- United States

- /

- Consumer Durables

- /

- NYSE:PHM

What PulteGroup (PHM)'s Millennial and Gen Z Homebuyer Focus Means for Shareholders

Reviewed by Sasha Jovanovic

- In recent days, PulteGroup released a survey indicating that the majority of millennials and Gen Z are making homeownership their top priority, often making lifestyle tradeoffs to afford a home, and highlighted their efforts to support first-time buyers with targeted offerings and financing solutions.

- This consumer insight arrives as homebuilder stocks experience renewed momentum, reflecting increased optimism around sustained housing demand from younger generations.

- We'll explore how strong homeownership demand among younger buyers, as highlighted by PulteGroup's survey, could influence its forward investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

PulteGroup Investment Narrative Recap

To invest in PulteGroup, you need to believe that long-term housing demand, especially from millennials and Gen Z, can offset ongoing challenges with affordability and regional market volatility. While the new survey signals strong intent from younger buyers, the biggest short-term catalyst remains actual conversion of this demand into new orders, and the primary risk is further weakness in affordability or order growth; this news highlights sentiment, but is not yet a material change to near-term financial drivers.

One of the more interesting recent announcements is PulteGroup's launch of Del Webb Explore, a product aimed at younger buyers seeking community-oriented, resort-style living. This is directly relevant to the latest survey, aligning company initiatives with demographic trends that could support future sales if affordability improves and buyer demand becomes actionable.

At the same time, investors should be aware that persistent affordability pressures, contrasting with this optimism, pose a risk to...

Read the full narrative on PulteGroup (it's free!)

PulteGroup is forecast to reach $17.7 billion in revenue and $2.2 billion in earnings by 2028. This outlook implies a 0.0% annual revenue decline and a $0.5 billion decrease in earnings from current earnings of $2.7 billion.

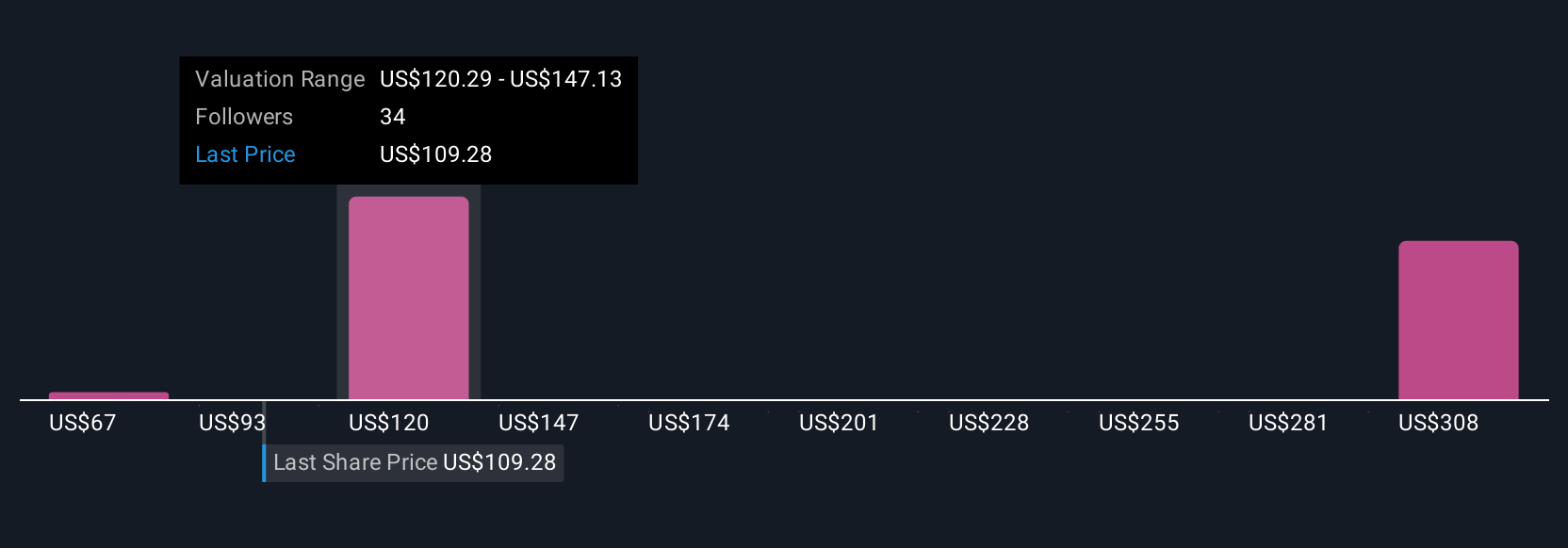

Uncover how PulteGroup's forecasts yield a $137.38 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Ten recent fair value estimates from the Simply Wall St Community range widely from US$88 to US$250 for PulteGroup. While many see opportunity in long-term housing undersupply, the wide gap in expectations shows just how differently you might weigh risks like demand volatility or regional exposure, explore a variety of viewpoints to inform your own outlook.

Explore 10 other fair value estimates on PulteGroup - why the stock might be worth 29% less than the current price!

Build Your Own PulteGroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PulteGroup research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PulteGroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PulteGroup's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHM

PulteGroup

Through its subsidiaries, engages in the homebuilding business in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives