- United States

- /

- Luxury

- /

- NYSE:TPR

Is It Too Late to Consider Tapestry After Its 92% 1 Year Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Tapestry is still a buy after its big run, you are not alone. This stock has become a litmus test for how investors value premium brands in a changing consumer landscape.

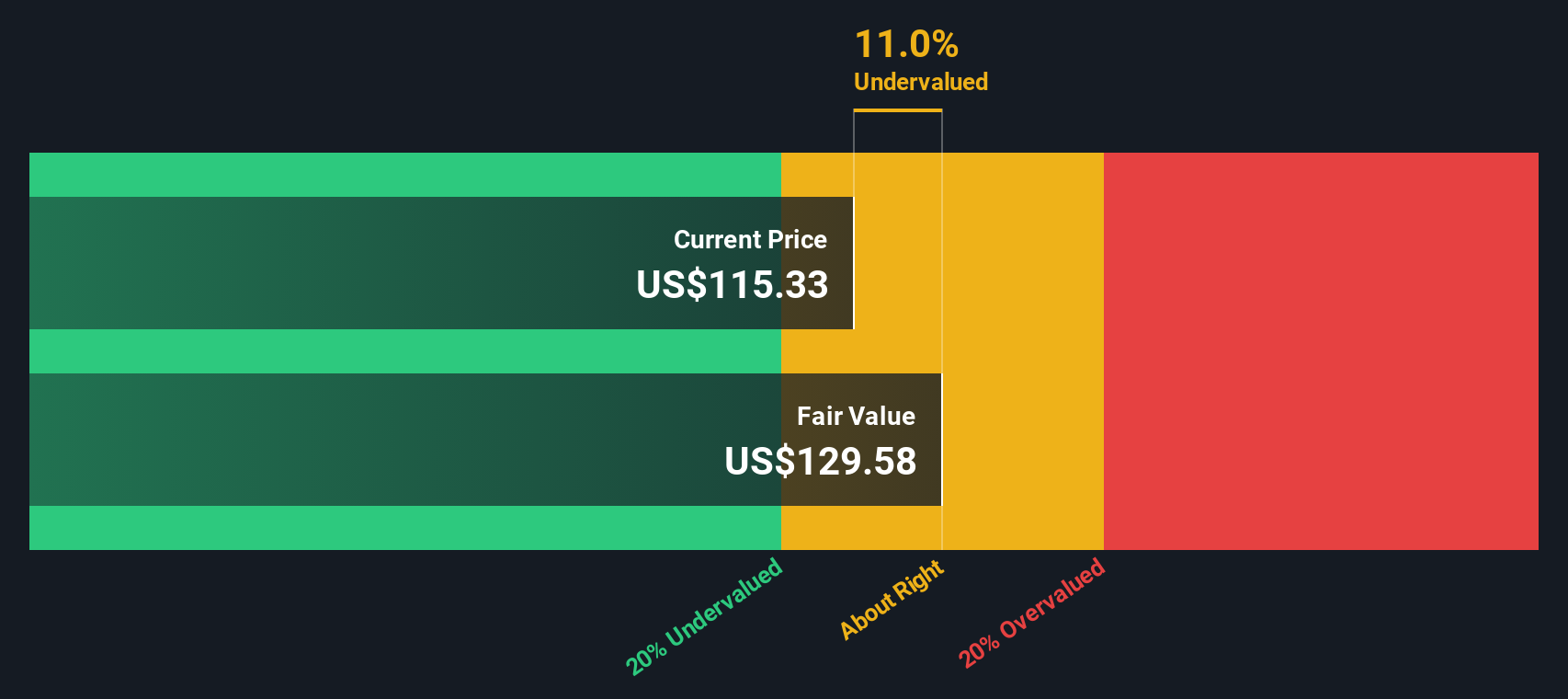

- The share price has been on a tear, up 5.2% over the last week, 11.0% over the last month, and 79.4% year to date, capping off a 92.0% 1-year gain and multi-year returns north of 200%.

- Much of that momentum has been tied to headlines around Tapestry's portfolio strategy and brand investments, alongside renewed optimism about the resilience of luxury and affordable luxury spending. Investors have been digesting news about how management is positioning Coach, Kate Spade, and Stuart Weitzman to capture long-term demand, and what that means for sustainable value creation rather than short-term sentiment swings.

- Despite the surge, Tapestry only scores 1 out of 6 on our undervaluation checks. We will walk through what different valuation methods are saying and then finish with a more holistic way to think about the stock's true worth.

Tapestry scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tapestry Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms.

For Tapestry, the model starts with last twelve month free cash flow of about $1.06 billion and uses a 2 Stage Free Cash Flow to Equity approach. Analyst forecasts see free cash flow rising to around $1.53 billion by 2028, with further increases extrapolated by Simply Wall St out to 2035, where projected free cash flow reaches roughly $2.29 billion. These later years are not direct analyst estimates; they are model based extensions built on earlier growth assumptions.

When all these projected cash flows are discounted back, the DCF model arrives at an intrinsic value of about $137.55 per share. That implies Tapestry is roughly 14.4% undervalued compared with its current share price and suggests the market is not fully pricing in its long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tapestry is undervalued by 14.4%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Tapestry Price vs Earnings

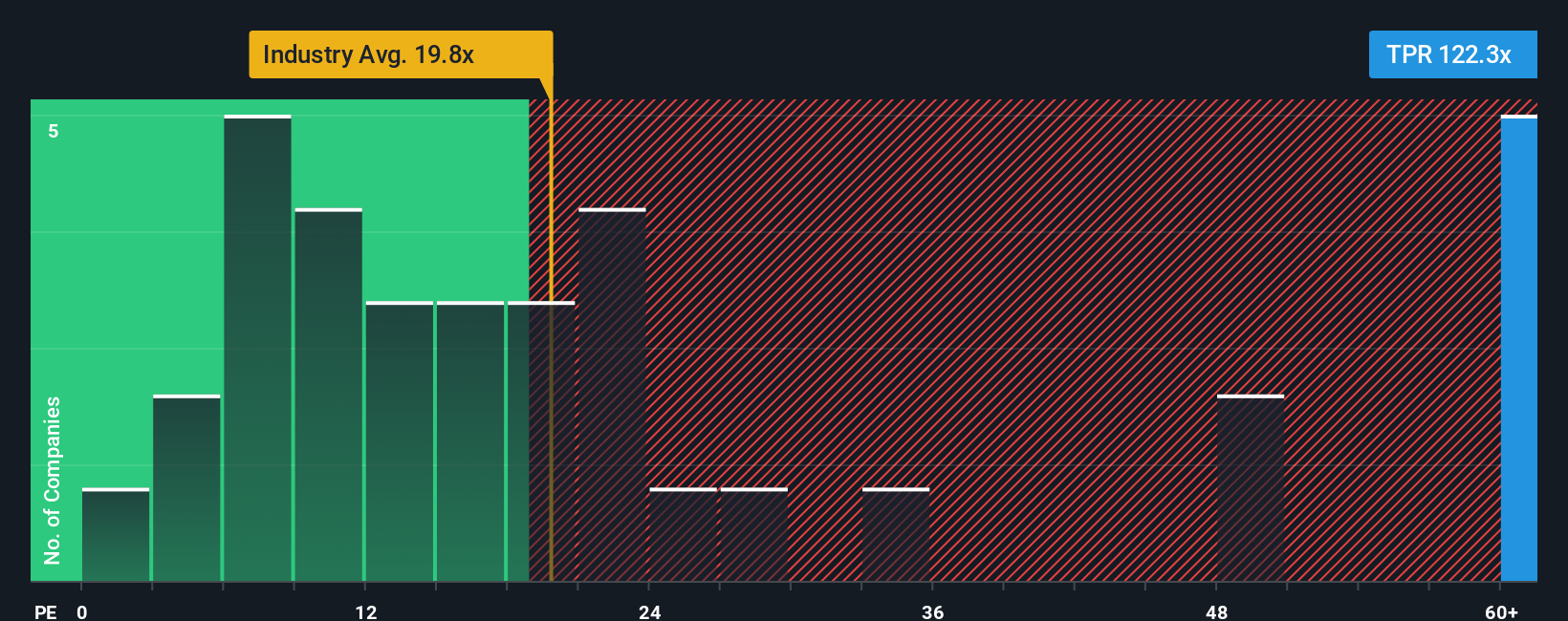

For a profitable business like Tapestry, the price to earnings, or PE, ratio is a useful way to gauge how much investors are paying for each dollar of current earnings. In general, faster growing and less risky companies can justify a higher PE, while slower growing or more volatile businesses tend to trade on lower multiples.

Tapestry currently trades on a PE of about 88.8x, a big premium to both the luxury industry average of roughly 21.2x and its peer group around 31.1x. On the surface, that suggests the market is pricing in very strong growth and resilience compared with other luxury names. However, those simple comparisons do not fully reflect Tapestry’s specific drivers.

This is where Simply Wall St’s fair ratio comes in. The fair ratio of about 27.3x is a proprietary estimate of what Tapestry’s PE should be, after accounting for its earnings growth outlook, profitability, risk profile, industry positioning and market cap. Because it blends these fundamentals, it is more informative than a blunt comparison with peers or the broad industry. Stacking this 27.3x fair ratio against today’s 88.8x market multiple implies the shares look significantly overvalued on an earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tapestry Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page where you can connect your view of Tapestry’s story to a set of financial forecasts and a resulting fair value estimate. You can then compare that fair value with today’s share price to decide whether it looks like a buy or a sell. The whole Narrative updates dynamically as new news or earnings arrive so your thesis stays current. For example, one Tapestry Narrative might lean bullish and assume the company reaches around $139 per share, based on steady revenue growth, margin expansion to the high teens, and continued buybacks. Another, more cautious Narrative could anchor closer to $66 per share, stressing Kate Spade execution risk, tariff pressure, and slower store productivity. By seeing these different story-driven fair values side by side, you can quickly choose or adapt the Narrative that best fits your own assumptions.

Do you think there's more to the story for Tapestry? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tapestry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPR

Tapestry

Provides accessories and lifestyle brand products in North America, Greater China, rest of Asia, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026