- United States

- /

- Luxury

- /

- NYSE:TPR

Is It Too Late To Consider Tapestry After Its 316% Five Year Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Tapestry is still a smart buy after its huge run, or if you are turning up late to the party, this breakdown will walk through what the current price really implies about future returns.

- The stock has cooled slightly in the last week, down 1.3%, but it is still up 2.8% over the last month, 66.5% year to date, 74.3% over 1 year, 224.0% over 3 years, and an eye-catching 316.0% over 5 years.

- Recently, the story around Tapestry has been shaped by strategic brand repositioning and ongoing integration efforts across its portfolio. The market often interprets these moves as a signal of longer term margin and growth ambitions. At the same time, shifting sentiment in consumer discretionary names has put a spotlight on which brands can defend pricing power and maintain demand through cycles.

- Despite that backdrop, Tapestry only earns a 1/6 valuation score, suggesting it screens as undervalued on just one of six checks. We will walk through the main valuation methods next and then finish by looking at a more complete way to judge what the market might really be missing.

Tapestry scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tapestry Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future, then discounting those cash flows back to their value in today's dollars.

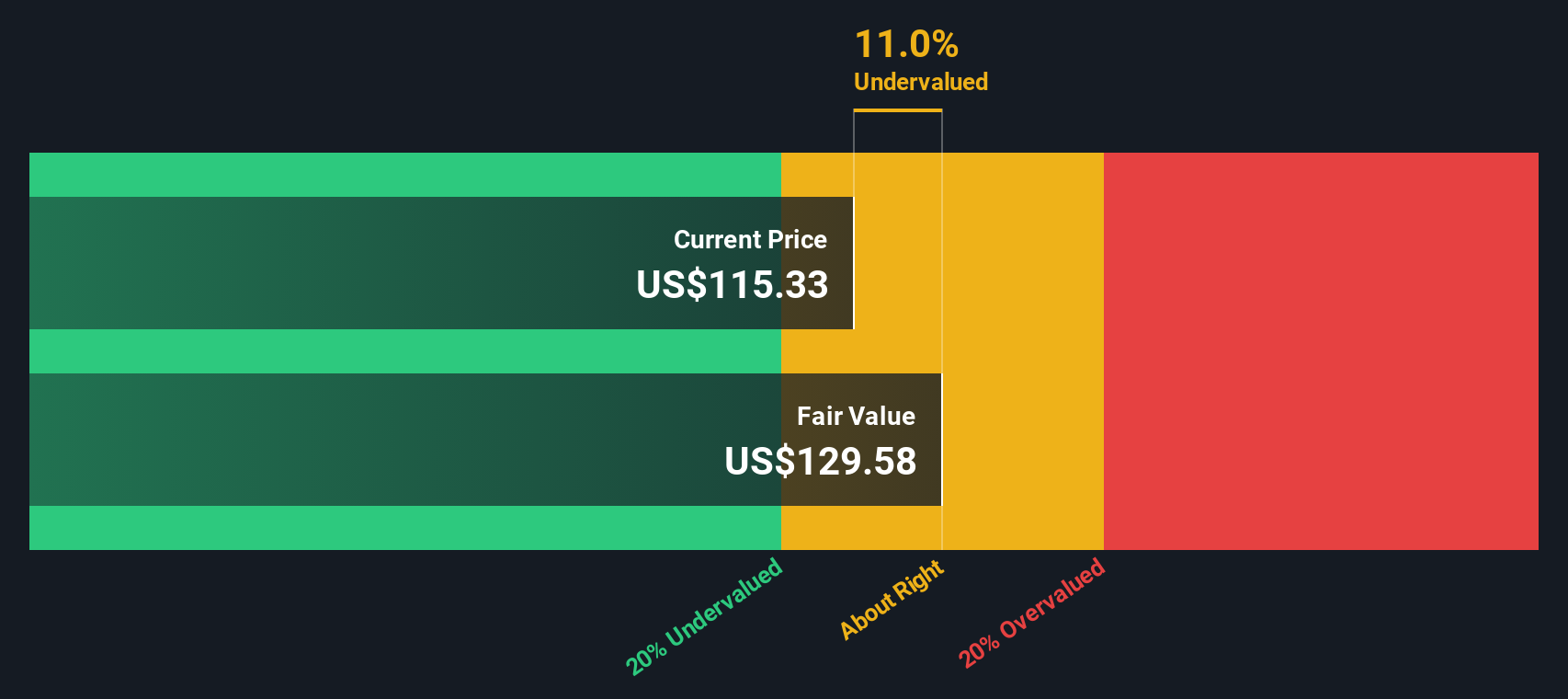

For Tapestry, the model starts from last twelve month free cash flow of about $1.06 billion and uses analyst estimates for the next few years, then extrapolates further growth. By 2028, free cash flow is projected to reach roughly $1.53 billion, and the extended ten year path sees cash flows continuing to rise at moderating growth rates, based on Simply Wall St's two stage Free Cash Flow to Equity approach.

Rolling all of those discounted cash flows together yields an estimated intrinsic value of $136.26 per share. With the DCF implying that Tapestry is 19.8% undervalued relative to its current share price, the model indicates there could be meaningful upside for long term investors who consider these cash flow assumptions reasonable.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tapestry is undervalued by 19.8%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: Tapestry Price vs Earnings

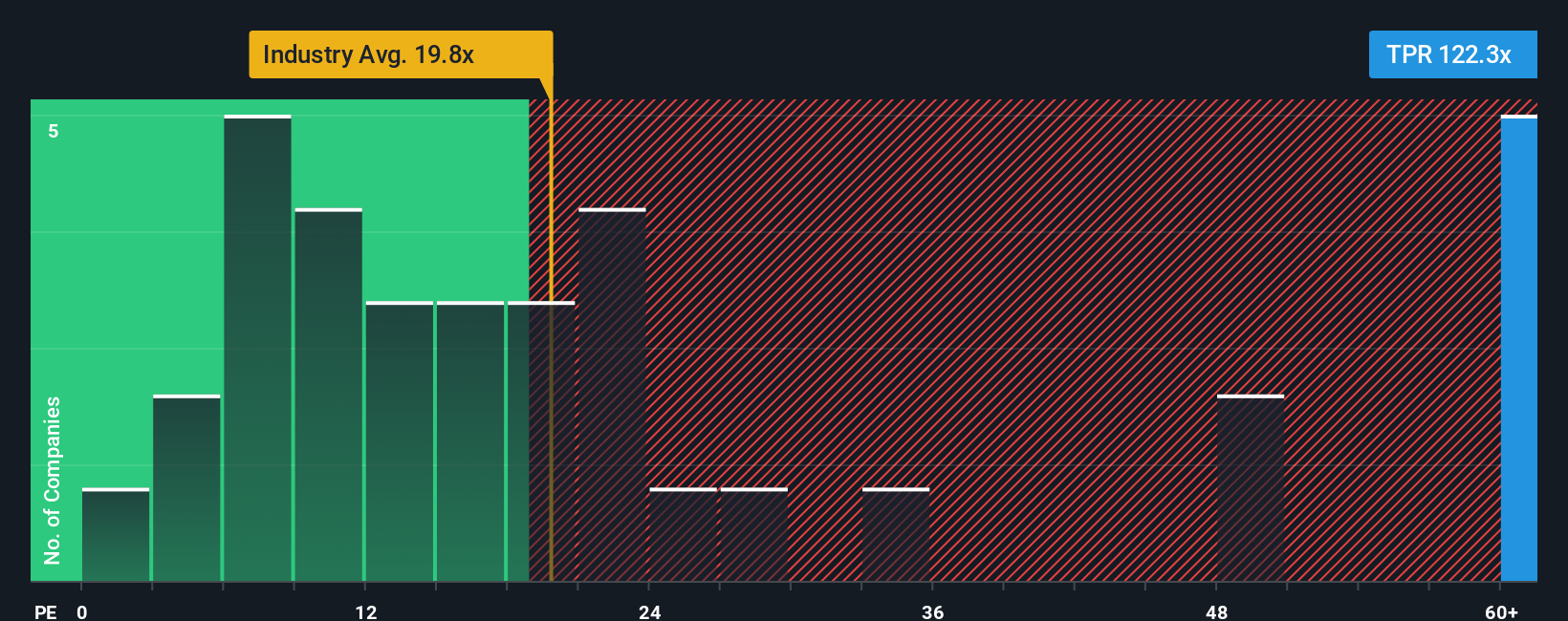

For profitable companies like Tapestry, the price to earnings ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. A higher PE can be reasonable when a business has strong, visible growth ahead and relatively low risk, while slower or more uncertain growth usually justifies a lower, more conservative multiple.

Tapestry currently trades on a rich 82.39x PE, well above both the Luxury industry average of about 21.04x and the broader peer group average of roughly 29.96x. To move beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what a normal PE should be once you factor in company specific drivers such as expected earnings growth, profitability, industry characteristics, market cap and risk profile.

Because the Fair Ratio incorporates these fundamentals, it offers a more tailored benchmark than headline industry or peer averages. For Tapestry, the Fair Ratio is 27.07x, far below the current 82.39x multiple. That sizable gap suggests the market is pricing in growth and durability well beyond what the fundamentals alone would indicate.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tapestry Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce Narratives, an easy tool on Simply Wall St's Community page that lets you connect your view of Tapestry's story to a concrete financial forecast and fair value. It turns your assumptions about future revenue, earnings and margins into numbers you can compare with the current price. You can see how your buy or sell decision stacks up against other investors, and watch those Narratives update dynamically as new news or earnings arrive. Some investors currently build a bullish Tapestry Narrative that justifies a fair value near $139 based on accelerating international growth, margin expansion and buybacks. Others construct a more cautious Narrative closer to $66 that incorporates risks around tariffs, brand concentration and shifting consumer tastes.

Do you think there's more to the story for Tapestry? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tapestry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPR

Tapestry

Provides accessories and lifestyle brand products in North America, Greater China, rest of Asia, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026