- United States

- /

- Consumer Durables

- /

- NYSE:SKY

Champion Homes (SKY): Assessing Valuation Following Strong Earnings and Robust Share Buybacks

Reviewed by Simply Wall St

Champion Homes (NYSE:SKY) delivered higher sales and net income in the second quarter, backed by a steady share repurchase program. These moves say a lot about how management is steering the business this year.

See our latest analysis for Champion Homes.

Shares of Champion Homes have rebounded strongly in the past month, with a 14.6% gain in the share price, even after a dip earlier this year. While recent board changes and flat revenue guidance signal some transition, momentum appears to be picking up again. For longer-term investors, the three-year total shareholder return of nearly 65% still stands out, despite a challenging 16% total return over the past year.

If you’re eyeing what else is gaining traction in the market, it might be the perfect time to broaden your scope and discover fast growing stocks with high insider ownership

With recent gains, robust buybacks, and strengthening earnings, is Champion Homes’ current valuation underappreciating its momentum? Or has the market already priced in the company’s next stage of growth?

Most Popular Narrative: 3.9% Undervalued

With the most widely followed narrative placing fair value at $84.67, Champion Homes’ recent close of $81.39 sits just below that consensus. The market is showing some optimism, and the following expert insight offers a window into the thinking behind this calculation.

Strategic expansion into high-margin multifamily and commercial modular segments, alongside the recent Iseman Homes acquisition and continued integration synergies, positions Champion to structurally improve net margins and drive earnings growth over time. Broader adoption of off-site construction solutions among builders and developers, along with growing builder/developer pipelines, increases Champion's share of a diversifying addressable market, supporting revenue and market share gains.

This narrative is built on more than short-term trends. Craving a look at what fuels that premium? The bullish case hinges on ambitious growth plans, earnings targets, and a profit profile many in the sector may envy. Want to pinpoint the exact assumptions that drive this price target higher? The secret is in the details. Uncover what numbers helped tip the scales in favor of Champion's upside potential.

Result: Fair Value of $84.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing order rates and renewed material cost inflation could cloud Champion Homes’ near-term outlook, which may challenge assumptions behind the bullish valuation narrative.

Find out about the key risks to this Champion Homes narrative.

Another View: What Do Market Multiples Say?

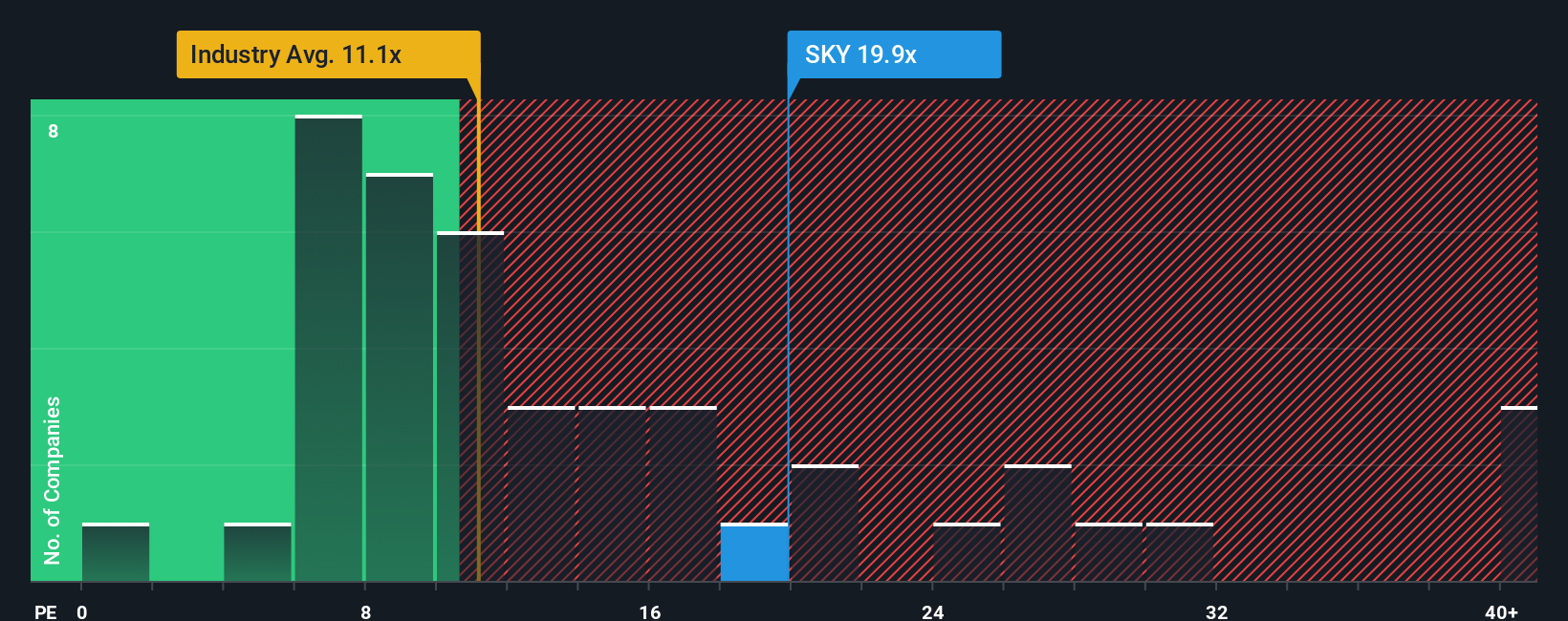

Looking through a different lens, Champion Homes trades at a price-to-earnings ratio of 20.6x, which looks steep next to both peer companies (11.3x) and the industry average (10.5x). Even compared to its fair ratio of 13.1x, the stock appears expensive, which could signal caution ahead if the market shifts its view. What if the optimism surrounding growth fades? Will the valuation premium hold up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Champion Homes Narrative

If you have a different take or want to build your own perspective, you can dig into the data and compose a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Champion Homes.

Looking for More Spark in Your Portfolio?

Smart investors seize fresh opportunities before the crowd moves in. Don’t overlook game-changers and market movers beyond Champion Homes; your next winner could be just a click away.

- Capture consistent income by scanning these 16 dividend stocks with yields > 3% offering yields above 3%. This approach can be useful for strengthening your cash flow.

- Stay ahead of the curve with these 25 AI penny stocks as artificial intelligence fuels a new era of market leaders and disruptors.

- Position yourself for growth by targeting these 878 undervalued stocks based on cash flows with solid fundamentals and room to run.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKY

Champion Homes

Produces and sells factory-built housing in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives