- United States

- /

- Consumer Durables

- /

- NYSE:TOL

Is There Still Upside in Toll Brothers After Recent Housing Market Strength?

Reviewed by Bailey Pemberton

- Ever wondered whether Toll Brothers stock is attractively priced, or if the recent buzz has already baked in all the upside? Here is a breakdown of what is really happening beneath the headline numbers.

- Despite a slight dip of 0.7% this week and a 5.0% pullback over the past month, Toll Brothers still boasts a strong year-to-date gain of 7.3%. However, it is down 10.9% over the last year and is up over 200% across five years.

- Recent headlines have highlighted continued strength in the U.S. housing market and Toll Brothers’ strategic land acquisitions, adding context to its volatile share price. Industry chatter points to resilient buyer demand even as mortgage rates fluctuate, keeping investors attentive.

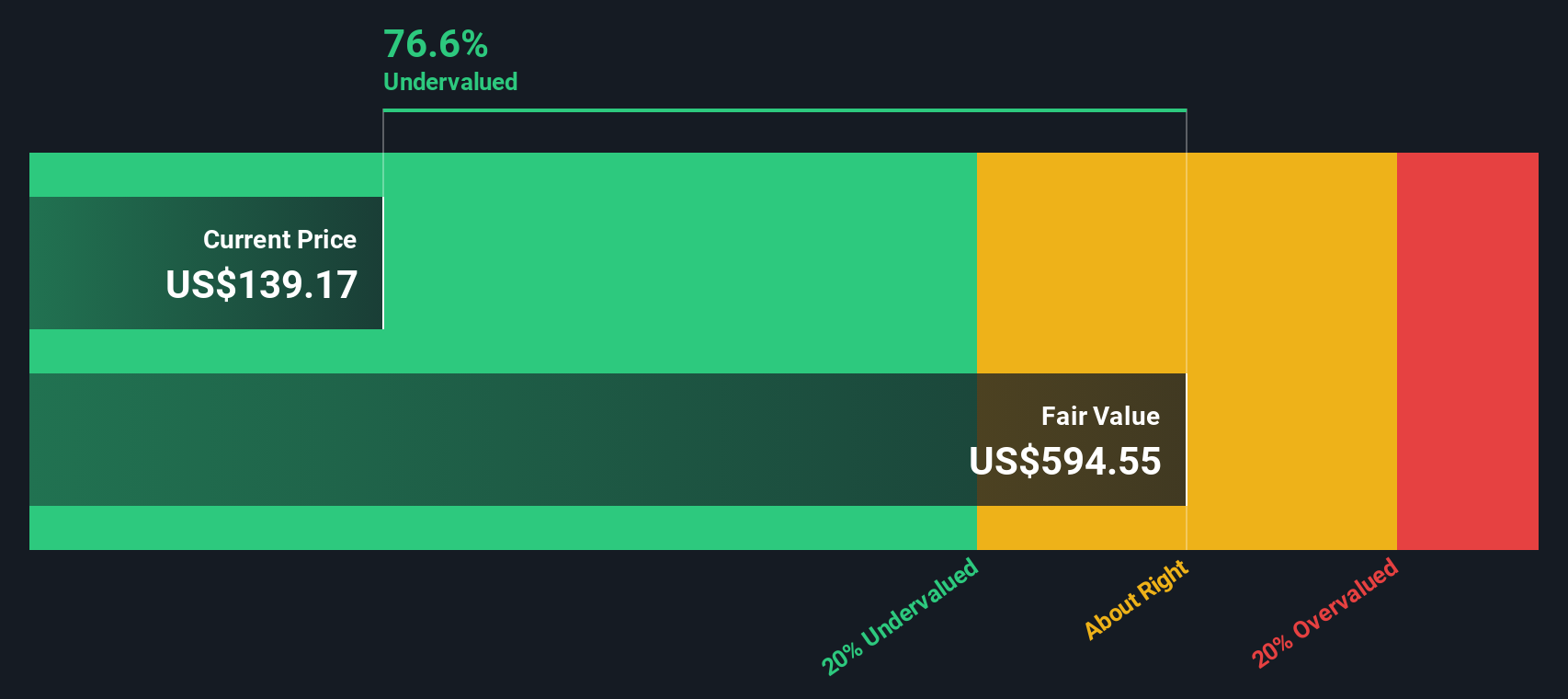

- Our valuation check gives Toll Brothers an impressive score of 5 out of 6 for undervaluation. But how do the standard methods stack up, and could there be an even better way to judge its value? Here is a closer look at the numbers and what really moves the needle.

Approach 1: Toll Brothers Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting them back to present value. This method helps illustrate what the business is really worth today based on its long-term earning power, rather than just its current profits or asset values.

For Toll Brothers, the DCF analysis uses a two-stage Free Cash Flow to Equity model. According to the most recent data, Toll Brothers generated $920 million in free cash flow over the last twelve months. Analysts forecast a peak in free cash flow at around $1.83 billion in 2026, with projected figures thereafter gradually declining to $1.26 billion by 2035. It is important to note that these later projections are extrapolated by Simply Wall St beyond what analysts traditionally estimate.

After discounting all these future cash flows to today’s dollars, the intrinsic value of Toll Brothers comes out to approximately $192.75 per share. Based on the current market price, this represents an implied discount of 30.7 percent, suggesting the stock is trading noticeably below what the underlying business may be worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Toll Brothers is undervalued by 30.7%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Toll Brothers Price vs Earnings

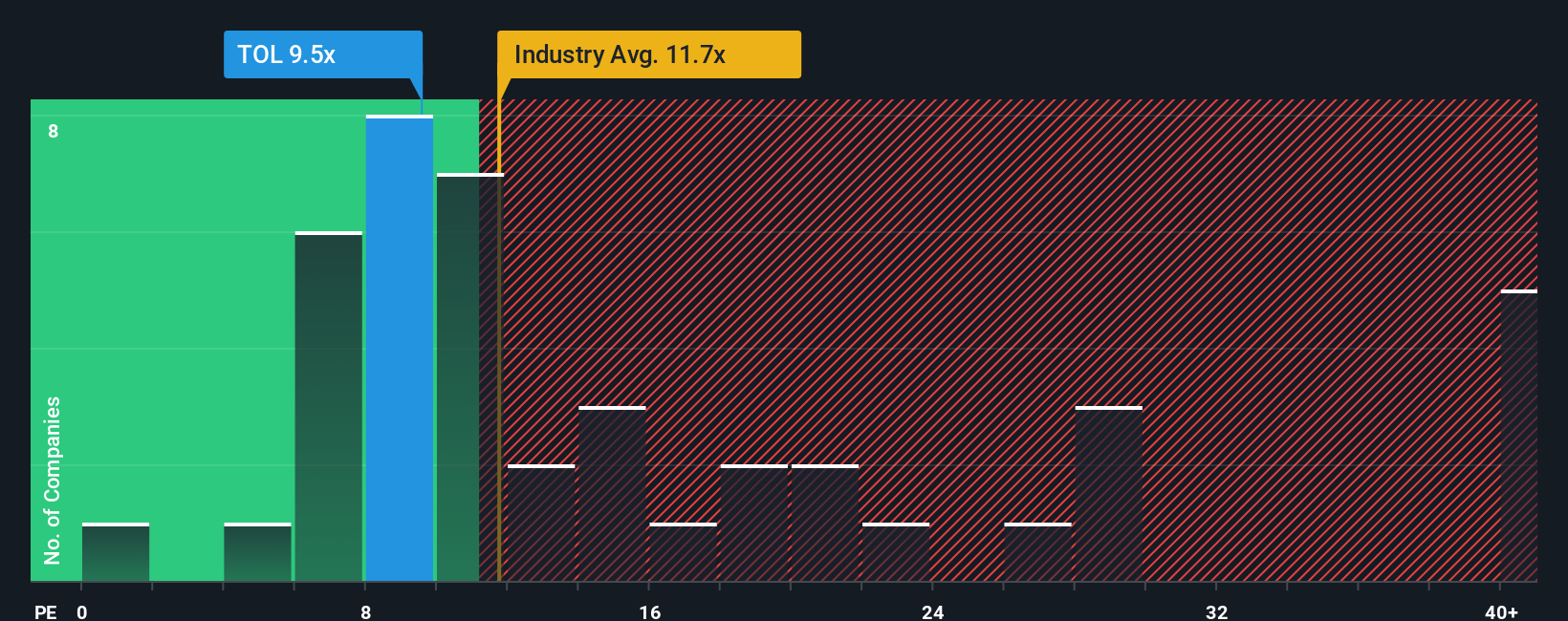

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Toll Brothers because it expresses how much investors are willing to pay for each dollar of earnings. For mature, consistently profitable businesses, the PE ratio can provide a quick and relevant snapshot of market expectations versus the company's underlying performance.

Determining what constitutes a “normal” or “fair” PE multiple depends largely on expectations for a company's future growth as well as perceived risks. Companies with stronger growth prospects or lower risk profiles tend to justify higher PE ratios, while those facing headwinds or uncertainties may trade at lower multiples.

Toll Brothers currently trades at a PE multiple of 9.4x. This is below the Consumer Durables industry average of 10.9x and well under the peer average of 17.5x, making it look attractively priced at first glance. However, these benchmarks do not always factor in company-specific factors that matter to individual investors.

This is where Simply Wall St's Fair Ratio comes in. Unlike simple industry or peer comparisons, the Fair Ratio for Toll Brothers, calculated at 14.8x, is designed to reflect the company's unique expectations for earnings growth, profit margins, industry positioning, market cap, and risk profile. This makes it a more insightful benchmark for assessing valuation.

Comparing the Fair Ratio of 14.8x with the current PE ratio of 9.4x, Toll Brothers looks considerably undervalued using this approach, suggesting room for upside as the market recognizes its true earning power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

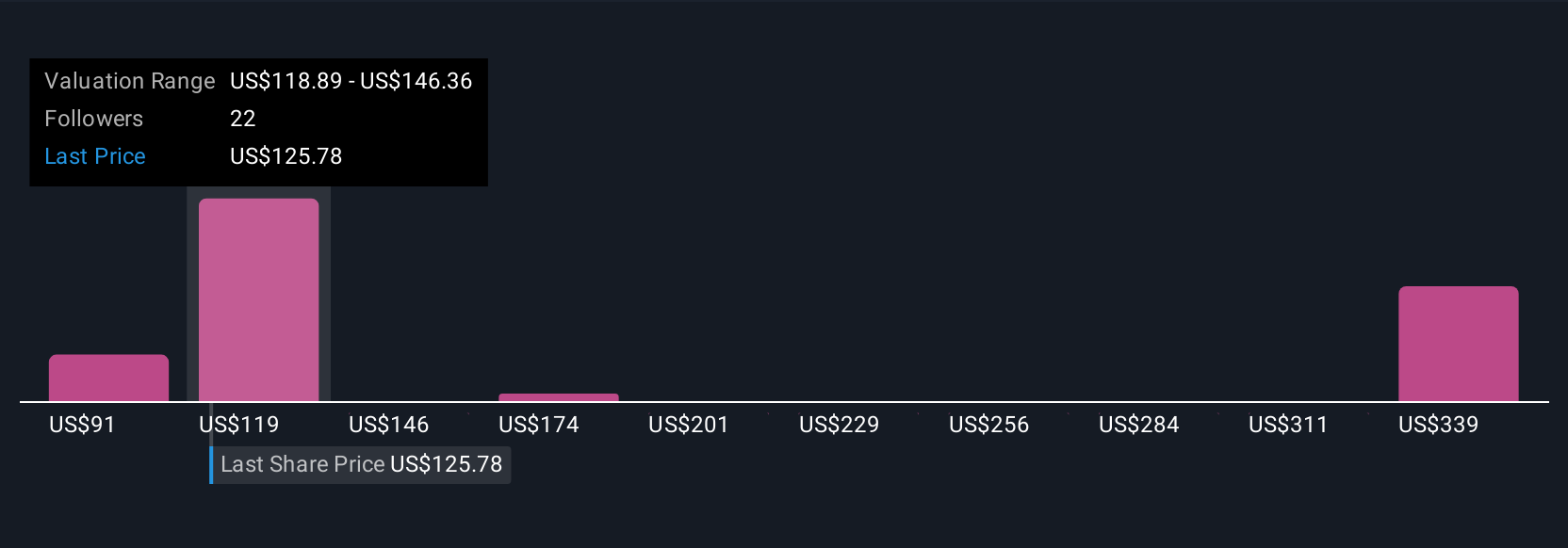

Upgrade Your Decision Making: Choose your Toll Brothers Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a story you create to explain your perspective on a company like Toll Brothers, backing up your viewpoint with numbers such as your own estimates for future revenue, earnings, and margins. This approach then connects to a fair value for the stock.

Rather than relying only on standard ratios or consensus estimates, Narratives let you see the “why” behind the numbers. They link a company’s unique story, its financial forecast, and a justification for buying or selling. On Simply Wall St’s Community page, Narratives are easy to use and are updated automatically as the latest news or earnings are released, keeping your view as current and relevant as possible.

Comparing your Narrative’s Fair Value with the current share price makes it clear when to act. For example, some investors believe Toll Brothers’ expansion into luxury communities and surging demand from younger affluent buyers justify a bull case price of $183. Others focus on spec home risk and margin pressure, estimating a more cautious fair value as low as $92.

Do you think there's more to the story for Toll Brothers? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toll Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOL

Toll Brothers

Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives