- United States

- /

- Luxury

- /

- NYSE:UAA

3 Promising Penny Stocks With Over $900M Market Cap

Reviewed by Simply Wall St

As U.S. stock indexes have recently surged, with the Dow climbing over 650 points in a single day, investors are increasingly seeking opportunities beyond the usual market leaders. Penny stocks, while often associated with speculative trading, can still offer significant potential when supported by robust financials. This article will explore several penny stocks that combine strong balance sheets with promising growth prospects, demonstrating that even in today's evolving market landscape, these smaller companies can present compelling investment opportunities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.76 | $375.03M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.745 | $614.83M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8508 | $146.26M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.42 | $636.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.95 | $250.95M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $1.99 | $27.72M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.44 | $580.28M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.8112 | $6.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.62 | $82.24M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 353 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Alight (ALIT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alight, Inc. is a technology-enabled services company operating globally with a market cap of approximately $1.11 billion.

Operations: The company's revenue segment is Employer Solutions, which generated $2.29 billion.

Market Cap: $1.11B

Alight, Inc. has been navigating challenging financial waters, with a significant net loss of US$1.07 billion in Q3 2025 and a substantial goodwill impairment charge of US$1.34 billion. Despite these setbacks, the company is actively pursuing strategic initiatives to enhance its offerings and market position. Recent collaborations with IBM and MetLife aim to leverage AI for benefits administration and retirement income solutions, respectively, potentially driving future growth. Additionally, Alight's leadership transition with Rohit Verma as CEO could bring strategic realignment given his successful track record at Crawford & Company amidst ongoing share buybacks totaling US$284 million since 2022.

- Click here and access our complete financial health analysis report to understand the dynamics of Alight.

- Review our growth performance report to gain insights into Alight's future.

ATRenew (RERE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ATRenew Inc. operates a pre-owned consumer electronics transactions and services platform in China, with a market cap of approximately $917.81 million.

Operations: The company generates revenue from its retail electronics segment, which amounts to CN¥19.64 billion.

