- United States

- /

- Leisure

- /

- NYSE:PII

Polaris (PII): Is the Stock’s Valuation Justified After Major 2026 RZR & RANGER Redesigns?

Reviewed by Simply Wall St

Polaris (PII) just introduced a broad lineup of upgrades and special edition models for its 2026 RZR and RANGER vehicles, highlighting a dramatic redesign and advanced technology features. This strategic refresh is likely to attract off-road enthusiasts and investors alike.

See our latest analysis for Polaris.

After a stretch of mixed news, including a recent executive retirement, Polaris has captured fresh attention with this lineup overhaul. The stock's 1-month share price return of nearly 21% hints at renewed momentum after a sluggish year, even though the 1-year total shareholder return remains slightly negative. If this kind of turnaround excites you, it might be time to see what else is happening in the auto industry: discover See the full list for free.

But with shares rebounding sharply this month, the key question for investors is whether Polaris is now undervalued given its innovations and growth potential, or if markets are already pricing in a brighter future.

Most Popular Narrative: 17.9% Overvalued

Polaris's most followed valuation narrative puts its fair value at $56.73, which is over 15% below the recent close of $66.90. This sharp divergence highlights the tension between improving business conditions and what is already priced into the shares.

There is strong demand for Polaris' premium products like the Polaris XPEDITION and RANGER series, indicating potential for sales growth and higher average selling prices, positively impacting revenue. Polaris is executing on new product launches and innovations, such as the digital helm in their boating lineup, which are expected to enhance their portfolio and drive future sales growth, potentially increasing revenue.

What is fueling this bold price target? The valuation hinges on expectations for profit margins and earnings growth that could rival much larger peers. But are these ambitions realistic, or is the real story in the numbers you haven’t seen yet?

Result: Fair Value of $56.73 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff costs and weak international sales remain significant risks. These factors could potentially dampen Polaris’s recovery if these headwinds do not subside.

Find out about the key risks to this Polaris narrative.

Another View: Market Multiples Suggest Better Value

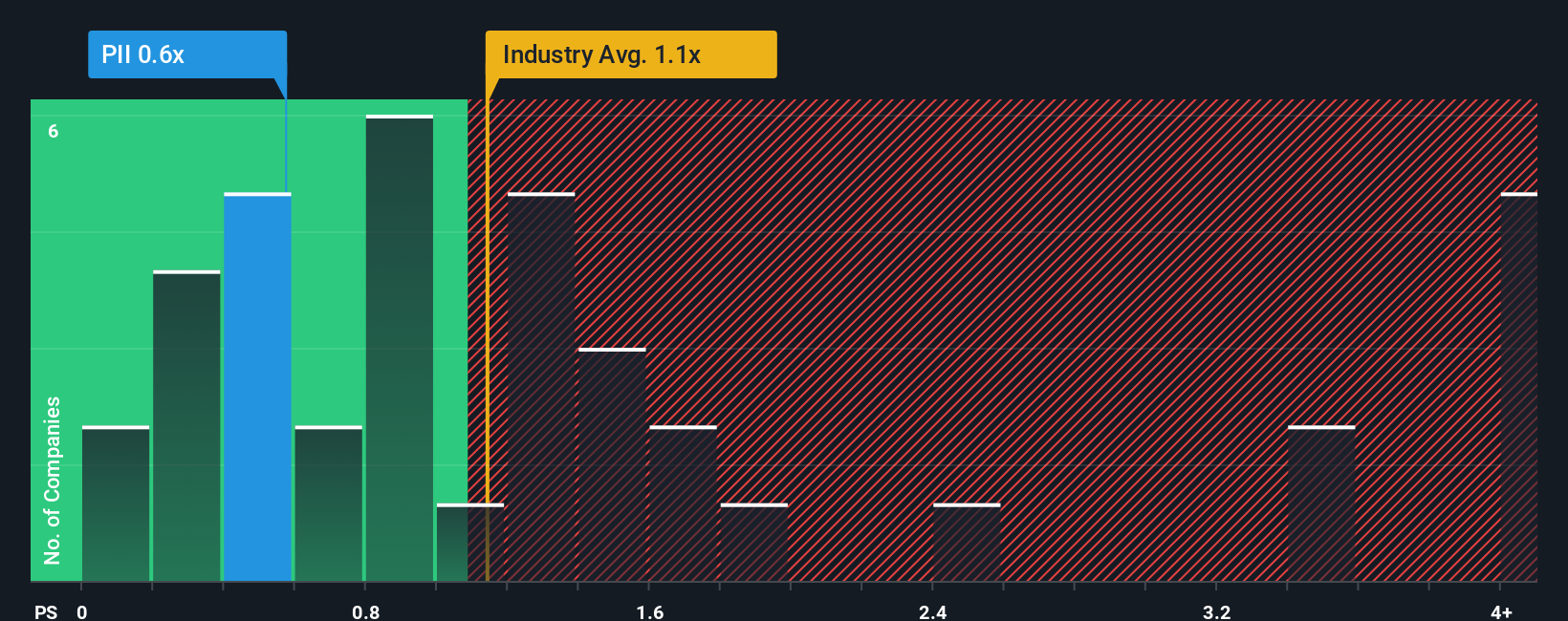

Looking beyond the analyst-driven price target, the current price-to-sales ratio puts Polaris at just 0.5x, markedly lower than both its peer average of 1.3x and the US Leisure industry at 0.9x. The fair ratio, based on market trends, would be around 0.7x. This gap hints that shares might actually be undervalued by the market’s usual standards. Does the low multiple present a real opportunity, or does it signal risk investors should respect?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Polaris Narrative

If you want to dig deeper or chart your own path, you can explore the data on Polaris and build a personalized take in just a few minutes. Do it your way

A great starting point for your Polaris research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay a step ahead. Uncover under-the-radar opportunities now. If you wait, you might just miss out on tomorrow’s breakout stars.

- Amplify your portfolio’s income potential by targeting reliable companies with compelling yields in these 17 dividend stocks with yields > 3%.

- Catch the next tech wave by tapping into these 24 AI penny stocks that are transforming everything from healthcare to logistics through AI-powered strategies.

- Capitalize on overlooked value with these 876 undervalued stocks based on cash flows that could offer attractive returns as the market corrects mispriced opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives