- United States

- /

- Luxury

- /

- NYSE:RL

What Ralph Lauren (RL)'s Renewed Olympic Partnership and Team USA Collection Means For Shareholders

Reviewed by Sasha Jovanovic

- Ralph Lauren recently unveiled Team USA’s Opening and Closing Ceremony uniforms for the Milano Cortina 2026 Winter Games, marking its 10th consecutive Olympics as official outfitter, alongside launching a purchasable Team USA Collection across select U.S. and Italian retail and online channels.

- By deepening its Olympic partnership and rolling out limited-edition, globally distributed Team USA merchandise, Ralph Lauren is reinforcing its global lifestyle branding and creating fresh touchpoints with highly engaged sports fans.

- Next, we’ll examine how Ralph Lauren’s renewed Olympic spotlight and Team USA collection may influence its investment narrative and growth drivers.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ralph Lauren Investment Narrative Recap

To own Ralph Lauren, you need to believe in the durability of its global luxury lifestyle brand and its ability to keep growing earnings despite macro uncertainty and tariff pressures. The renewed Olympic spotlight and Team USA collection help brand heat and near term demand, but do not materially change the key short term catalyst, which remains execution on margin expansion, or the main risk around consumer price sensitivity and potential markdowns if demand softens.

Among recent developments, upward earnings estimate revisions and a positive Zacks Rank point to constructive sentiment around Ralph Lauren’s near term performance, which ties directly into how effectively the company converts brand moments like the Olympics into sustained revenue and margin resilience. This sits alongside management’s own guidance for mid single digit constant currency revenue growth, which still needs to be delivered against a more uncertain backdrop in Europe and wholesale.

Yet beneath the Olympic buzz, investors should be aware that rising inventories and potential markdown risk could...

Read the full narrative on Ralph Lauren (it's free!)

Ralph Lauren's narrative projects $8.4 billion revenue and $1.0 billion earnings by 2028.

Uncover how Ralph Lauren's forecasts yield a $366.75 fair value, in line with its current price.

Exploring Other Perspectives

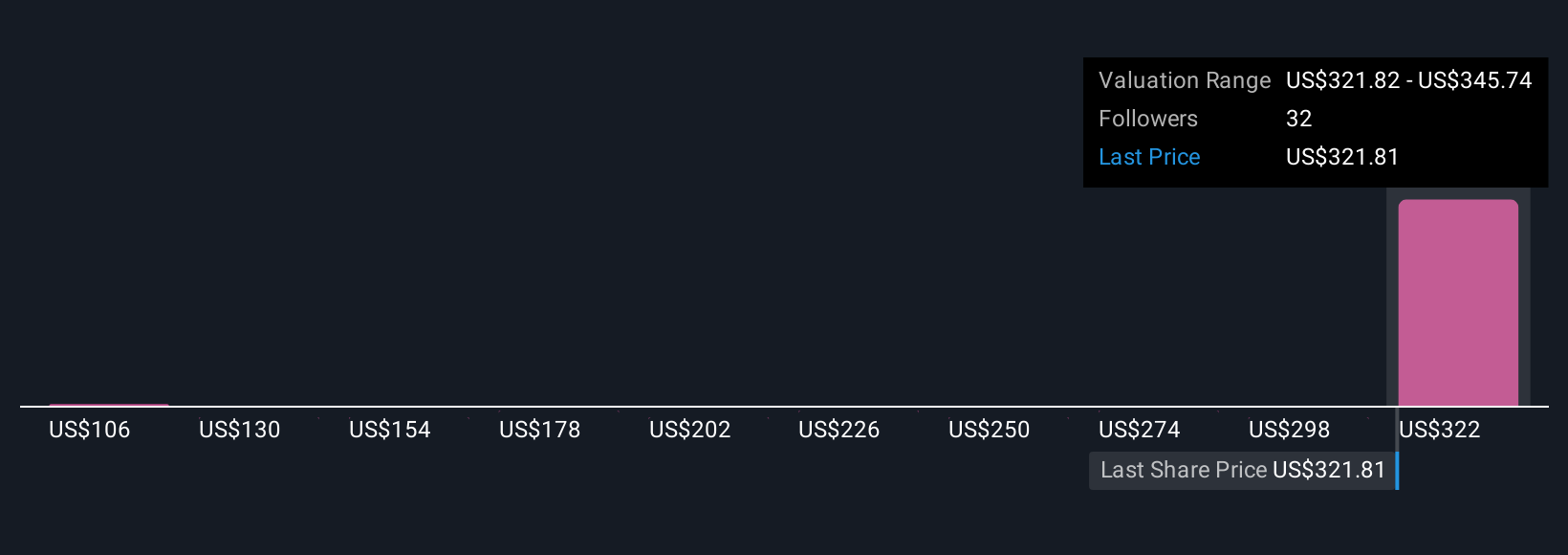

Seven members of the Simply Wall St Community currently value Ralph Lauren between US$106 and US$367 per share, showing a wide spread of expectations. You can set those views against concerns about slower European growth and see how different investors weigh potential brand driven upside against macro and pricing risk.

Explore 7 other fair value estimates on Ralph Lauren - why the stock might be worth as much as $366.75!

Build Your Own Ralph Lauren Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ralph Lauren research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ralph Lauren research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ralph Lauren's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026