- United States

- /

- Consumer Durables

- /

- NYSE:SKY

Champion Homes (SKY) Valuation in Focus as Competitive Pressures Weigh on Growth Prospects

Reviewed by Kshitija Bhandaru

Champion Homes (NYSE:SKY) has caught investor attention lately as fresh analysis points to slowing revenue growth and shrinking profitability, mainly linked to stiffer competition. The latest sentiment indicates that financial and competitive pressures have become top concerns for shareholders.

See our latest analysis for Champion Homes.

Despite a recent earnings announcement on the horizon, Champion Homes has struggled to regain momentum. Its latest share price rally, up over 17% in the past week, is still overshadowed by a 12% year-to-date decline and a disappointing 24% drop in total shareholder return over twelve months. While the five-year total return is impressive, recent competitive challenges have investors weighing whether this is a dip worth buying or a sign of shifting long-term prospects.

If market shifts like these have you wondering what else is out there, now’s the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With valuation metrics hovering near analyst targets and profitability growth slowing, the key question is whether Champion Homes is currently trading at a bargain or if the market has already accounted for all future upside.

Most Popular Narrative: 8.6% Undervalued

Champion Homes’ most widely tracked narrative puts the company’s fair value at $82.83, which stands notably above the last close of $75.67. This creates a gap that has investors watching closely as fundamental shifts in the manufactured housing sector play out.

Increasing national focus on housing affordability and supportive policy momentum, such as the bipartisan advancement of the ROAD to Housing Act, is expected to drive structural, long-term demand for manufactured homes. This would directly benefit Champion's volumes and revenue growth in coming years. Accelerating shifts among first-time buyers and traditional homeowners toward affordable, high-quality off-site construction, supported by targeted marketing and product innovation, should expand Champion's customer base and support sustainable top-line growth.

Curious what bold assumptions lift Champion Homes above market worries? The growth forecast is not based on wishful thinking. A key to this valuation is a delicate interplay of margin resilience, revenue momentum, and a profit multiple that suggests new confidence in this sector. The full narrative reveals what numbers drive these projections and what could tip the balance.

Result: Fair Value of $82.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softening demand in key sales channels and rising material costs could present challenges for both Champion Homes’ revenue growth and its margin outlook going forward.

Find out about the key risks to this Champion Homes narrative.

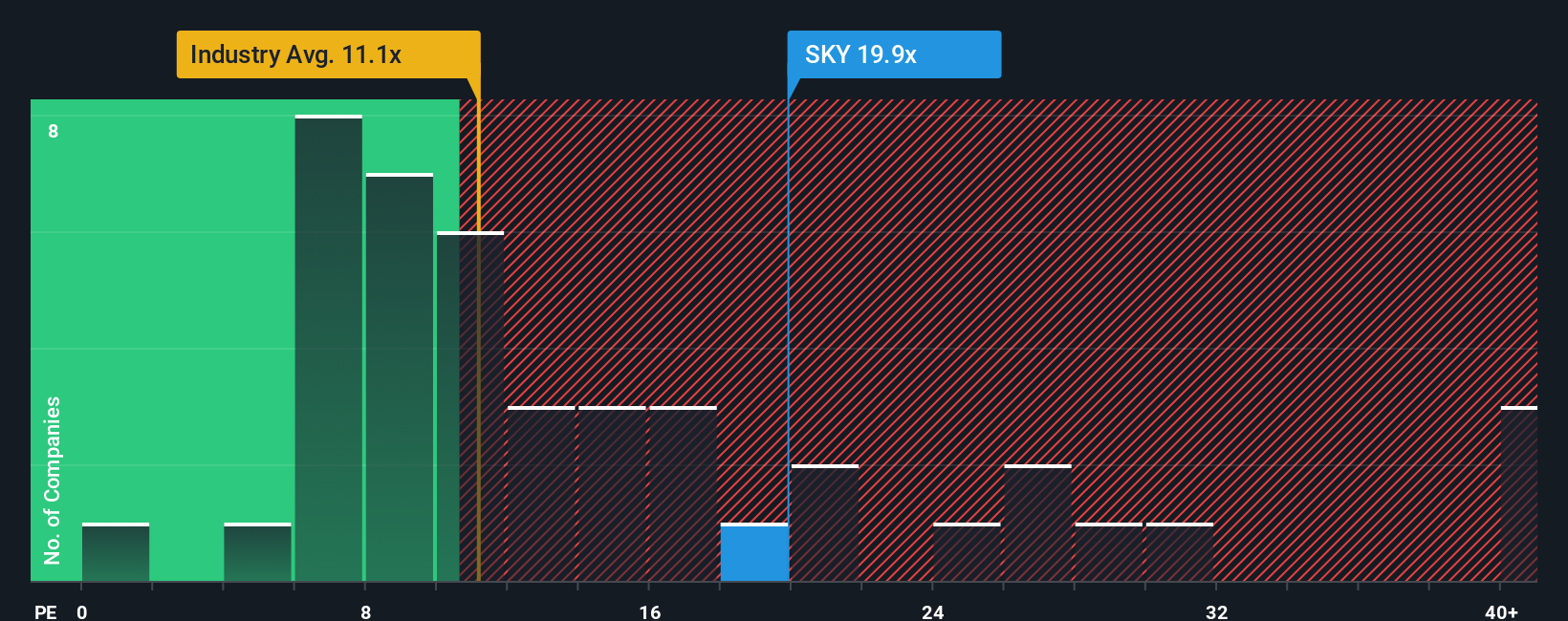

Another View: Expensive by Earnings Multiple

Taking a look through the lens of price-to-earnings, Champion Homes is valued at 19.7x earnings, noticeably higher than both the industry average of 10.2x and its peer group at 11.5x. Compared to a fair ratio of 14.9x, the stock appears expensive, suggesting less margin for error if growth slows. Does this signal caution for value-seekers, or is the market anticipating more upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Champion Homes Narrative

Prefer to map your own path or see things differently? You can dive in and build your personal take on Champion Homes in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Champion Homes.

Looking for More Investment Ideas?

Your next smart move could be just a click away. Don’t settle for a single opportunity when there is a world of promising stocks to consider. Expand your research now and give your portfolio a powerful edge.

- Tap into growth potential with these 878 undervalued stocks based on cash flows, where solid fundamentals meet attractive pricing for investors who value true bargains.

- Accelerate your returns by following the momentum of AI innovations. See the leaders behind global disruption through these 24 AI penny stocks.

- Jump on financial stability and consistent yield by accessing these 18 dividend stocks with yields > 3% and uncovering companies rewarding shareholders with robust dividends above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKY

Champion Homes

Produces and sells factory-built housing in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives