- United States

- /

- Consumer Durables

- /

- NYSE:SKY

Champion Homes (SKY): Assessing Valuation Following Sector-Wide Weakness from Homebuilder Peers

Reviewed by Simply Wall St

Champion Homes, a leading modular home builder, saw its stock dip after sector rivals NVR and M/I Homes reported lackluster quarterly results. Broader housing market headwinds, especially high mortgage rates, are fueling cautious investor sentiment across the industry.

See our latest analysis for Champion Homes.

With shares recently sliding after an industry-wide reaction to weak peer results, Champion Homes is navigating familiar homebuilding headwinds. The company’s 17.5% 90-day share price return stands out compared to a subdued year-to-date performance. Its impressive 198% five-year total shareholder return signals lasting strength even as current sector sentiment remains cautious.

If you’re eyeing what else might be gathering momentum in the homebuilding space, now could be the right time to discover See the full list for free.

With recent declines shaking out some optimism, is Champion Homes now presenting an undervalued opportunity, or is the market already factoring in the company’s future growth prospects?

Most Popular Narrative: 7.7% Undervalued

With Champion Homes closing at $76.45 and the narrative assigning a fair value of $82.83, bulls argue there’s still headroom if key industry catalysts play out. The narrative’s quantitative case leans on structural drivers that could set the stage for expansion beyond recent market turbulence.

“Strengthening demand and policy support for affordable off-site housing, coupled with product innovation, expand Champion's market reach and support sustained revenue growth. Strategic expansion, acquisitions, and operational efficiencies position Champion for margin improvement and long-term earnings growth in a diversifying market.”

Curious why this homebuilder’s valuation hinges on macro policy shifts and a transformational approach to margins? The fair value calculation rides on a blend of high-impact growth levers and ambitious future profitability assumptions. Could these be the numbers that disrupt expectations?

Result: Fair Value of $82.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing demand and ongoing material cost pressures could challenge the optimistic outlook and test Champion Homes’ ability to meet analyst expectations.

Find out about the key risks to this Champion Homes narrative.

Another View: What Do Multiples Say?

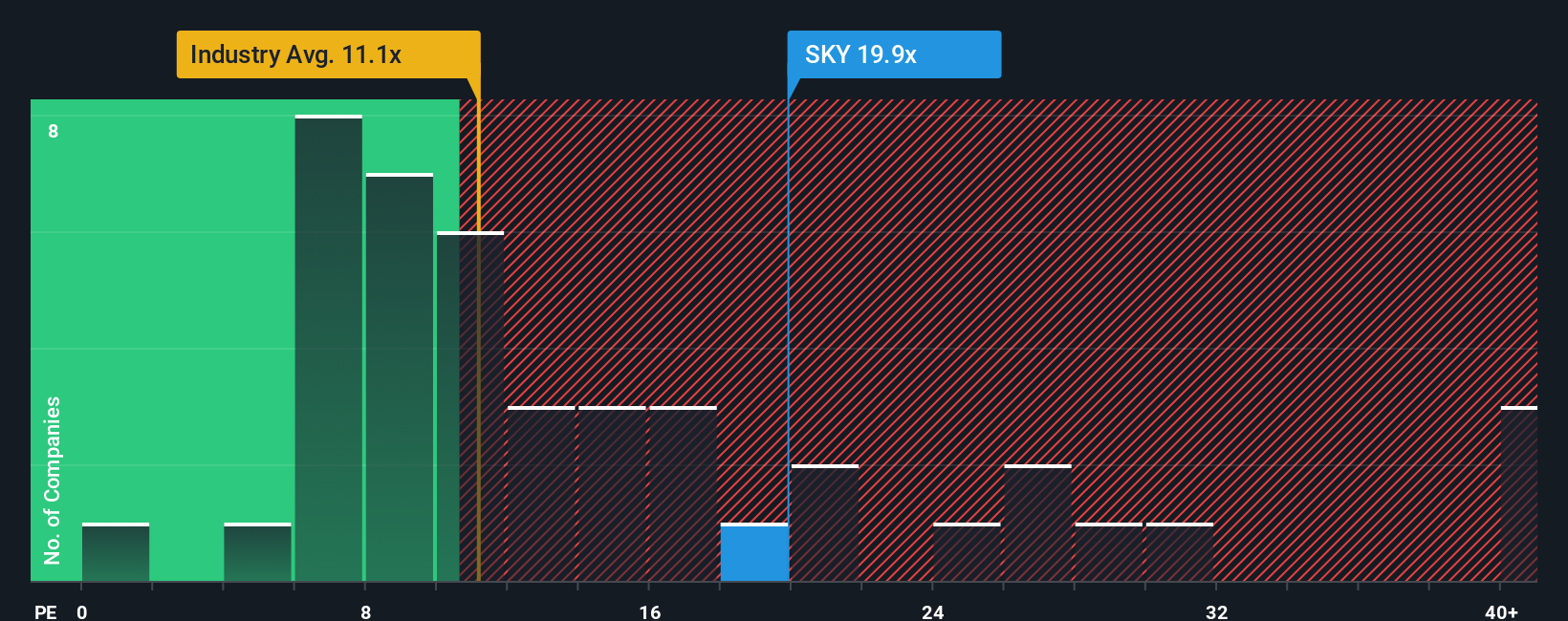

Looking at where Champion Homes trades relative to earnings, the stock’s price-to-earnings ratio of 19.9 is meaningfully higher than peers (12x) and the US Consumer Durables sector average (10.6x). It also sits well above the fair ratio of 15. This suggests investors might be paying a premium for future growth. Does this mark an opportunity or just increase downside risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Champion Homes Narrative

If you see the data differently or want to craft your own perspective, it's quick and easy to develop your own in just a few minutes. Why not Do it your way?

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Champion Homes.

Looking for more investment ideas?

Smart investors look beyond the obvious. Give yourself an edge and spot tomorrow’s trends early by checking out these powerful opportunities from the Simply Wall Street Screener:

- Accelerate your portfolio with high-yield opportunities by tapping into these 17 dividend stocks with yields > 3%, which offers strong returns and steady income streams.

- Tap into the future of healthcare by reviewing these 33 healthcare AI stocks, featuring companies driving medical breakthroughs with artificial intelligence.

- Catch under-the-radar innovators on the rise as you scan through these 3566 penny stocks with strong financials, carefully selected for strong financials and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKY

Champion Homes

Produces and sells factory-built housing in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives