- United States

- /

- Consumer Durables

- /

- NYSE:VZIO

Investors in VIZIO Holding (NYSE:VZIO) from a year ago are still down 27%, even after 5.2% gain this past week

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in VIZIO Holding Corp. (NYSE:VZIO) have tasted that bitter downside in the last year, as the share price dropped 27%. That falls noticeably short of the market return of around 3.9%. VIZIO Holding may have better days ahead, of course; we've only looked at a one year period. It's down 28% in about a quarter.

On a more encouraging note the company has added US$66m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

View our latest analysis for VIZIO Holding

SWOT Analysis for VIZIO Holding

- Currently debt free.

- No major weaknesses identified for VZIO.

- Annual earnings are forecast to grow faster than the American market.

- Trading below our estimate of fair value by more than 20%.

- Revenue is forecast to grow slower than 20% per year.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year VIZIO Holding grew its earnings per share, moving from a loss to a profit.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. But we may find different metrics more enlightening.

In contrast, the 18% drop in revenue is a real concern. If the market sees the weak revenue as jeopardising EPS, that could explain the lower share price.

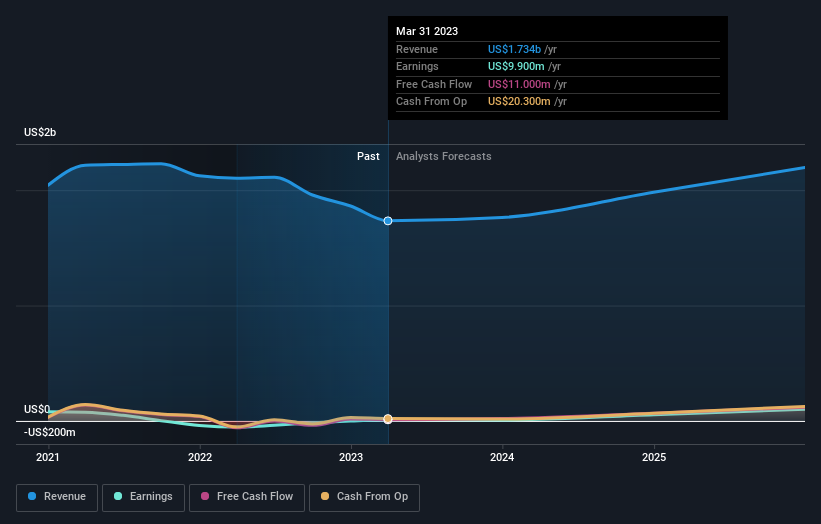

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

VIZIO Holding is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While VIZIO Holding shareholders are down 27% for the year, the market itself is up 3.9%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Notably, the loss over the last year isn't as bad as the 28% drop in the last three months. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that VIZIO Holding is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VZIO

VIZIO Holding

Through its subsidiaries, provides smart televisions, sound bars, and accessories in the United States.

Flawless balance sheet with reasonable growth potential.