- United States

- /

- Luxury

- /

- NYSE:VFC

VF Corp (VFC): Has the Recent Share Price Rebound Stretched Its Valuation?

Reviewed by Simply Wall St

V.F (VFC) has been grinding higher recently, with the stock up around 32% over the past month and roughly 25% in the past 3 months, even as long term returns remain weak.

See our latest analysis for V.F.

That recent surge sits against a tougher backdrop, with the year to date share price return still negative and multi year total shareholder returns deeply underwater. This suggests sentiment is improving but investors remain cautious about the turnaround story.

If V.F has you thinking about what could rally next, this is a good moment to explore fast growing stocks with high insider ownership as a fresh source of new ideas.

So with V.F still trading below most long term highs despite a sharp recent rebound, is the market overlooking a potential value recovery, or is it already baking in all the future growth that matters?

Most Popular Narrative: 16.3% Overvalued

With V.F shares closing at $18.67 against a narrative fair value of $16.05, the current price assumes a lot about the turnaround ahead.

The analysts have a consensus price target of $15.19 for V.F based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $10.0.

Want to see what kind of margin reset, revenue rebuild, and future earnings power could justify this valuation shift? The full narrative lays out the detailed roadmap.

Result: Fair Value of $16.05 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing Vans weakness and elevated leverage mean any stumble in execution or consumer demand could quickly challenge the current recovery narrative.

Find out about the key risks to this V.F narrative.

Another Take on Value

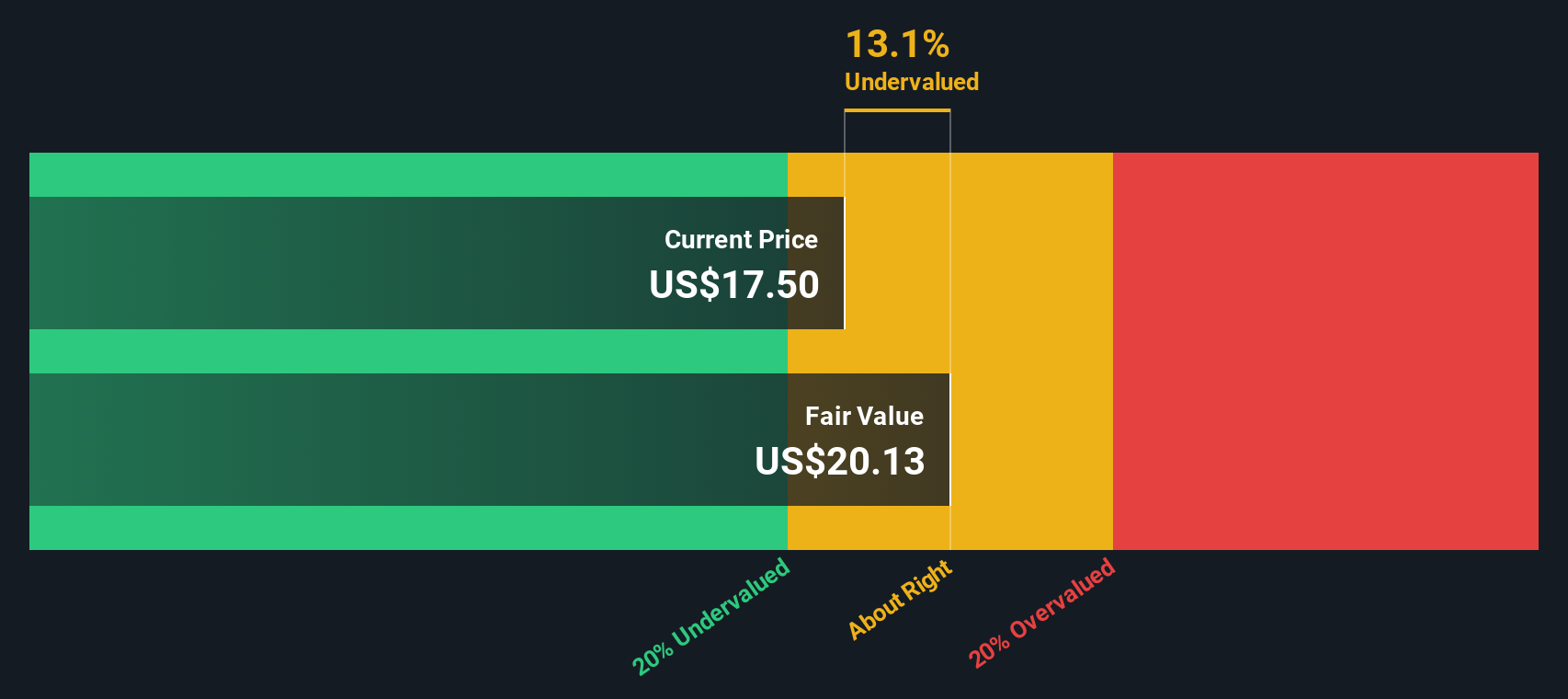

While the narrative fair value suggests V.F looks overvalued, our DCF model points the other way, with shares trading about 7.4% below an estimated fair value of $20.16. If cash flows improve as forecast, today’s skepticism could become a missed entry point.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out V.F for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own V.F Narrative

If you see the story differently, or like to dig into the numbers yourself, you can easily build your own view in just minutes: Do it your way.

A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one stock. The Simply Wall St Screener uncovers focused, data driven opportunities you would probably miss by scrolling headlines and hype alone.

- Capture asymmetric upside by targeting these 3574 penny stocks with strong financials that already show stronger balance sheets and earnings momentum than typical speculative names.

- Ride structural growth trends by backing these 25 AI penny stocks at the heart of automation, intelligent software, and data driven decision making.

- Lock in potential bargains by zeroing in on these 912 undervalued stocks based on cash flows where cash flow strength is not yet fully reflected in market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026