Market Cap: $917.81M

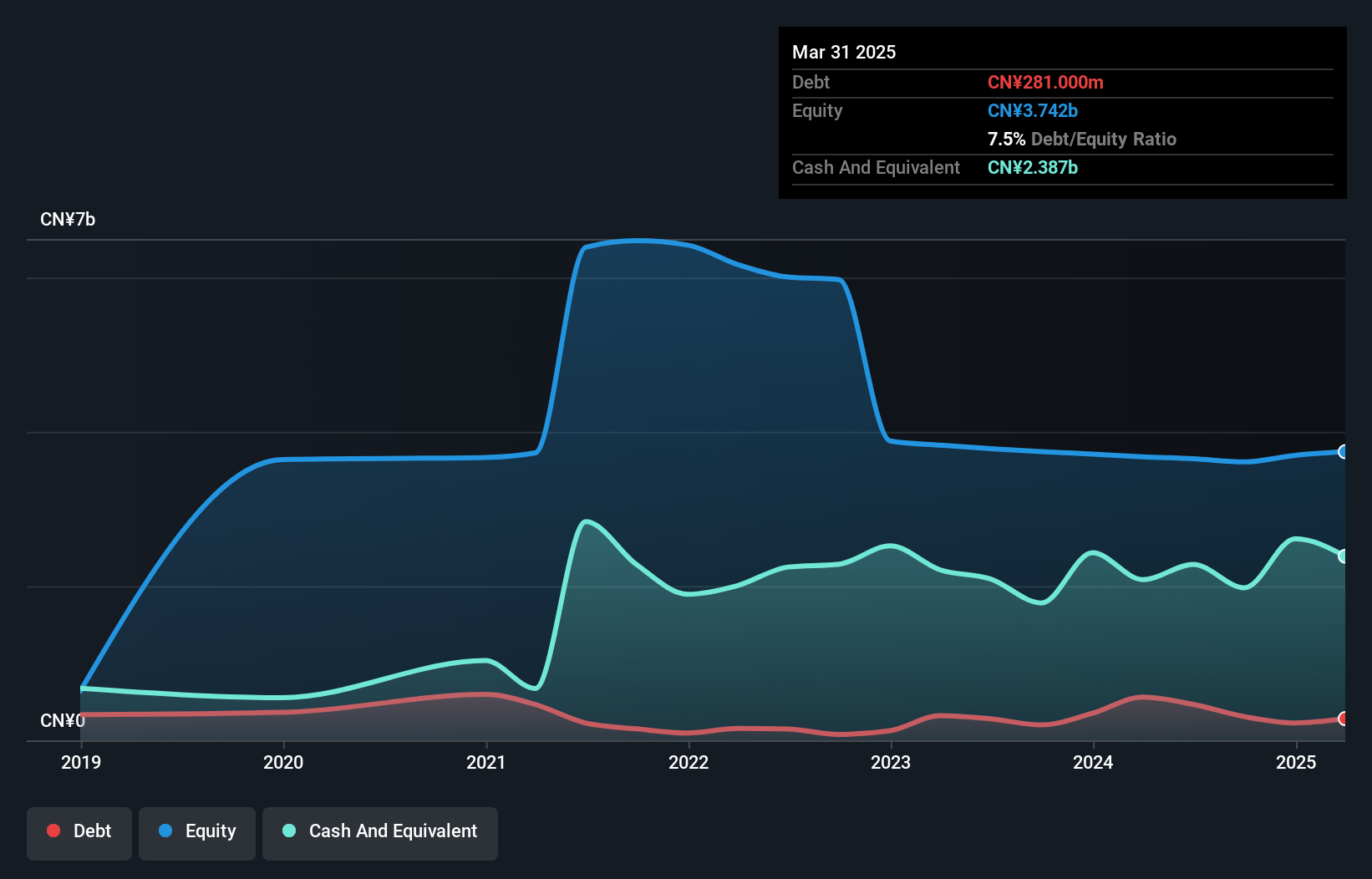

ATRenew Inc. has shown robust financial performance, with net income rising to CN¥90.82 million in Q3 2025 from CN¥17.88 million the previous year, and a nine-month net income of CN¥205.95 million compared to a loss last year. The company forecasts 2025 revenue between RMB20.87 billion and RMB20.97 billion, marking substantial growth from the prior period. Its financial stability is underscored by short-term assets exceeding liabilities and debt well-covered by cash flow at 429%. Additionally, ATRenew's recent share buyback initiative reflects confidence in its market position while maintaining stable weekly volatility at 7%.

- Dive into the specifics of ATRenew here with our thorough balance sheet health report.

- Understand ATRenew's earnings outlook by examining our growth report.

Under Armour (UAA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Under Armour, Inc. is involved in developing, marketing, and distributing performance apparel, footwear, and accessories for men, women, and youth with a market cap of approximately $1.87 billion.

Operations: The company's revenue is primarily generated from North America at $2.99 billion, followed by Europe, The Middle East and Africa (EMEA) at $1.14 billion, Asia-Pacific at $708.50 million, and Latin America at $212.47 million.

Market Cap: $1.87B

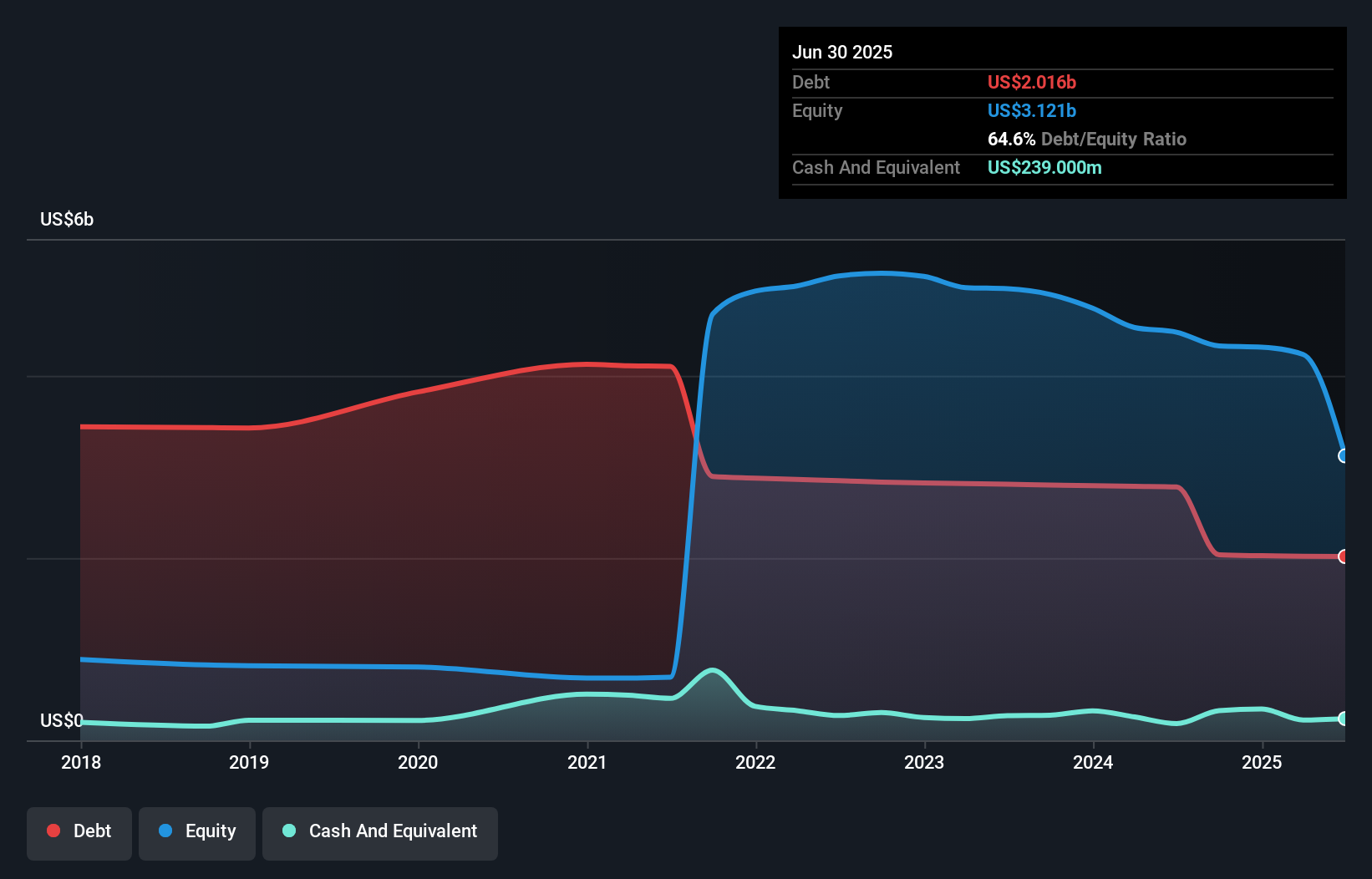

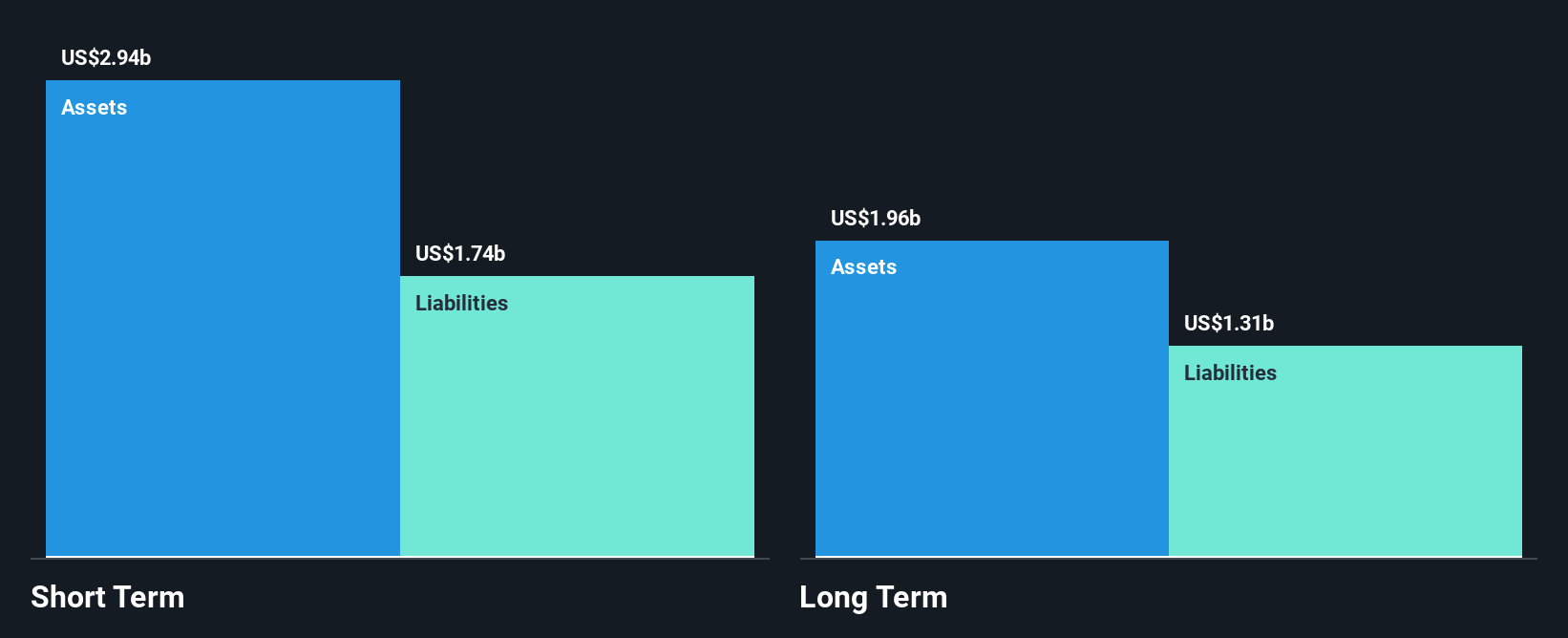

Under Armour faces challenges with a forecasted operating loss of US$56 million to US$71 million for fiscal 2026, contrasting previous expectations of operating income. The company's revenue has declined, particularly in North America and Asia-Pacific, although EMEA shows growth potential. Despite being unprofitable, Under Armour's short-term assets exceed liabilities significantly. Management changes are underway with the appointment of Reza Taleghani as CFO in February 2026, bringing extensive financial leadership experience. The separation from Curry Brand marks a strategic shift as the company navigates its financial restructuring amidst high debt levels and negative return on equity.

- Jump into the full analysis health report here for a deeper understanding of Under Armour.

- Evaluate Under Armour's prospects by accessing our earnings growth report.

Taking Advantage

- Take a closer look at our US Penny Stocks list of 353 companies by clicking here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UAA

Under Armour

Engages developing, marketing, and distributing performance apparel, footwear, and accessories for men, women, and youth.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success