- United States

- /

- Consumer Durables

- /

- NYSE:PHM

PulteGroup (PHM): Margin Decline Reinforces Cautious Market Narratives Despite Low Valuation

Reviewed by Simply Wall St

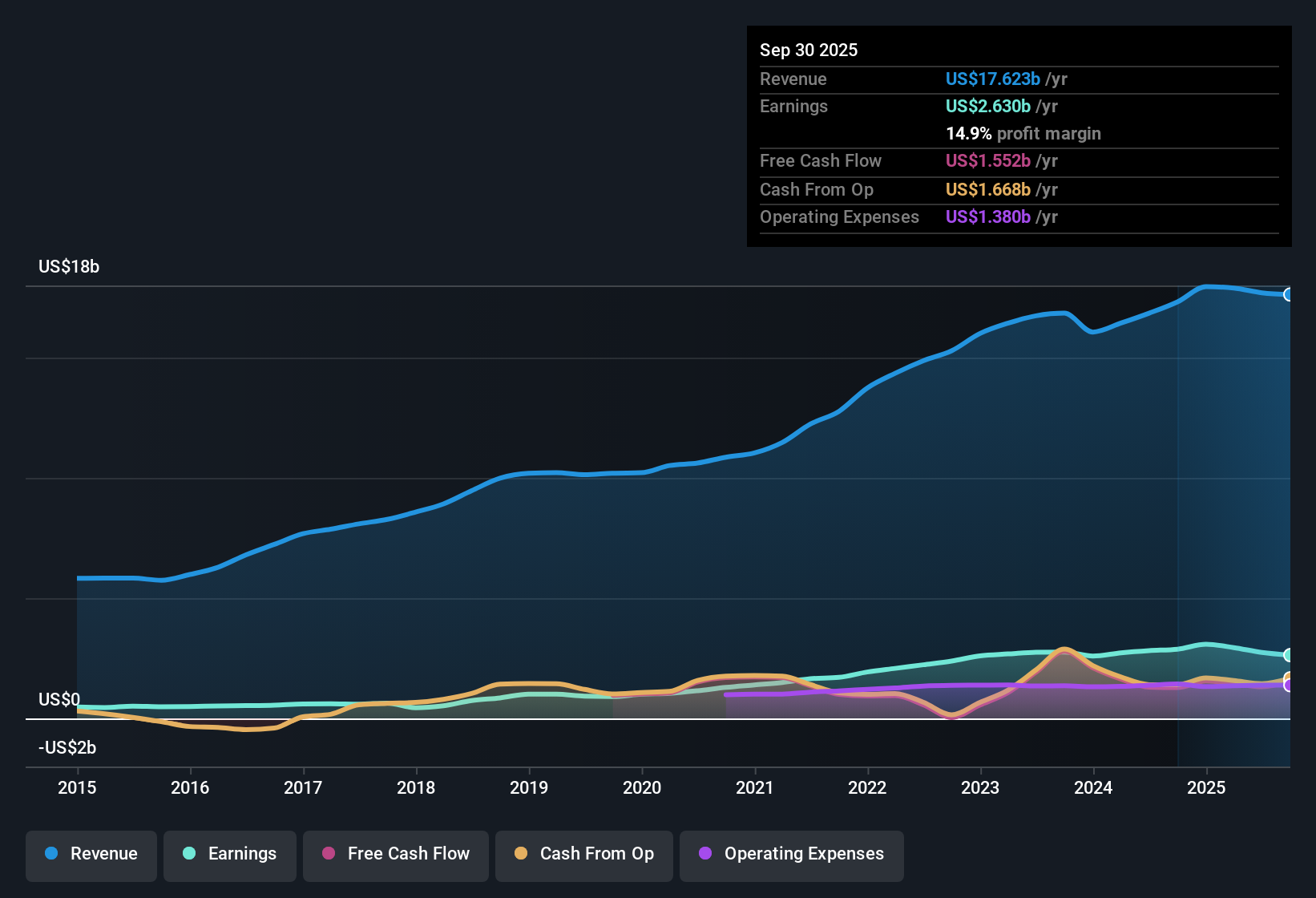

PulteGroup (PHM) reported that earnings are forecast to decline at an average annual rate of 6.2% over the next three years, while revenue is also expected to edge down at a slight 0.09% per year. Profit margins have slipped from 16.6% last year to 14.9% currently. Over the past five years, earnings have climbed at a 14% annual rate. Investors are weighing this mix of solid historical growth with a cautious outlook as the market responds to the results.

See our full analysis for PulteGroup.Next, we will dig into how these numbers stack up against the prevailing narratives around PulteGroup and what they could mean for sentiment moving forward.

See what the community is saying about PulteGroup

Margin Compression Signals Profit Headwinds

- Analysts project profit margins will contract from 15.5% today to 12.4% within three years, which aligns with their expectation for earnings to drop from $2.7 billion currently to $2.2 billion by August 2028.

- According to the analysts' consensus view, the margin decline stems partly from persistent affordability challenges and increased use of sales incentives, now at 8.7% of gross sales price compared to 6.3% last year.

- Rising construction input costs and potential tariff increases are also flagged as top risks that could further weigh on profitability.

- Despite these risks, a strategic focus on operational efficiency and active adult communities is expected to help buffer some of the margin decline.

Valuation Stands Out Versus Peers

- PulteGroup’s Price-to-Earnings ratio of 9.2x remains well below the peer average of 12.2x and the broader industry average of 10.4x. This suggests the market assigns a discount to the stock even as its DCF fair value estimates are as high as $159.74.

- Analysts' consensus view highlights that this attractive relative and absolute valuation, combined with a current share price of $123.27, creates potential upside especially if fundamentals stabilize.

- The average analyst price target is $137.85, about 12% above the present share price, even as baseline forecasts point to modest declines.

- However, realization of this upside depends on management’s ability to defend margins despite cost pressures and to capitalize on longer-term housing demand drivers.

Geographic and Strategic Flexibility

- PulteGroup’s focus on geographic diversification across the Midwest, Southeast, and Northeast, as well as its capital-efficient land strategy, is designed to mitigate the risk of regional softness and shifting demographic trends.

- The analysts' consensus view notes that while regions like the West and Texas face demand headwinds, the company’s operational flexibility and leadership in active adult communities could preserve sales volumes and support resilience across market cycles.

- Key initiatives in technology and off-site manufacturing are also expected to enhance efficiency and customer conversion over time.

- Analysts remain watchful of population migration patterns and whether PulteGroup can continually align its land investments and product mix to these evolving trends.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PulteGroup on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Share your perspective and craft your own narrative in just a few minutes. Do it your way.

A great starting point for your PulteGroup research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

PulteGroup faces challenges with shrinking profit margins, modest growth forecasts, and exposure to cost pressures that may threaten future stability.

If you want to focus on businesses delivering steadier earnings and revenue growth regardless of the cycle, use our stable growth stocks screener (2087 results) to compare companies with a track record of dependable performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHM

PulteGroup

Through its subsidiaries, engages in the homebuilding business in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives