- United States

- /

- Luxury

- /

- NYSE:TPR

Taking Stock of Tapestry’s (TPR) Valuation After TD Cowen’s Bullish Call on Record Q1 Results

Reviewed by Simply Wall St

After meeting with Tapestry (TPR) leadership, TD Cowen doubled down on its positive view. The firm pointed to record first quarter results that beat forecasts and to momentum from the company’s shifting product mix and One Coach strategy.

See our latest analysis for Tapestry.

The upbeat meeting and record quarter come on top of a strong run, with a roughly 71 percent year to date share price return and a powerful multiyear total shareholder return suggesting momentum is firmly building rather than fading.

If Tapestry’s surge has you rethinking where growth could come from next, it might be a good time to explore fast growing stocks with high insider ownership.

With shares already up sharply, trading just below Wall Street’s target and our own estimate of intrinsic value suggesting some upside, the question now is whether Tapestry remains mispriced or if the market is already banking on future growth.

Most Popular Narrative Narrative: 8% Undervalued

With Tapestry last closing at $111.92 against a narrative fair value of $121.68, the story frames upside as a long game built on compounding improvements.

Ongoing investments in digital infrastructure, omnichannel capabilities, and data-driven customer engagement are expected to enable margin expansion and direct-to-consumer growth, enhancing both revenue and net margins long-term.

Want to see what happens when steady sales growth meets rapidly rising margins and shrinking share count? The narrative stacks these levers in a surprisingly aggressive way. Curious how those moving parts build to its long term earnings and valuation view? Dive in to see the full playbook behind that upside case.

Result: Fair Value of $121.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming tariff headwinds and lingering Kate Spade turnaround uncertainty could derail margin expansion and temper the multi year buyback driven upside story.

Find out about the key risks to this Tapestry narrative.

Another Angle On Value

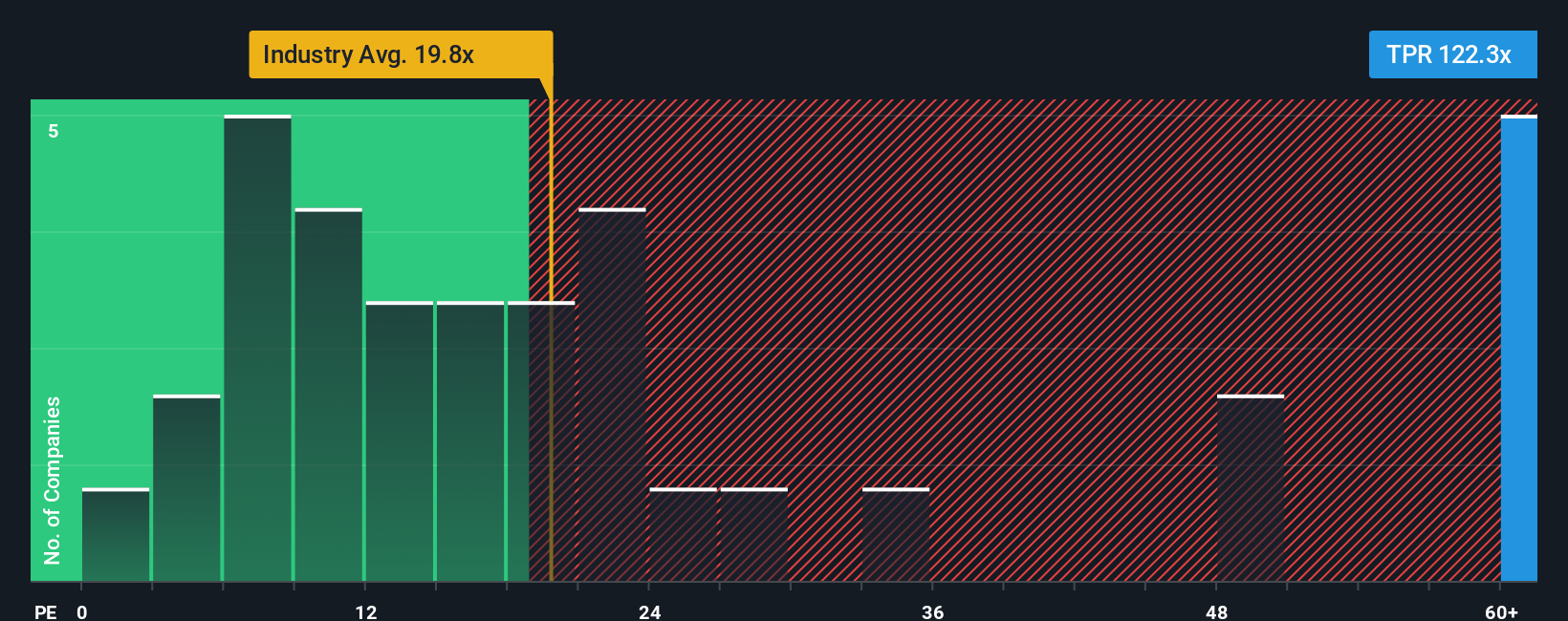

Step away from narratives and the simple earnings ratio looks far less generous. Tapestry trades on a price to earnings of 84.4 times, sharply above the US Luxury average of 21 times and a fair ratio of 27.1 times, raising the risk that sentiment not fundamentals is doing the heavy lifting. If earnings or momentum slip, how far could that gap realistically close?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tapestry Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a fresh narrative in minutes with Do it your way.

A great starting point for your Tapestry research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before markets move on without you, put Simply Wall Street’s screener to work and uncover fresh opportunities beyond Tapestry that match your strategy.

- Capture deep value potential by targeting these 907 undervalued stocks based on cash flows where prices may lag far behind long term cash flow strength.

- Ride the wave of intelligent automation with these 26 AI penny stocks positioned at the heart of data driven transformation.

- Explore meaningful income streams through these 14 dividend stocks with yields > 3% that combine solid yields with the potential for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tapestry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPR

Tapestry

Provides accessories and lifestyle brand products in North America, Greater China, rest of Asia, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026