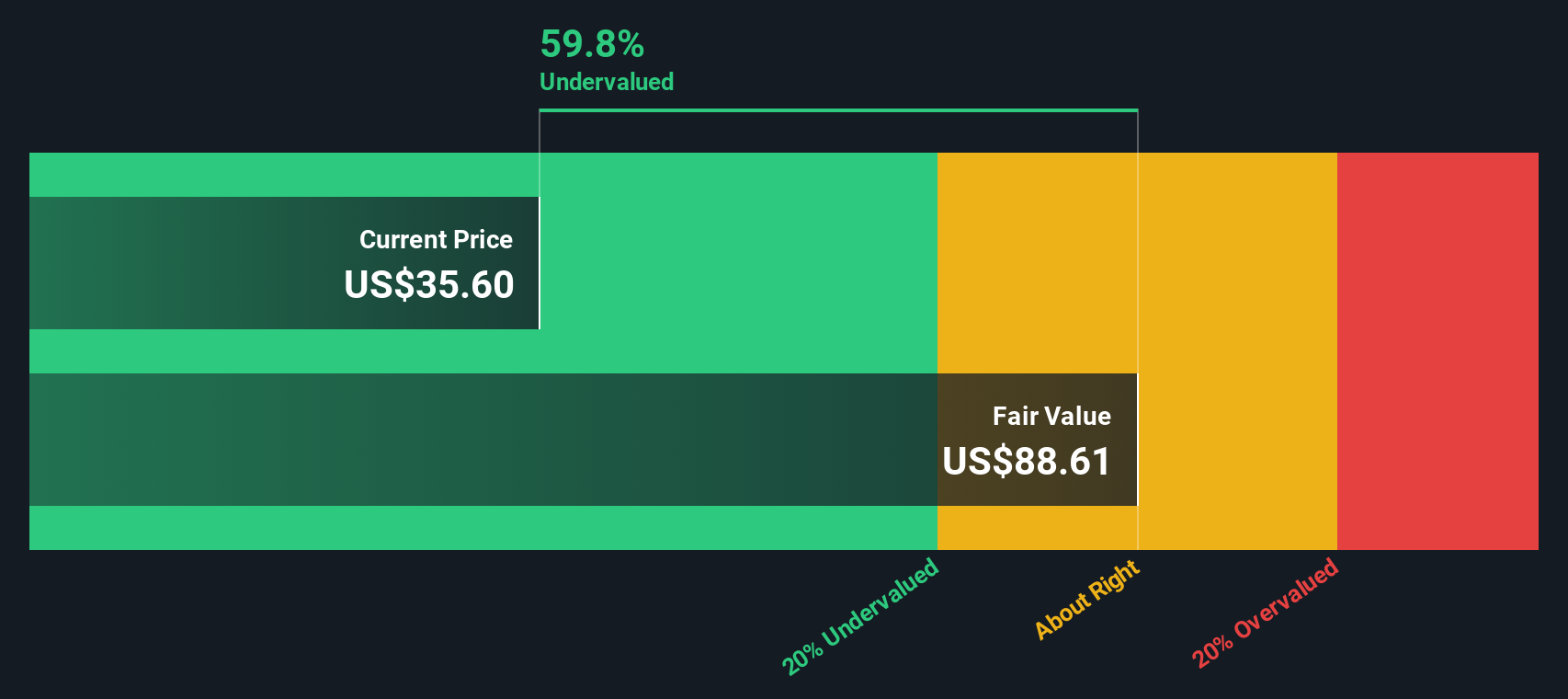

Based on this model, the DCF valuation assigns an intrinsic value of $73.78 per share to YETI Holdings. With shares currently trading around $34.92, the DCF implies the stock is trading at a 52.7% discount to intrinsic value, which may indicate substantial undervaluation according to this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests YETI Holdings is undervalued by 52.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: YETI Holdings Price vs Earnings

The price-to-earnings (PE) ratio is a popular way to value profitable companies like YETI Holdings because it shows how much the market is willing to pay for each dollar of the company’s earnings. Investors favor this metric for mature, cash-generating businesses where profits, not just sales or assets, are the clearest drivers of value.

In the case of PE ratios, higher growth prospects or lower risks often justify a higher multiple, while more uncertainty or slower growth can pull the "normal" or "fair" PE lower. Assessing whether a PE ratio makes sense therefore means considering not just the company, but its industry and the broader market context.

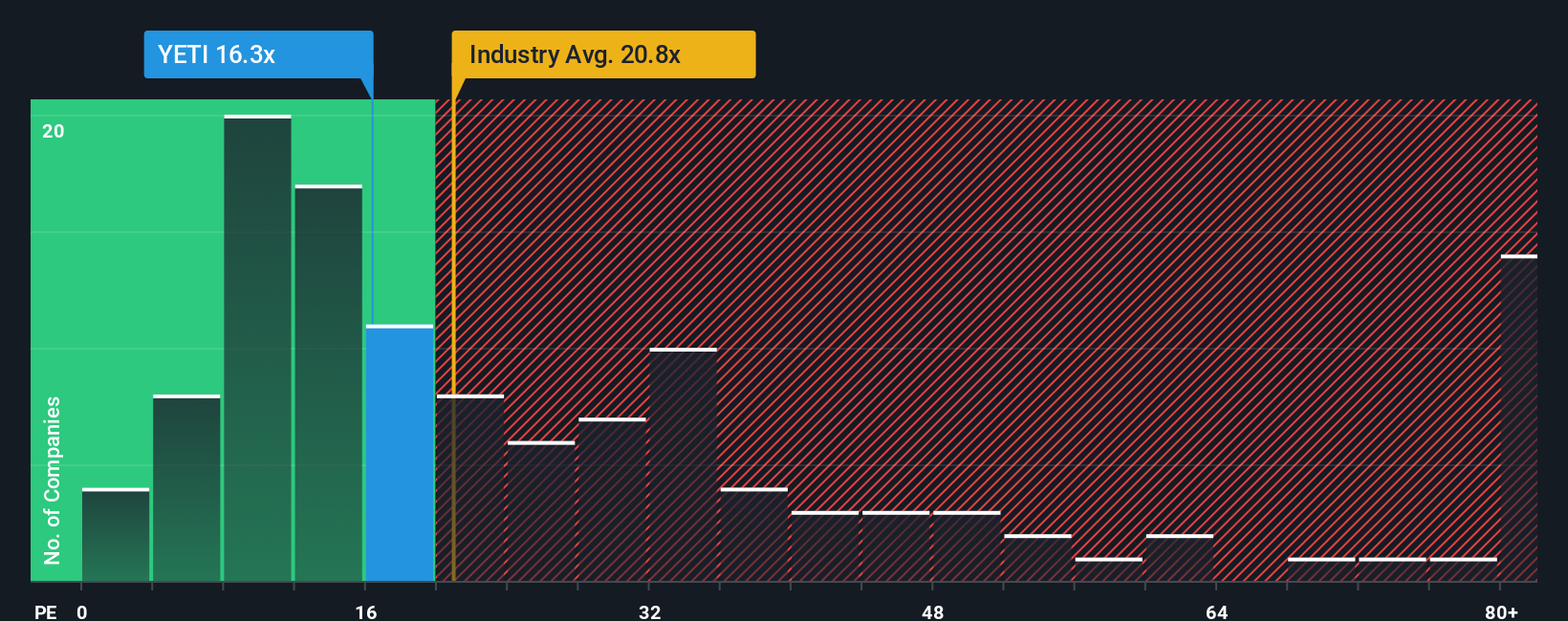

Currently, YETI Holdings trades at a PE ratio of 16x. For comparison, the average PE ratio across its direct peers is 58x, and the broader leisure industry average stands at about 20.6x. This positions YETI below both groups, suggesting a potential discount on standard comparative grounds.

However, Simply Wall St's proprietary "Fair Ratio," calculated specifically for YETI by factoring in growth, profitability, industry environment, and market cap, estimates a fair PE for YETI at 15x. Unlike generic industry or peer benchmarks, this Fair Ratio customizes the expected valuation to YETI’s unique strengths and risks, making it a more nuanced and credible guide for investors.

With YETI’s actual PE ratio at 16x compared to a Fair Ratio of 15x, the stock appears to be valued about right on an absolute basis. By these measures, it is neither notably overvalued nor undervalued.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your YETI Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own story or perspective about a company’s future, linking what you believe about YETI Holdings’ strategy, growth, and risks directly to a set of financial forecasts like future revenue, earnings, and margins, resulting in your own Fair Value estimate.

Rather than relying on a single static number, Narratives on Simply Wall St’s Community page let you create, compare, and refine your convictions using an accessible, guided tool trusted by millions of investors. Narratives bring the numbers to life by showing how your assumptions play out over time and update automatically when new information arrives, such as earnings releases or industry news.

This approach empowers you to easily see if the current market price offers a buying opportunity or signals caution, because your Fair Value constantly adapts in line with the facts and your thesis. For instance, one Narrative on YETI Holdings might be highly optimistic, setting a Fair Value at $53 based on bullish international growth, while another might be more cautious, pricing the stock at $32 due to concerns over competition and supply chain risks.

Do you think there's more to the story for YETI Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YETI

YETI Holdings

Designs, retails, and distributes outdoor products under the YETI brand name.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives