- United States

- /

- Luxury

- /

- NYSE:WWW

Wolverine World Wide, Inc. (NYSE:WWW) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

The Wolverine World Wide, Inc. (NYSE:WWW) share price has done very well over the last month, posting an excellent gain of 27%. The annual gain comes to 124% following the latest surge, making investors sit up and take notice.

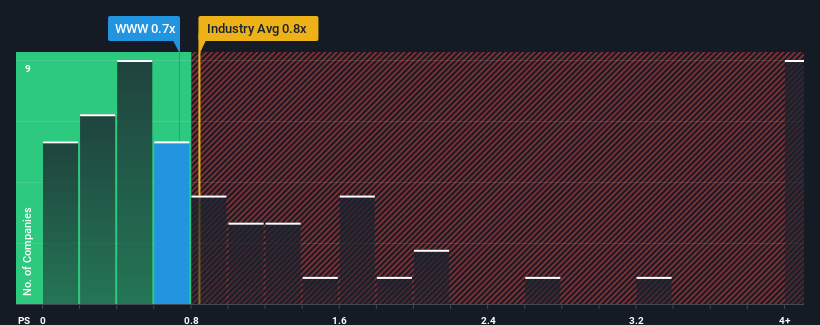

In spite of the firm bounce in price, it's still not a stretch to say that Wolverine World Wide's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Luxury industry in the United States, where the median P/S ratio is around 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Wolverine World Wide

What Does Wolverine World Wide's P/S Mean For Shareholders?

Wolverine World Wide hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Wolverine World Wide's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Wolverine World Wide?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Wolverine World Wide's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 13% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 5.2% as estimated by the eight analysts watching the company. Meanwhile, the broader industry is forecast to expand by 2.7%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Wolverine World Wide's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Wolverine World Wide's P/S Mean For Investors?

Its shares have lifted substantially and now Wolverine World Wide's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

While Wolverine World Wide's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you take the next step, you should know about the 2 warning signs for Wolverine World Wide (1 doesn't sit too well with us!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Wolverine World Wide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WWW

Wolverine World Wide

Designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives