- United States

- /

- Luxury

- /

- NYSE:RL

Is Analyst Division on RL Reflecting a Deeper Question About Ralph Lauren's Growth Trajectory?

Reviewed by Sasha Jovanovic

- In recent days, Ralph Lauren has faced mixed analyst commentary, with some pointing to brand momentum and growth potential while others express concerns over underwhelming constant currency revenue performance and anticipated uneven sales growth.

- This divergent outlook underscores market uncertainty about the company’s near-term prospects, despite ongoing efforts in global brand elevation and digital expansion.

- We’ll explore how this combination of optimistic brand momentum and worries over revenue growth may influence Ralph Lauren’s investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ralph Lauren Investment Narrative Recap

To own Ralph Lauren shares today, you need to believe that the brand’s global appeal, digital transformation, and disciplined premium positioning can power consistent performance despite macro headwinds. The latest mixed analyst commentary, flagging both brand momentum and concerns over shaky revenue trends, does not materially shift the key near-term catalyst: the company’s ability to defend or expand its margins, with the biggest immediate risk being any sign of softening consumer demand amid cost pressures and revenue uncertainty.

Among recent developments, Ralph Lauren’s reaffirmation of its Fiscal 2026 guidance stands out, as it signals confidence in hitting revenue and margin targets following this period of heightened scrutiny about sales growth. The ongoing focus on international and digital expansion remains closely linked to these targets and is likely to figure prominently as results approach...

Read the full narrative on Ralph Lauren (it's free!)

Ralph Lauren's narrative projects $8.4 billion in revenue and $1.0 billion in earnings by 2028. This requires 5.0% yearly revenue growth and a $205.3 million earnings increase from $794.7 million today.

Uncover how Ralph Lauren's forecasts yield a $351.94 fair value, a 7% upside to its current price.

Exploring Other Perspectives

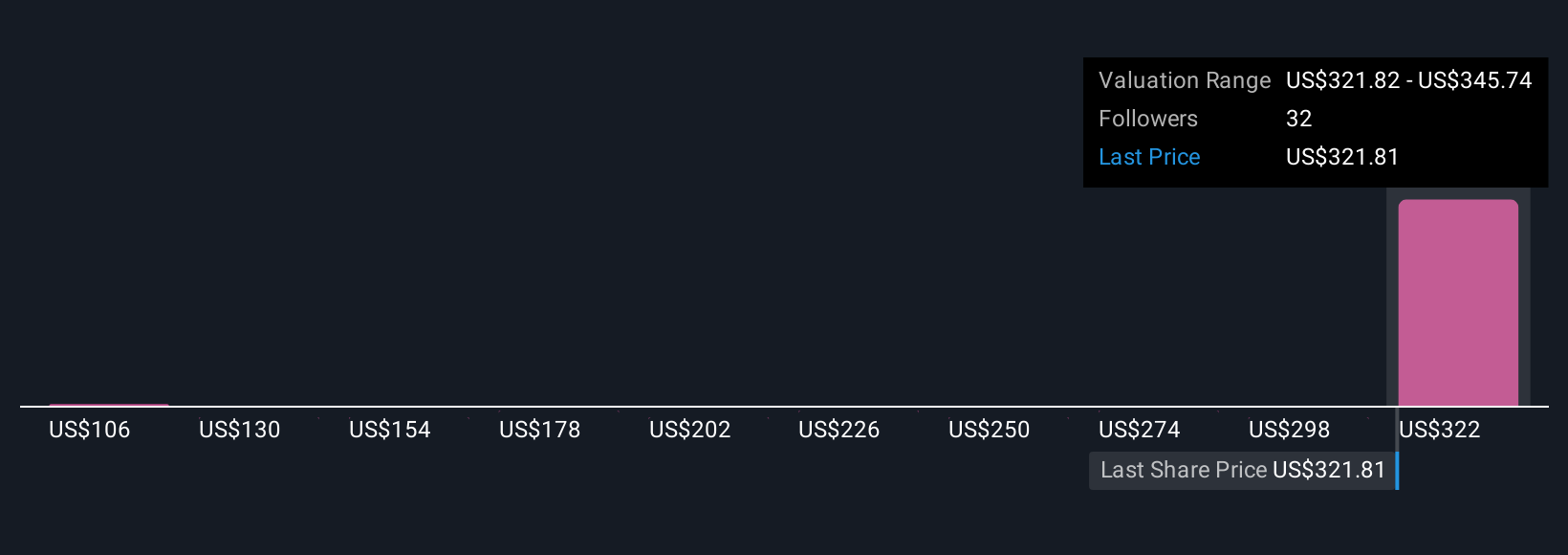

Simply Wall St Community members produced seven fair value estimates for Ralph Lauren, spanning from US$106 to nearly US$352 per share. With analyst debate now turning to revenue growth risks, it is clear that opinions about what could drive or limit the stock’s performance differ widely, see how your viewpoint compares.

Explore 7 other fair value estimates on Ralph Lauren - why the stock might be worth less than half the current price!

Build Your Own Ralph Lauren Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ralph Lauren research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ralph Lauren research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ralph Lauren's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives