- United States

- /

- Consumer Durables

- /

- NYSE:TOL

Does Toll Brothers’ (TOL) Surge in Luxury Community Launches Signal Lasting Strength in Premium Housing?

Reviewed by Sasha Jovanovic

- In recent days, Toll Brothers has announced the launch of several new luxury home communities and phases across key markets in Florida, Georgia, Nevada, North Carolina, Connecticut, Colorado, and Washington, reporting strong sales momentum and rapid sell-through in some locations.

- This wave of openings and robust demand highlights Toll Brothers’ continued expansion in premium housing markets, reflecting the company's emphasis on resort-style amenities, personalization options, and affluent buyer appeal across diverse regions.

- We'll examine how the company's accelerated luxury community launches and high sales velocity impact Toll Brothers' broader investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Toll Brothers Investment Narrative Recap

Owning Toll Brothers shares means believing in the strength of affluent homebuyer demand and the company’s ability to expand in high-end, supply-constrained markets. While the company’s steady rollout of new luxury communities, including the recent launches in Florida, Georgia, and Nevada, reflects growth ambitions, the announcements themselves do not appear to materially shift the short-term catalyst of market absorption or alter the most pressing risk: dependence on spec home construction amid a highly competitive environment.

Of the recent announcements, the rapid sales momentum and launch of the Sebastian Landing waterfront community in St. Augustine, Florida, is especially relevant. Its price points and exclusive amenities speak directly to the company’s strategy to capture affluent buyers, an important piece in driving top-line growth, but one that heightens exposure to margin risk if incentives or discounts must rise in weaker demand periods.

By contrast, investors should be acutely aware of the rising share of spec homes in Toll Brothers’ delivery mix because if demand softens...

Read the full narrative on Toll Brothers (it's free!)

Toll Brothers' outlook anticipates $13.1 billion in revenue and $1.7 billion in earnings by 2028. This is based on a projected 6.3% annual revenue growth and a $0.3 billion increase in earnings from the current $1.4 billion.

Uncover how Toll Brothers' forecasts yield a $149.94 fair value, a 14% upside to its current price.

Exploring Other Perspectives

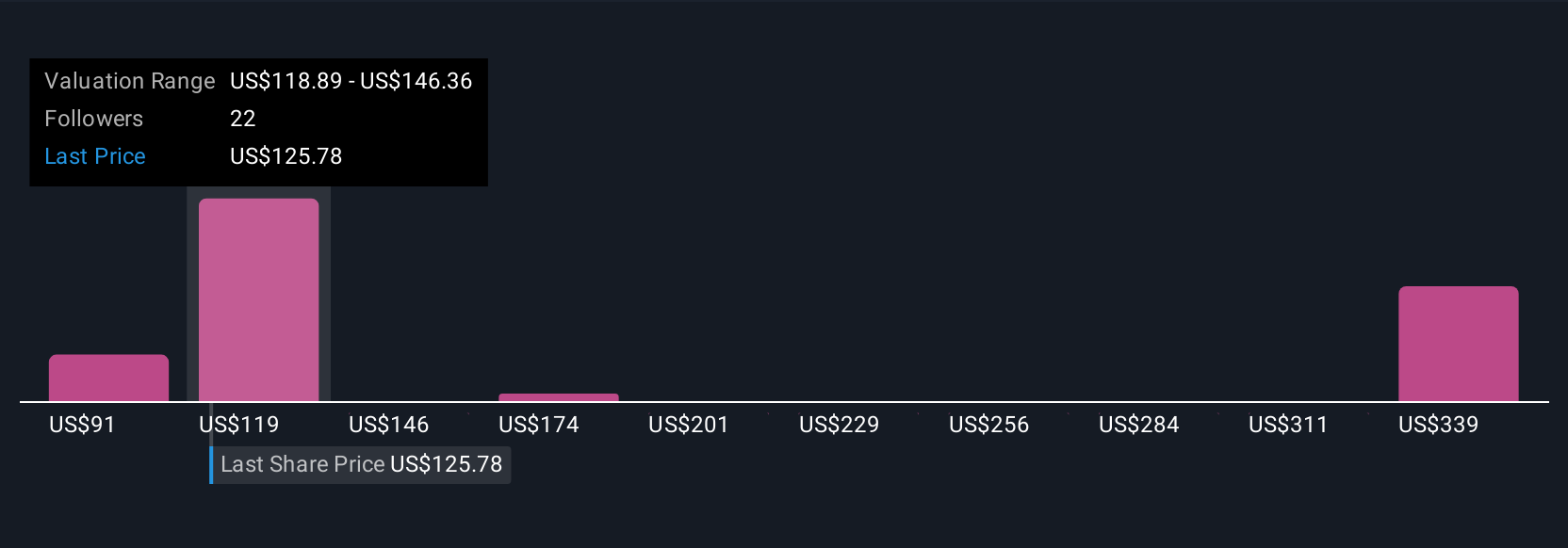

Ten fair value estimates from the Simply Wall St Community span US$91.41 to US$191.06 per share, capturing a broad range of expectations among retail investors. As optimism builds on community count expansion, the biggest question remains how Toll Brothers will manage margin risks if incentives keep rising and demand cools; explore other views and see which resonates with your outlook.

Explore 10 other fair value estimates on Toll Brothers - why the stock might be worth 31% less than the current price!

Build Your Own Toll Brothers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toll Brothers research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Toll Brothers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toll Brothers' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toll Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOL

Toll Brothers

Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives