- United States

- /

- Consumer Durables

- /

- NYSE:SGI

A Closer Look at Somnigroup International’s (SGI) Valuation Following Q2 Earnings and Strategic Moves

Reviewed by Kshitija Bhandaru

If you have been tracking Somnigroup International (NYSE:SGI), the latest move in the stock could have you wondering what’s next. The company just reported its Q2 earnings, showing the fastest revenue growth among its home furnishings peers, thanks to its acquisition of Mattress Firm and the debut of a new product line. The market clearly responded to this blend of strategic moves and operational growth, boosting optimism about where SGI might be heading from here.

This bullish sentiment is not new to Somnigroup International shareholders. The company’s share price is up 27% over the past quarter, capping off a year in which the stock gained nearly 57%. Add in strong revenue growth for the year and a string of new initiatives, and it is clear that momentum has been building, not fading, especially as the broader sector also moved higher in response to solid earnings.

With the share price rallying so strongly, investors now face a fresh question: is SGI still attractively valued, or is the market already pricing in future growth?

Most Popular Narrative: 1.8% Undervalued

According to the most widely followed narrative, Somnigroup International is currently trading just below its calculated fair value. Analysts see the recent growth and strategic initiatives as supporting a modest undervaluation at current prices.

“Strong and sustained growth in international markets, driven by both product innovation and expanded distribution, is broadening Somnigroup's revenue base and lessening dependence on mature markets. This supports higher, more resilient long-term revenue growth. Investments in differentiated sleep technologies, such as the expanded partnership with Fullpower for exclusive Sleeptracker AI integration, position Somnigroup to capitalize on the accelerating consumer focus on health, wellness, and sleep quality. This is fueling premium product adoption and supporting both revenue and gross margin expansion.”

Curious about what is really powering this fair value call? It is not just about topline growth or recent deals. There is a secret playbook of aggressive profit forecasts, ambitious margin targets, and a future profit multiple more common among growth icons than sleepy mattress makers. Ready to discover which numbers are shaping these analyst price targets? The full narrative holds the jaw-dropping financial assumptions that every investor wants to know.

Result: Fair Value of $85.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high input costs and rapidly changing consumer preferences could quickly derail these upbeat forecasts, which challenges Somnigroup International’s growth outlook.

Find out about the key risks to this Somnigroup International narrative.Another View: Looking Through a Different Lens

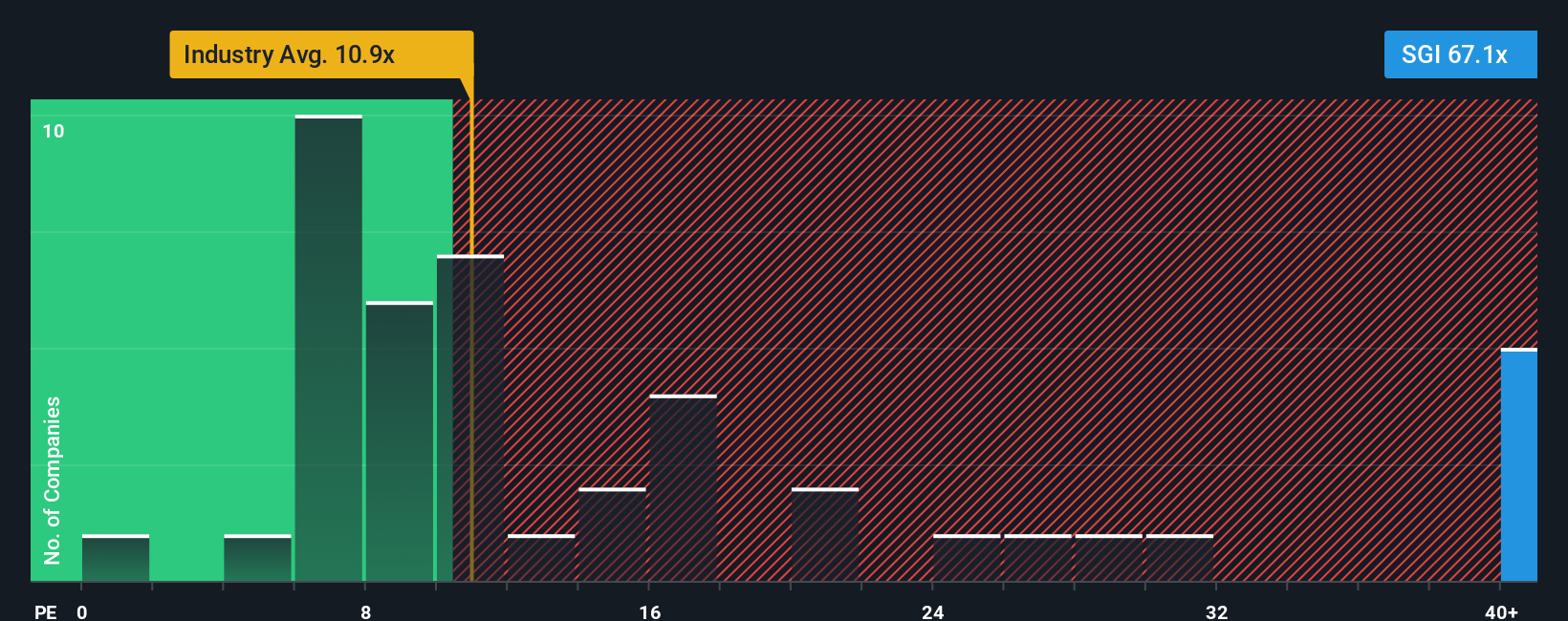

From another angle, a quick glance at Somnigroup International’s valuation against the industry using earnings tells a different story. By this measure, the stock actually looks expensive compared to its sector peers. Which valuation would you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Somnigroup International to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Somnigroup International Narrative

If you are not convinced by these perspectives or want to see how the numbers stack up for yourself, you can build your own take in just a few minutes with Do it your way.

A great starting point for your Somnigroup International research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop with Somnigroup International when there are smart opportunities waiting across the market? Use these curated strategies to identify your next potential winner before the crowd catches on.

- Uncover fast-growing businesses with disruptive tech by jumping into AI penny stocks, which are reshaping tomorrow’s industries through artificial intelligence breakthroughs.

- Secure reliable income streams and stability when you browse dividend stocks with yields > 3%, which consistently deliver yields above 3% year after year.

- Catch hidden value opportunities others miss by hunting for undervalued stocks based on cash flows, which are poised for a re-rating based on robust cash flows and sound fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SGI

Somnigroup International

Designs, manufactures, distributes, and retails bedding products in the United States and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives