- United States

- /

- Luxury

- /

- NYSE:RL

Ralph Lauren (RL): Examining Valuation After 66% Shareholder Return This Year

Reviewed by Kshitija Bhandaru

See our latest analysis for Ralph Lauren.

Backed by improving fundamentals, Ralph Lauren’s share price has picked up solid momentum this year, with a 1-year total shareholder return of nearly 66%. That surge reflects investors’ renewed enthusiasm for stable, steadily expanding brands. It follows recent earnings strength that has boosted sentiment after a quieter patch.

If you’re interested in what else is gaining traction right now, it could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

The big question now, with RL shares up and projections positive, is whether the rally has left the stock undervalued or if the market has already priced in future growth. Is this still a buying opportunity?

Most Popular Narrative: 6.9% Undervalued

Compared to the previous close of $321.81, the most widely followed narrative assigns Ralph Lauren a fair value of $345.74. With the stock trading below this fair value, the narrative presents a confident outlook for ongoing brand momentum and profitable global expansion that could support further upside.

Accelerating international expansion, especially in Asia and Greater China where sales grew over 30% and now represent 9% of company revenue (up from 3-4% a few years ago), positions Ralph Lauren to benefit from rising global wealth and middle-class growth, supporting sustained top-line revenue gains.

Want to know the quantitative assumptions that fuel this valuation? The narrative centers on big gains from Asia, a focused digital strategy, and rising profit margins. Which future milestones will determine if the analysts’ ambitious targets are reached? Open the full narrative for the metrics that back up this bullish fair value.

Result: Fair Value of $345.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as slowing European growth and potential inventory markdowns from increased stock levels could threaten the current bullish outlook for Ralph Lauren.

Find out about the key risks to this Ralph Lauren narrative.

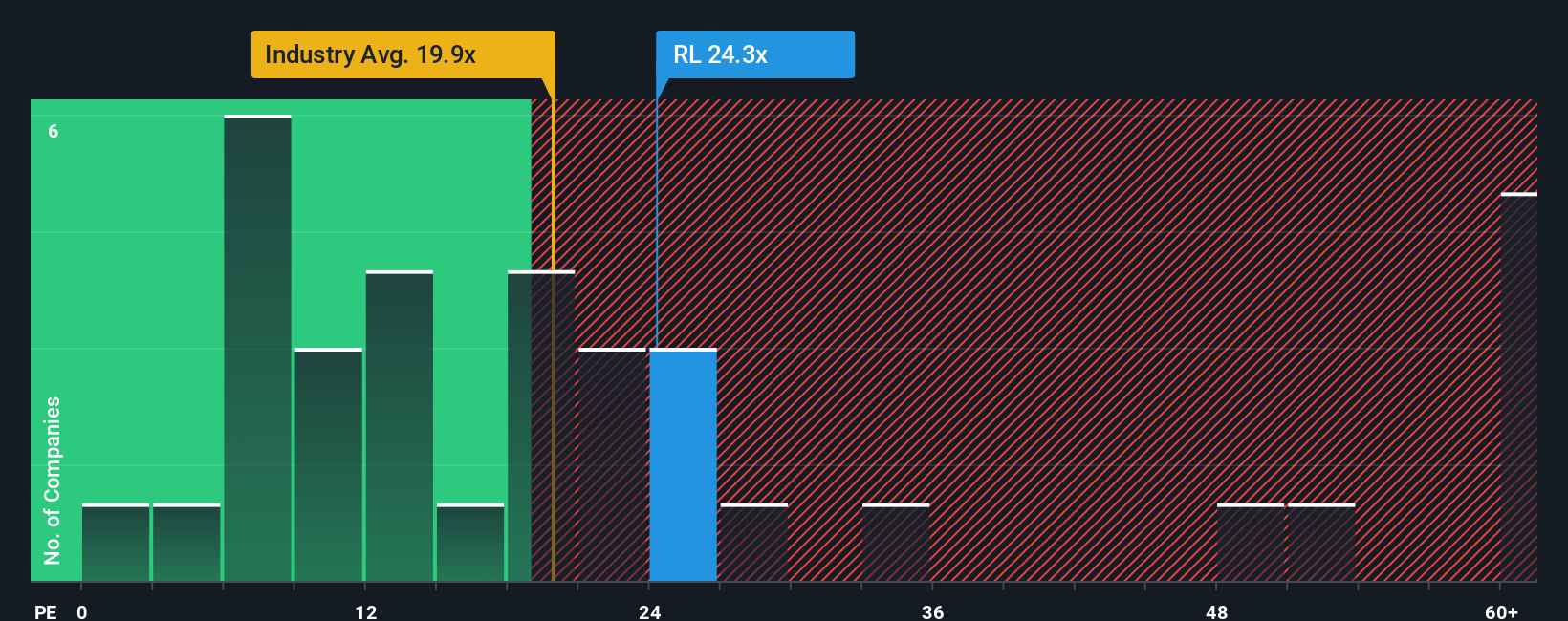

Another View: Market Multiples Signal a Different Story

While fair value estimates suggest Ralph Lauren shares are undervalued, the market’s favorite yardstick, the price-to-earnings ratio, tells a more cautious tale. RL currently trades at around 24.5 times earnings, which is higher than both the US Luxury industry average of 21.3x and the fair ratio of 19x. This suggests the stock is priced at a premium, adding a note of caution to the bull case. Will the market keep rewarding the company’s brand strength, or is there valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ralph Lauren Narrative

If you see things differently or want to dig into the details yourself, you can craft your own personalized thesis using our tools in just a few minutes. Do it your way

A great starting point for your Ralph Lauren research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let fresh opportunities pass you by. Take action now with handpicked ideas that could shape your next winning move. Some of these stocks are flying under the radar and may not stay there for long.

- Fuel your passive income goals by checking out these 19 dividend stocks with yields > 3% that consistently deliver impressive yields above 3% and steady growth potential.

- Capitalize on breakthrough disruption when you spot these 24 AI penny stocks at the forefront of artificial intelligence innovation and transformation.

- Capture value others have missed by browsing these 896 undervalued stocks based on cash flows trading below their true worth based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives