- United States

- /

- Luxury

- /

- NYSE:VFC

Is V.F Still a Bargain After Its 31% Jump and Stretched Earnings Multiple?

Reviewed by Bailey Pemberton

- Wondering if V.F at around $19 a share is a bargain or just a value trap? Here is a breakdown of what the recent moves and current valuation are really telling us before you make any big calls.

- The stock has bounced about 2.7% over the last week and a hefty 31.0% in the last month, even though it is still down 11.0% year to date and 7.9% over the last year, with a much steeper 73.7% slide over five years.

- That kind of rebound after a long slump has coincided with investors reacting to strategic updates around the business and shifting sentiment toward whether the turnaround story is finally gaining traction. At the same time, the market has been reassessing consumer discretionary names more broadly, with changing expectations around interest rates and spending patterns helping to drive sharper moves in names like V.F.

- On our checks, V.F only scores 1 out of 6 for being undervalued, which might surprise anyone looking at the recent price momentum. Next, we will walk through different ways to value the stock, and then finish with a more holistic approach that can give an even clearer picture than traditional metrics alone.

V.F scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: V.F Discounted Cash Flow (DCF) Analysis

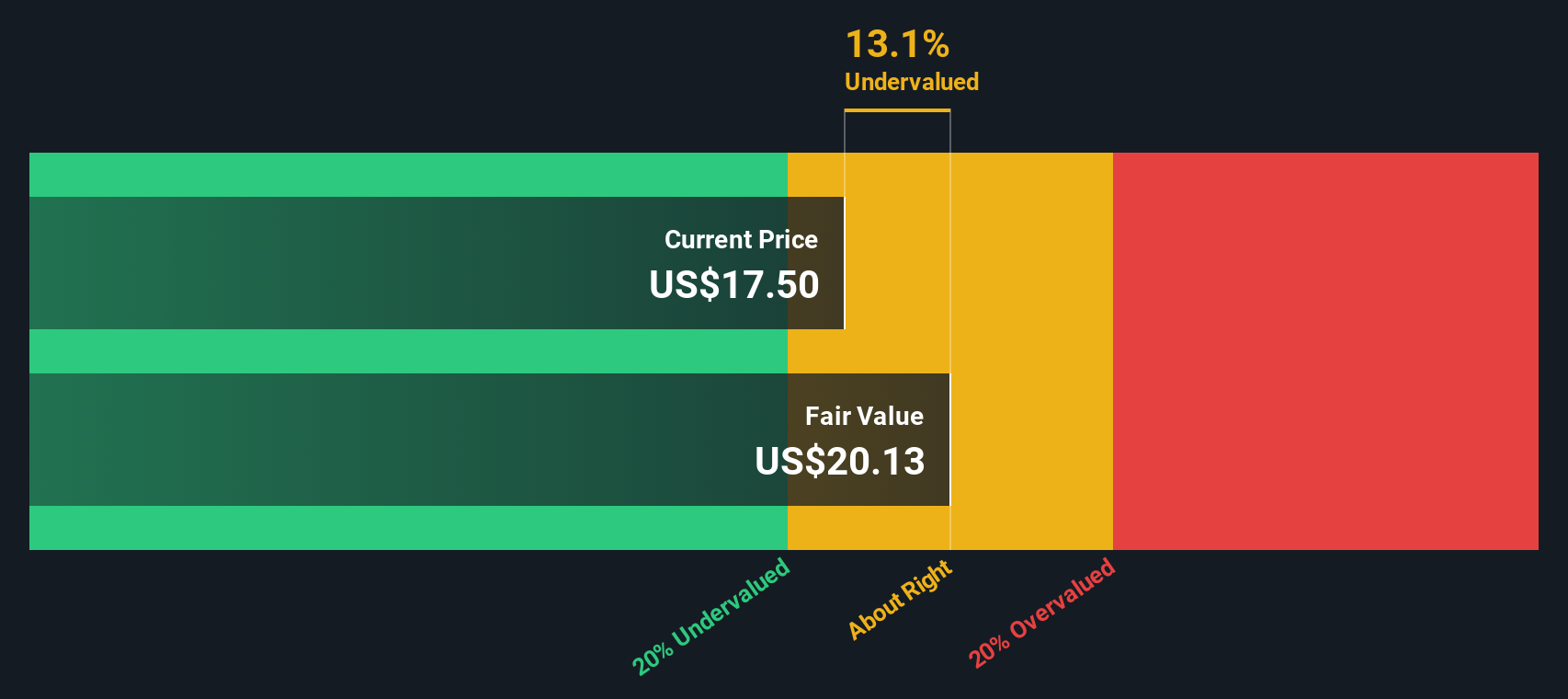

A Discounted Cash Flow, or DCF, model estimates what a company is worth today by projecting its future cash flows and then discounting those back to a present value. For V.F, the model used is a 2 Stage Free Cash Flow to Equity framework, which focuses on cash available to shareholders.

V.F generated about $208.1 Million in free cash flow over the last twelve months, and analyst forecasts, combined with Simply Wall St extrapolations, point to this rising steadily. By 2030, free cash flow is projected to reach roughly $679 Million, with interim years stepping up from around $425.5 Million in 2026 to the high $800 Million range by 2035 as growth moderates over time.

When all these projected cash flows are discounted back to today, the model arrives at an intrinsic value of about $20.38 per share. Compared with the current share price of roughly $19, the DCF suggests the stock is about 5.9% undervalued, which is a relatively small margin and leaves limited cushion if assumptions prove too optimistic.

Result: ABOUT RIGHT

V.F is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: V.F Price vs Earnings

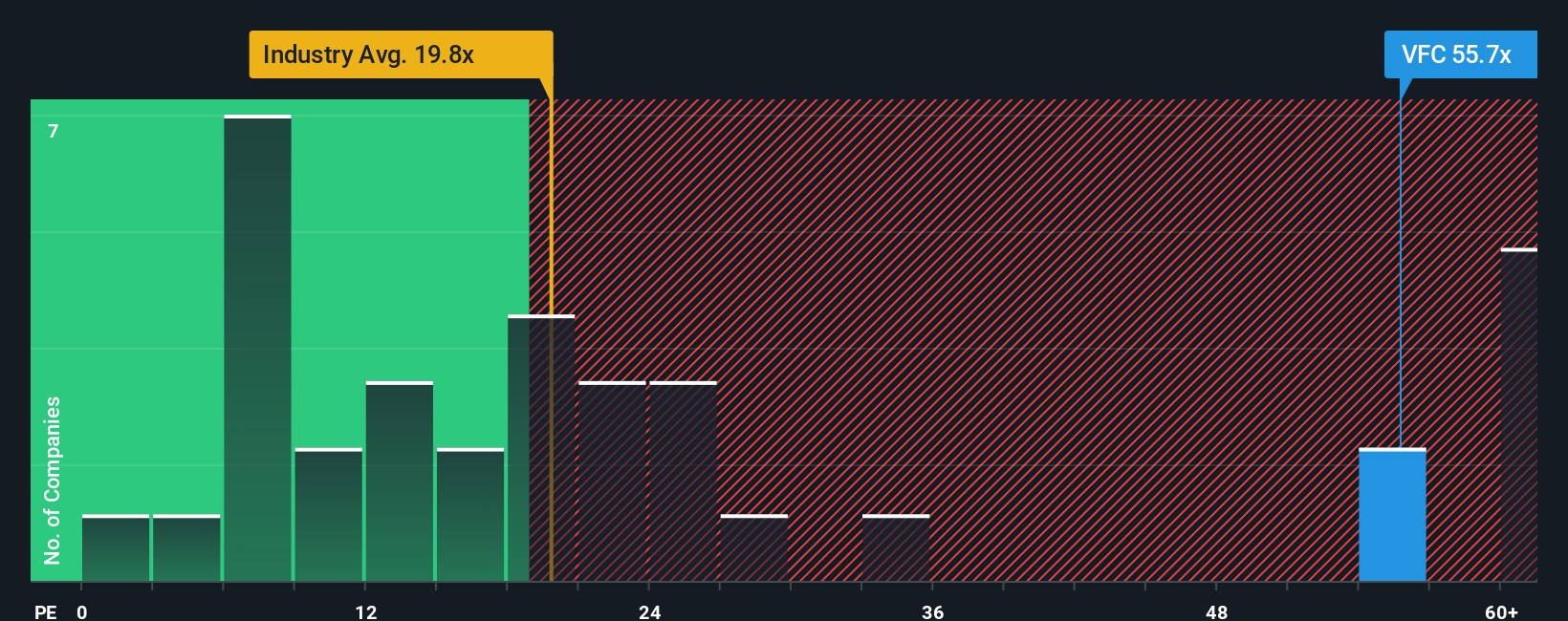

For companies that are generating profits, the price to earnings (PE) ratio is often the go to valuation gauge because it directly compares what investors pay with what the business is actually earning. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty usually call for a lower, more conservative multiple.

V.F currently trades on a PE of about 81.24x, which is far richer than both the Luxury industry average of roughly 21.17x and the broader peer group at about 14.97x. Simply Wall St also calculates a proprietary Fair Ratio of around 28.10x for V.F, which reflects what the PE might reasonably be given its specific mix of earnings growth prospects, profitability, size and risk profile.

This Fair Ratio approach can be more informative than a simple peer or industry comparison because it adjusts for company specific drivers rather than assuming all businesses in a sector deserve the same multiple. When we set the current 81.24x PE against the 28.10x Fair Ratio, V.F screens as significantly more expensive than what its fundamentals would typically support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making, Choose your V.F Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories that connect your view of a company with specific forecasts for its future revenue, earnings, margins and, ultimately, a fair value estimate you can compare with today’s share price. On Simply Wall St’s Community page, used by millions of investors, Narratives turn abstract numbers into a concrete investment plan by linking three things: what you believe will happen to the business, how that flows into a financial model, and what price would then be reasonable to pay or accept to sell. Because Narratives update dynamically when new information arrives, such as earnings results, news or guidance changes, your fair value moves with the story rather than staying frozen in time. For V.F, one investor might build a more optimistic Narrative that assumes premiumization, digital growth and a successful Vans reset justify a fair value closer to $40 per share. Another might focus on brand weakness, tariff pressure and leverage risk and conclude a much more conservative fair value nearer $10. Those differing views can guide whether each investor thinks V.F is a buy, a hold or a sell today.

Do you think there's more to the story for V.F? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026